ComEd 2002 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

funds into the decommissioning trust accounts plus the finan-

cial activity reflected in Nuclear Decommissioning Trust Funds

in Exelon’s Consolidated Balance Sheets will,over time,establish

a corresponding liability in accumulated depreciation reflect-

ing the cost to decommission the nuclear generating stations

previously owned by PECO.Exelon will adopt SFAS No.143,“Asset

Retirement Obligations”(SFAS No. 143) as of January 1, 2003. See

“New Accounting Pronouncements” within this note for a dis-

cussion as to how this standard will change the accounting for

nuclear decommissioning costs.

Regulatory accounting practices for the nuclear generating

stations previously owned by ComEd were discontinued as a

result of an ICC order capping ComEd’s ultimate recovery of

decommissioning costs. See Note 11—Nuclear Decommission-

ing and Spent Fuel Storage regarding regulatory accounting

practices for nuclear generating stations transferred by ComEd

to Generation. The difference between the current decommis-

sioning cost estimate and the decommissioning liability

recorded in accumulated depreciation for the former ComEd

operating stations is being amortized to depreciation expense

on a straight-line basis over the remaining lives of the stations.

The current decommissioning cost estimate (adjusted annually

to reflect inflation) for the former ComEd retired units recorded

in deferred credits and other liabilities is accreted to deprecia-

tion expense. Financial activity of the decommissioning trust

related to Exelon’s nuclear generating stations no longer

accounted for under common regulatory practices (e.g., invest-

ment income and realized and unrealized gains and losses on

trust investments) is reflected in Nuclear Decommissioning

Trust Funds in Exelon’s Consolidated Balance Sheets with a cor-

responding gain or expense recorded in Exelon’s Consolidated

Income Statement or in other comprehensive income.The offset

to the financial activity in the decommissioning trust funds is

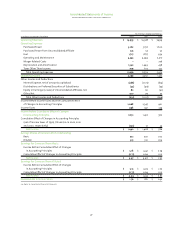

summarized as follows:

– Interest income is recorded in other income and deductions,

– Realized gains and losses are recorded in other income and

deductions,

– Unrealized gains and losses are recorded in other

comprehensive income,and

– Trust fund operating expenses are recorded in operation and

maintenance expense

Exelon believes that the amounts being recovered from

customers through electric rates along with the earnings on the

trust funds will be sufficient to fully fund its decommissioning

obligations.

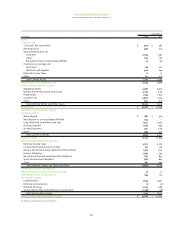

Capitalized Interest

Exelon uses SFAS No.34,“Capitalizing Interest Costs,”to calculate

the costs during construction of debt funds used to finance its

non-regulated construction projects. Exelon recorded capital-

ized interest of $20 million, $17 million and $2 million in 2002,

2001 and 2000,respectively.

Allowance for Funds Used During Construction (AFUDC) is

the cost, during the period of construction, of debt and equity

funds used to finance construction projects for regulated oper-

ations. AFUDC is recorded as a charge to Construction Work in

Progress and as a non-cash credit to AFUDC that is included in

Other Income and Deductions. The rates used for capitalizing

AFUDC are computed under a method prescribed by regulatory

authorities (see Note 6—Supplemental Financial Information).

Capitalized Software Costs

Costs incurred during the application development stage of

software projects for software that is developed or obtained

for internal use are capitalized. At December 31, 2002, 2001

and 2000, capitalized software costs totaled $335 million, $240

million and $285 million, respectively, net of $156 million, $85

million and $53 million of accumulated amortization, respec-

tively. Such capitalized amounts are amortized ratably over the

expected lives of the projects when they become operational,

not to exceed ten years. Certain capitalized software is being

amortized over fifteen years pursuant to regulatory approval.

Derivative Financial Instruments

Exelon accounts for derivative financial instruments under SFAS

No. 133, “Accounting for Derivatives and Hedging Activities”

(SFAS No. 133). Under the provisions of SFAS No. 133, all deriva-

tives are recognized on the balance sheet at their fair value

unless they qualify for a normal purchases and normal sales

exception. Normal purchases and normal sales are contracts

where physical delivery is probable, quantities are expected to

be used or sold in the normal course of business over a reason-

able period of time,and price is not tied to an unrelated under-

lying derivative. Changes in the fair value of the derivative

financial instruments thatdo not qualify for a normal purchase

and normal sales exception are recognized in earnings unless

specific hedge accounting criteria are met. A derivative finan-

cial instrument can be designated as a hedge of the fair value of

a recognized asset or liability or of an unrecognized firm com-

mitment (fair value hedge), or a hedge of a forecasted transac-

tion or the variability of cash flows to be received or paid related

to a recognized asset or liability (cash flow hedge). Changes in

the fair value of a derivative that is highly effective as, and is

designated and qualifies as, a fair value hedge, along with the

gain or loss on the hedged asset or liability that is attributable

to the hedged risk, are recorded in earnings.Changes in the fair

value of a derivative that is highly effective as,and is designated

as and qualifies as a cash flow hedge are recorded in other com-

prehensive income,until earnings are affected by the variability

of cash flows being hedged.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

84