ComEd 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(see Note 8—Accounts Receivable). Exelon recognizes contract

revenues and profits on certain long-term fixed-price contracts

from its services businesses under the percentage-of-completion

method of accounting based on costs incurred as a percentage

of estimated total costs of individual contracts.

Premiums received and paid on option contracts and swap

arrangements are amortized to revenue and expense over the

life of the contracts. Certain of these contracts are considered

derivative instruments and are recorded at fair value with sub-

sequent changes in fair value recognized as revenues and

expenses unless hedge accounting is applied. Commodity

derivatives used for trading purposes are accounted for using

the mark-to-market method. Under this methodology, these

derivatives are adjusted to fair value, and the unrealized gains

and losses are recognized in current period income.

Long-Term Contract Accounting

Enterprises recognizes contract revenue and profits on certain

long-term fixed-price contracts by the percentage-of-comple-

tion method of accounting. In determining the amount of rev-

enue to recognize,Exelon is required to estimate the total costs

and profits expected to be recorded under the contract over its

contract term, and the recoverability of costs related to change

orders. Changes in these estimates could result in the recogni-

tion of differences in earnings. At December 31, 2002 and 2001,

Current Assets includes $70 million and $77 million, respec-

tively, of Costs and Earnings in Excess of Billings on uncom-

pleted contracts and Current Liabilities includes $44 million

and $56 million, respectively, of Billings and Earnings in Excess

of Costs on uncompleted contracts.

At December 31,2002 and 2001,Accounts Receivable includes

$49 million and $46 million, respectively, of contract retention.

This amount represents revenue recognized on costs incurred

that is not yet billable until final completion of the project

and acceptance by the customer. In applying the percentage-

of-completion accounting method, the collection of these

estimated revenues is deemed probable.

Purchased Gas Adjustment Clause

PECO’s natural gas rates are subject to a fuel adjustment clause

designed to recover or refund the difference between the actual

cost of purchased gas and the amount included in base rates.

Differences between the amounts billed to customers and the

actual costs recoverable are deferred and recovered or refunded

in future periods by means of prospective quarterly adjustments

to rates.

Nuclear Fuel

The cost of nuclear fuel is capitalized and charged to fuel

expense using the unit of production method. Estimated costs

of nuclear fuel storage and disposal at operating plants are

charged to fuel expense as the related fuel is consumed.

Stock-Based Compensation

Exelon uses the disclosure-only provisions of SFAS No. 123,

“Accounting for Stock-Based Compensation” (SFAS No. 123). See

Note 17—Common Stock for further discussion of these plans.

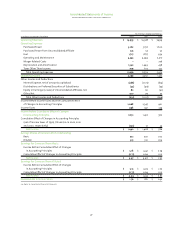

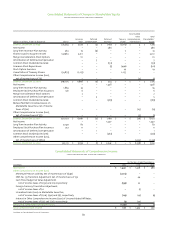

The table below shows the effect on net income and earnings

per share had Exelon elected to account for its stock-based

compensation plans using the fair value method under SFAS

No. 123 for the years ended December 31, 2002, 2001 and 2000:

2002 2001 2000

Net income—as reported $ 1,440 $ 1,428 $ 586

Deduct:Total stock-based

compensation expense

determined under fair value

based method for all awards,

net of income taxes 33 26 25

Pro forma net income $1,407 $ 1,402 $ 561

Earnings per share:

Basic—as reported $4.47 $ 4.46 $ 2.91

Basic—pro forma $ 4.36 $ 4.38 $ 2.77

Diluted—as reported $4.44 $ 4.43 $ 2.87

Diluted—pro forma $ 4.33 $ 4.35 $ 2.75

Income Taxes

Deferred Federal and state income taxes are provided on all

significant temporary differences between book basis and tax

basis of assets and liabilities. Investment tax credits previously

utilized for income tax purposes have been deferred on the

Consolidated Balance Sheets and are recognized in book income

over the life of the related property. Exelon and its subsidiaries

file a consolidated Federal income tax return. Income taxes are

allocated to each of Exelon’s subsidiaries within the consoli-

dated group based on the separate return method. Exelon esti-

mates its income tax valuation allowance by assessing which

deferred tax assets are more likely than not to be recovered in

the future (see Note 14—Income Taxes).

Gains and Losses on Reacquired Debt

Recoverable gains and losses on reacquired debt related to

regulated operations are deferred and amortized to interest

expense over the period consistent with rate recovery for

ratemaking purposes. Gains and losses on other debt are

recognized in Exelon’s Consolidated Statements of Income as

incurred (see Note 6—Supplemental Financial Information).

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

82