ComEd 2002 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

117

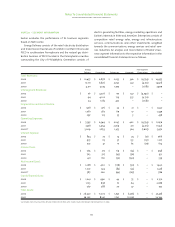

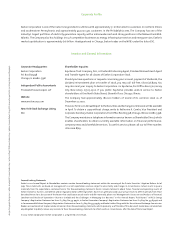

note 20 • segment information

Exelon evaluates the performance of its business segments

based on Net Income.

Energy Delivery consists of the retail electricity distribution

and transmission businesses of ComEd in northern Illinois and

PECO in southeastern Pennsylvania and the natural gas distri-

bution business of PECO located in the Pennsylvania counties

surrounding the City of Philadelphia. Generation consists of

electric generating facilities, energy marketing operations and

Exelon’s interests in Sithe and AmerGen. Enterprises consists of

competitive retail energy sales, energy and infrastructure

services, communications and other investments weighted

towards the communications, energy services and retail serv-

ices industries. An analysis and reconciliation of Exelon’s busi-

ness segment information to the respective information in the

consolidated financial statements are as follows:

Energy Intersegment

Delivery Generation Enterprises Corporate Eliminations Consolidated

Total Revenues:

2002 $ 10,457 $ 6,858 $ 2,033 $ 346 $ (4,739) $ 14,955

2001 10,171 6,826 2,292 341 (4,712) 14,918

2000 4,511 3,274 1,395 – (1,681) 7,499

Intersegment Revenues:

2002 $ 76 $ 4,226 $ 97 $ 341 $ (4,740) $ –

2001 94 4,102 179 337 (4,712) –

2000 24 1,185 472 – (1,681) –

Depreciation and Amortization:

2002 $ 978 $ 276 $ 55 $ 31 $ – $ 1,340

2001 1,081 282 69 17 – 1,449

2000 297 123 35 3 – 458

Operating Expenses:

2002 $ 7,597 $ 6,349 $ 2,047 $ 402 $ (4,739) $ 11,656

2001 7,578 5,954 2,369 371 (4,716) 11,556

2000(a) 3,009 2,833 1,473 324 (1,667) 5,972

Interest Expense:

2002 $ 854 $ 75 $ 14 $ 74 $ (51) $ 966

2001 973 115 37 133 (151) 1,107

2000 522 41 17 63 (29) 614

Income Taxes:

2002 $ 765 $ 217 $ 69 $ (53) $ – $ 998

2001 703 327 (43) (56) – 931

2000 421 160 (52) (190) – 339

Net Income/(Loss):

2002 $ 1,268 $ 400 $ (178) $ (50) $ – $ 1,440

2001 1,022 524 (85) (33) – 1,428

2000(a) 587 260 (94) (167) – 586

Capital Expenditures:

2002 $ 1,041 $ 990 $ 44 $ 75 $ – $ 2,150

2001 1,105 858 61 64 – 2,088

2000 367 288 70 27 – 752

Total Assets:

2002 $ 26,550 $ 11,007 $ 1,297 $ (1,376) $ – $ 37,478

2001 26,365 8,145 1,743 (1,509) – 34,744

(a) Includes non-recurring items of $276 million ($177 million after income taxes) for Merger-related expenses in 2000.