ComEd 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or waiver, if necessary, can be successfully negotiated with the

SBG Facility lenders.

See Note 19—Commitments and Contingencies for further

discussion of Sithe.

Acquisition of Generating Plants from TXU

On April 25, 2002, Generation acquired two natural-gas and

oil-fired plants from TXU Corp.(TXU) for an aggregate purchase

price of $443 million. The purchase included the 893-megawatt

Mountain Creek Steam Electric Station in Dallas and the 1,441-

megawatt Handley Steam Electric Station in Fort Worth. The

transaction included a purchased power agreement for TXU to

purchase power during the months of May through September

from 2002 through 2006. During the periods covered by the

purchased power agreement, TXU will make fixed capacity

payments, variable expense payments, and will provide fuel to

Exelon in return for exclusive rights to the energy and capacity

of the generation plants. Substantially all of the purchase price

has been allocated to property,plant and equipment.

Sale of AT&T Wireless

On April 1,2002,Enterprises sold its 49% interest in AT&T Wireless

PCS of Philadelphia,LLC to a subsidiary of AT&T Wireless Services

for $285 million in cash. Enterprises recorded an after-tax gain

of $116 million in Other Income and Deductions on Exelon’s

Consolidated Statements of Income on its $84 million invest-

ment, which had been reflected in Deferred Debits and Other

Assets on Exelon’s Consolidated Balance Sheets.

InfraSource Acquisitions

In 2001, Exelon’s infrastructure services business (InfraSource),

acquired the assets of a utility service contracting company for

an aggregate purchase price of approximately $31 million. The

acquisition was accounted for using the purchase method of

accounting. The excess of purchase price over the fair value of

net assets acquired was $19 million. The allocation of purchase

price to the fair value of assets acquired and liabilities assumed

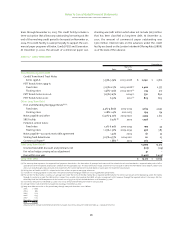

in the acquisition is as follows:

Current Assets (including cash acquired of $1) $ 11

Property, Plant and Equipment 11

Cost in excess of net assets acquired 19

Current Liabilities (10)

Total $ 31

AmerGen Energy Company, LLC

In August2000,AmerGen,a joint venture with British Energy,Inc.,

a wholly owned subsidiary of British Energy plc, (British Energy),

completed the purchase of Oyster Creek Nuclear Generating

Facility (Oyster Creek) from GPU, Inc. (GPU) for $10 million. Under

the terms of the purchase agreement,GPU agreed to fund outage

costs of $89 million, including the cost of fuel,for a refueling out-

age that occurred in 2000. AmerGen is repaying these costs to

GPU in equal annual installments through 2009. In addition,

AmerGen assumed full responsibility for the ultimate decom-

missioning of Oyster Creek. At the closing of the sale, GPU pro-

vided funding for the decommissioning trust of $440 million.In

conjunction with this acquisition, AmerGen has received a fully

funded decommissioning trust fund which has been computed

assuming the anticipated costs to appropriately decommission

Oyster Creek discounted to net present value using the NRC’s

mandated rate of 2%.AmerGen believes that the amount of the

trust fund and investment earnings thereon will be sufficient

to meet its decommissioning obligation. GPU is purchasing the

electricity generated by Oyster Creek pursuant to a three-year

power purchase agreement.

note 04 • adoption of new accounting pronouncements

and accounting changes

SFAS No. 141 and SFAS No. 142

In 2001,FASB issued SFAS No. 141,“Business Combinations”(SFAS

No. 141), which requires that all business combinations be

accounted for under the purchase method of accounting and

establishes criteria for the separate recognition of intangible

assets acquired in business combinations. SFAS No. 141 became

effective for business combinations initiated after June 30,

2001. In addition, SFAS No. 141 required that unamortized nega-

tive goodwill related to pre-July 1, 2001 purchases be recognized

as a change in accounting principle concurrent with the adop-

tion of SFAS No. 142, “Goodwill and Other Intangible Assets”

(SFAS No. 142). At December 31, 2001, AmerGen, an equity-

method investee of Generation, had $43 million of negative

goodwill, net of accumulated amortization, recorded on its bal-

ance sheet.Upon AmerGen’s adoption of SFAS No.141 in January

2002, Generation recognized its proportionate share of income

of $22 million ($13 million, net of income taxes) as a cumulative

effect of a change in accounting principle.

Exelon adopted SFAS No. 142 as of January 1, 2002. SFAS No.

142 establishes new accounting and reporting standards for

goodwill and intangible assets. Other than goodwill, Exelon

does nothave significant other intangible assets recorded on its

consolidated balance sheets. Under SFAS No. 142, goodwill is no

longer subject to amortization; however, goodwill is subject to

an assessment for impairment using a two-step fair value

based test. The first step must be performed at least annually,

or more frequently if events or circumstances indicate that

goodwill might be impaired and compares the fair value of a

reporting unit to its carrying amount, including goodwill. If the

carrying amount of the reporting unit exceeds its fair value,the

second step is performed. The second step compares the carry-

ing amount of the goodwill to the fair value of the goodwill. If

the fair value of goodwill is less than the carrying amount, an

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

89