ComEd 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

including leverage,liquidity,profitability,credit ratings and risk

management capabilities.Generation has entered into payment

netting agreements or enabling agreements that allow for pay-

ment netting with the majority of its large counterparties,

which reduce Generation’s exposure to counterparty risk by

providing for the offset of amounts payable to the counterparty

against amounts receivable from the counterparty. The credit

department monitors current and forward credit exposure to

counterparties and their affiliates,both on an individual and an

aggregate basis.

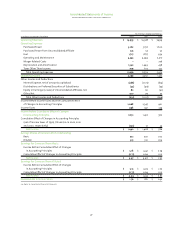

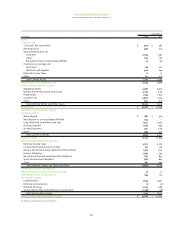

The following table provides information on Generation’s

credit exposure, net of collateral, as of December 31, 2002. It

further delineates that exposure by the credit rating of the

counterparties and provides guidance on the concentration of

credit risk to individual counterparties and an indication of

the maturity of a company’s credit risk by credit rating of the

counterparties. The figures in the table below do not include

sales to Generation’s affiliates or exposure through Independent

System Operators (ISOs) which are discussed below.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

Number of

Net Exposure of

Total Counterparties

Counterparties

Exposure Greater than Greater than

Before Credit Credit Net 10% of Net 10% of Net

Rating Collateral Collateral Exposure Exposure Exposure

Investment Grade $ 156 $ – $ 156 2 $ 71

Split Rating – – – – –

Non-Investment Grade 17 11 6 – –

No External Ratings

Internally Rated—Investment Grade 27 4 23 4 16

Internally Rated—Non-Investment Grade 4 2 2 – –

Total $ 204 $ 17 $ 187 6 $ 87

Maturity of Credit Risk Exposure

Exposure Total Exposure

Less than Greater than Before Credit

Rating 2 Years 2–5 Years 5 Years Collateral

Investment Grade $ 117 $ 39 $ – $ 156

Split Rating ––––

Non-Investment Grade 17 – – 17

No External Ratings

Internally Rated—Investment Grade 27 – – 27

Internally Rated—Non-Investment Grade 4 – – 4

Total $ 165 $ 39 $ – $ 204

Generation is a counterparty to Dynegy in various energy trans-

actions. In early July 2002, the credit ratings of Dynegy were

downgraded to below investment grade by two credit rating

agencies. As of December 31, 2002,Generation had a net receiv-

able from Dynegy of approximately $3 million and, consistent

with the terms of the existing credit arrangement,has received

collateral in support of this receivable. Generation also has

credit risk associated with Dynegy through Generation’s equity

investment in Sithe. Sithe is a 60% owner of the Independence

generating station, a 1,040-MW gas-fired qualified facility that

has an energy-only long-term tolling agreement with Dynegy,

with a related financial swap arrangement. As of December 31,

2002,Sithe had recognized an asset on its balance sheet related

to the fair market value of the financial swap agreement with

Dynegy that is marked-to-market under the terms of SFAS No.

133. If Dynegy is unable to fulfill the terms of this agreement,

Sithe would be required to impair this financial swap asset.

We estimate, as a 49.9% owner of Sithe, that the impairment

would result in an after-tax reduction of our equity earnings of

approximately $10 million.