ComEd 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

35

and limited access to capital markets. At December 31, 2002,

Enterprises held $128 million of investments. These types of

events, or others, could continue to occur in 2003, which could

result in additional impairment charges.

Enterprises’ results of operations may be affected by its ability to

manage its projects.

Enterprises consists of many businesses that utilize long-term

fixed-price contracts. At the beginning of the contract, we

estimate the total costs and profits of the contract; if the

actual costs vary significantly form the estimates,our results of

operations will be adversely impacted. Along with our ability

to execute, results may be impacted by economic conditions,

weather conditions and the regulatory environment.

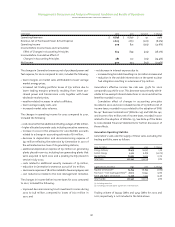

Capital Markets / Financing Environment

In order to expand our operations and to meet the needs of our

current and future customers, we invest in our businesses. Our

ability to finance our businesses and other necessary expendi-

tures is affected by the capital intensive nature of our opera-

tions and our current and future credit ratings. The capital

markets also affect our decommissioning trust funds and ben-

efit plan assets. Our financing needs will be dependent on our

strategic direction of acquiring integrated utilities and genera-

tion facilities, and our ability to dispose of unprofitable busi-

nesses that do not advance our goals. Further discussions on

our liquidity position can be found in the Liquidity and Capital

Resources section.

Our ability to grow our business is affected by our ability to

finance capital projects.

Our businesses require considerable capital resources. When

necessary, we secure funds from external sources by issuing

commercial paper and, as required, long-term debt securities.

We actively manage our exposure to changes in interest rates

through interest-rate swap transactions and our balance of

fixed- and floating-rate instruments. We currently anticipate

primarily using internally generated cash flows and short-term

financing through commercial paper to fund our operations as

well as long-term external financing sources to fund capital

requirements as the needs and opportunities arise. Our ability

to arrange debt financing, to refinance current maturities and

early retirements of debt,and the costs of issuing new debt are

dependent on:

– credit availability from banks and other financial institutions,

– maintenance of acceptable credit ratings (see Our Credit

Ratings below),

– investor confidence in us,

– investor confidence in other regional wholesale power markets,

– general economic and capital market conditions,

– the success of current projects, and

– the perceived quality of new projects.

Our credit ratings influence our ability to raise capital.

Our businesses have investment grade ratings and have been

successful in raising capital,which has been used to further our

business initiatives.Also,from time to time,we enter into energy

commodity and other contracts that require the maintenance

of investment grade ratings. Failure to maintain investment

grade ratings would require us to incur higher financing costs

and would allow, but not in most instances require, counter-

parties to energy commodity contracts to terminate the con-

tracts and settle the transaction. Also, the failure to maintain

investment grade ratings would restrict our access to the

wholesale energy markets.

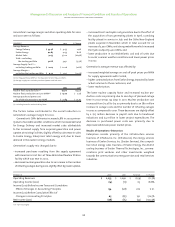

Equity market performance affects our decommissioning trust

funds and benefit plan asset values.

The sharp decline in the equity markets since the third quarter

of 2000 has reduced the value of the assets held in trusts to

satisfy the obligations of pension and postretirement benefit

plans and the eventual nuclear generation station decommis-

sioning requirements. If the markets continue to decline, we

may have higher funding requirements and pension and other

postretirement benefit expense. We will continue to manage

the assets in the pension and postretirement benefit plans and

nuclear decommissioning trusts in order to achieve the best

return possible in conjunction with our overall risk manage-

ment practices and diversified approach to investment. Please

refer to the Critical Accounting Estimates section that more

fully describes the quantitative financial statement effects of

changes in the equity markets on the nuclear decommissioning

trust funds and benefit plan assets.

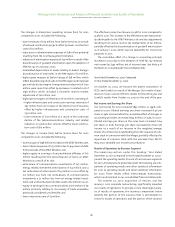

Our results of operations can be affected by inflation.

Inflation affects us through increased operating costs and

increased capital costs for electric plant. As a result of the rate

freezes and caps imposed under the legislation in Illinois and

Pennsylvania and price pressures due to competition, we may

not be able to pass the costs of inflation through to customers.

Other

We may incur substantial cost to fulfill our obligations related to

environmental matters.

Our businesses are subject to extensive environmental regula-

tion by local, state and Federal authorities. These laws and reg-

ulations affect the manner in which we conduct our operations

and make our capital expenditures. These regulations affect

how we handle air and water emissions and solid waste