ComEd 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

The assumptions are reviewed at the beginning of each year

during our annual review process. The impact of assumption

changes are reflected in the recorded pension amounts consis-

tent with assumption changes as they occur. As these assump-

tions change from period to period, recorded pension amounts

and funding requirements could also change.

Our pension and other postretirement benefit plans have

unrecognized losses of $2.1 billion and $0.8 billion, respectively,

at December 31, 2002. This unrecognized loss primarily repre-

sents the difference between the expected return on plan assets

and the actual return on plan assets that has not yet been recog-

nized in pension or other postretirement benefit expense. We

generally amortize these unrecognized (gains)/losses over five

years;however, the annual amortization amounts vary based on

actuarial determinations. Recognition of an unrecognized loss

will result in increased net periodic pension cost going forward.

Primarily as a result of sharp declines in the equity markets

since the third quarter of 2000, we recognized an additional

minimum liability of $1.0 billion, net of income taxes, and an

intangible asset of $211 million as prescribed by SFAS No. 87

in the fourth quarter of 2002. The liability was recorded as a

reduction to shareholders’ equity, and the equity will be

restored to the balance sheet in future periods when the fair

value of plan assets exceeds the accumulated benefit obliga-

tion.The recording of this additional minimum liability did not

affect net income or cash flow in 2002 or compliance with debt

covenants; however, pension cost and cash funding require-

ments could increase in future years without a substantial

recovery in the equity markets.

Our defined benefit pension plans currently meet the mini-

mum funding requirements of the Employment Retirement

Income Security Act of 1974 without any additional funding;how-

ever,we made a discretionary tax-deductible plan contribution

of $150 million in the fourth quarter of 2002 funded by ComEd,

Generation and BSC. We also expect to make a discretionary

tax-deductible plan contribution in 2003 of $300 million to

$350 million.

Approximately $93 million was included in operating and

maintenance expense in 2002 for the cost of our pension and

postretirement benefit plans, exclusive of the 2002 charges for

employee severance programs. Although the 2003 increase in

pension and postretirement benefit cost will depend on market

conditions, our estimate is that expense will increase by

approximately $125 million in 2003 from 2002 expense levels as

the result of the effects of the decline in market value of plan

assets in 2002, the decline in discount rate and increases in

health care costs.

In 2001, we adopted a cash balance pension plan. All

management and electing union employees who were hired by

us after 2001 became participants in the plan. Approximately

4,700 management employees who were active participants in

our previous qualified defined benefit plans at December 31,

2000 and remained employed by us on January 1, 2002 elected

to transfer to the cash balance plan. Participants in the cash

balance plan, unlike participants in the other defined benefit

plans, may request a lump-sum cash payment upon employee

termination. This may result in increased cash requirements

from pension plan assets, which may increase future funding

to the pension plan.

Stock-Based Compensation Plans

We maintain a Long-Term Incentive Plan (LTIP) for certain

full-time salaried employees and previously maintained a

broad-based incentive program for certain other employees.

The types of long-term incentive awards that have been

granted under the LTIP are non-qualified options to purchase

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

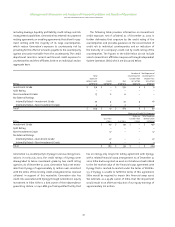

The following table illustrates the effect of changing the major actuarial assumptions discussed above:

Impact on

Projected Benefit Impact on Impact on

Obligation at Pension Liability at 2003

Change in Actuarial Assumption December 31, 2002 December 31, 2002 Pension Cost

Pension Benefits

Decrease Discount Rate by 0.5% $ 336 $ 336 $ 8

Decrease Rate of Return on Plan Assets by 0.5% – – 32

Impact on Impact on

Other Postretirement Postretirement Impact on 2003

Benefit Obligation at Benefit Liability at Postretirement

Change in Actuarial Assumption December 31, 2002 December 31, 2002 Benefit Cost

Postretirement Benefits

Decrease Discount Rate by 0.5% $ 152 $ – $ 18

Decrease Rate of Return on Plan Assets by 0.5% – – 6