ComEd 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

The majority of these contracts, however, qualify for the normal

purchases and normal sales SFAS No.133 exemption from mark-

to-market accounting treatment as they are for the purchase

and sale of energy to meet the requirements of our customers.

These contracts include short-term and long-term commitments

to purchase and sell energy and energy related products in the

retail and wholesale markets with the intent and ability to

deliver or take delivery in quantities we expect to use or sell

over a reasonable period in the normal course of business.

These contracts are reflected in the financial statements at

the lower of costor market,on a portfolio basis,using the accrual

method of accounting.We did not have any loss contracts as of

December 31, 2002. Under these contracts we recognize any

gains or losses when the underlying physical transaction affects

earnings. At the initiation of the contract, we make a determi-

nation as to whether or not the contract meets the criteria as a

normal purchase or normal sale. An example of an energy con-

tract that would qualify for the normal sale exemption would

include a forward sale contract under which we expect to supply

the full requirements of the counterparty. An example of a

contract that would qualify for the normal purchase exemption

would be an energy capacity contract that we enter into to

satisfy the needs of our customer base,either retail or wholesale.

The availability of the normal purchases and normal sales

exemption to specific contracts is based on a determination

that at certain times excess generation is available for a for-

ward sale and, similarly, a determination that at certain times

generation supply will be insufficient to serve our load. The

determination of the ability and intent to deliver or take deliv-

ery is based on internal models that forecast customer demand

and electricity supply. These models include assumptions

regarding customer load growth rates,which are influenced by

the economy, weather and the impact of customer choice, and

generating unit availability, particularly nuclear generating

unit capability factors. Significant changes in these assump-

tions could result in contracts being considered differently

under SFAS No. 133 and the potential requirement of mark-to-

market accounting.

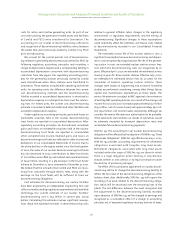

Proprietary Trading.As part of our energy trading operation,we

enter into contracts to buy and sell energy for trading purposes.

These contracts are recognized on the balance sheetat fair value

and changes in the fair value are recognized through earnings.

All proprietary trading activity is recorded net in revenue.

Trading activities are a very small portion of Exelon’s overall

power marketing activities. The trading portfolio is subject to

stringent risk management limits and policies, including

volumetric and depression limits to manage exposure to market

risk,as prescribed by the RMC.

Non-Trading Contracts.To manage our commodity risk exposure

and meet our load requirements, we have also entered into

non-trading contracts that do not meet the definition in SFAS

No.133 of a normal purchase or normal sale or meet the require-

ments for hedge accounting treatment.These non-trading con-

tracts are marked-to-market when the underlying item affects

earnings with the gains and losses recorded in Purchased Power

and Fuel expense.Non-trading contracts are subject to stringent

risk management limits and policies,as prescribed by the RMC.

Although we use derivative instruments to assist in

managing commodity price and interest rate risks, we can still

experience earnings volatility from period to period because of

the risks associated with marketing and trading electricity and

other energy-related products.

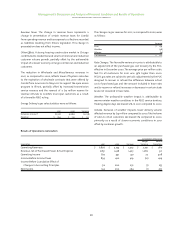

Regulatory Assets and Liabilities

Energy Delivery’s operating subsidiaries, ComEd and PECO, are

regulated by their respective state regulatory commissions as

well as by FERC. The regulators in Illinois and Pennsylvania, as

well as FERC, use cost-based rate structures to determine the

rates we will charge customers.In establishing cost-based rates,

the ICC and the PUC may consider the capital requirements and

working capital needs to operate the distribution and trans-

mission business, determine the operating cost levels that can

be passed on to customers and provide for a reasonable return

to our shareholders. In their determination of rates,the ICC and

PUC may include allowable costs in periods other than the peri-

ods in which an unregulated entity would record the costs in

the income statement.These costs are accounted for as either a

regulatory asset or liability. Regulatory assets represent costs

that have been deferred to future periods when it is probable

that the regulator will allow for recovery through rates charged

to customers. Regulatory liabilities represent revenues received

from customers to fund expected costs that have not yet been

incurred. Regulatory assets and liabilities are accounted for

under SFAS No.71,“Accounting for the Effects of Certain Types of

Regulation” (SFAS No. 71). Use of SFAS No. 71 is applicable to our

utility operations that meet the following criteria: the opera-

tions are subject to third-party regulation of rates;the rates are

cost-based; and the assumption that all costs will be recover-

able from customers through rates is appropriate and reason-

able.If a separable portion of our business no longer meets these

criteria, we are required to eliminate the financial statement

effects of regulation for that part of our business.

Both ComEd and PECO are currently subject to rate freezes

or rate caps that limit the opportunity to recover increased

costs and the costs of new investment in facilities through rates

during the rate freeze or rate cap period. Current rates include

the recovery of our existing regulatory assets.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies