ComEd 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

is designed to create value and strengthen our competitive

position by improving processes, productivity and cash flow.

Our third major corporate goal is to “invest in our consolidating

industry.”To further our strategy,each of the business segments

has formulated its own plans to achieve our corporate goals.

Energy Delivery. Energy Delivery focuses on providing reliable

and affordable services to customers. ComEd and PECO

continue to make improvements to their delivery systems to

minimize the frequency and duration of service interruptions,

while working more efficiently to lower their costs. We believe

that ComEd and PECO will continue to provide a significant

and steady source of earnings and cash flows over the next

several years.

Generation. Generation is focused on providing low cost and

reliable power through a generation portfolio with fuel and dis-

patch diversity. Generation’s direction is to continue to increase

fleet output and to improve fleet efficiency while sustaining

operational safety. Power Team is the unit within Generation

that manages the output of Generation’s assets and energy

sales to reduce the volatility of Generation’s earnings and cash

flows. We believe that Generation will provide a steady source

of earnings through its low cost operations and will take advan-

tage of higher wholesale prices when they can be realized.

Enterprises. Enterprises is focused on operating its investments

with the goal of maximizing its earnings and cash flow.

Enterprises is not currently contemplating any acquisitions.

Enterprises expects to divest itself of businesses that are not

consistent with our strategic direction. This does not necessar-

ily mean that an immediate exit will be arranged,but rather we

may retain businesses for a period of time if we believe that this

course of action will strengthen their value.

business outlook and the challenges

in managing our business

We face a number of challenges in achieving our vision and

keeping our commitments to our customers and our investors;

however, there are three principal areas on which we focus

our attention. First, our financial performance is significantly

affected by the availability and utilization of our generation

facilities. As the largest U.S. nuclear generator, we face opera-

tional and regulatory risks that,if not managed diligently, could

have significant adverse consequences. Second, our results of

operations are directly affected by wholesale energy prices.Energy

prices are driven by demand factors such as weather and eco-

nomic conditions in our service territories. They are also driven

by supply factors and the regions where we operate currently

have excess capacity. Over the last several years, wholesale

prices of electricity have generally been low. The possibility of

continued low wholesale prices, coupled with a continued eco-

nomic recessionary trend, could adversely affect our business.

Finally, our business may be significantly impacted by the end

of ComEd’s regulatory transition period in 2006.By existing law,

after 2006, ComEd will not collect competitive transition

charges (CTCs) from customers who elect to receive generation

services from alternative energy suppliers including the ComEd

Power Purchase Option (PPO).Additionally, the current bundled

rate structure may be reset in a regulatory proceeding. It is dif-

ficult to predict the outcome of a potential regulatory proceed-

ing to establish rates for 2007 and thereafter, nor is it possible

to predict what changes may occur to the restructuring law in

Illinois;however, we are undertaking various efforts to mitigate

the 2007 challenge.

These and other challenges affecting our businesses are

described below. There are several factors, such as weather,

economic activity and regulatory actions that affect Energy

Delivery, Generation and Enterprises in different ways. Also,

there are several factors that affect our business as a whole,

such as environmental compliance and the ability to access

capital on a cost-effective basis.

Energy Delivery

We must comply with numerous regulatory requirements in

managing our Energy Delivery business, which affect our costs

and responsiveness to changing events and opportunities.

Our Energy Delivery business is subject to regulation at the

state and Federal levels. ComEd is regulated by the Illinois

Commerce Commission (ICC) and PECO is regulated by the

Pennsylvania Public Utility Commission (PUC).These state com-

missions regulate the rates, terms and conditions of service;

various business practices and transactions; financing; and

transactions between the utilities and our affiliates. Both

ComEd and PECO are also subject to regulation by the Federal

Energy Regulatory Commission (FERC), which regulates their

transmission rates, certain other aspects of their businesses

and, for PECO, gas pipelines. The regulations adopted by these

state and Federal agencies affect the manner in which we do

business, our ability to undertake specified actions and the

costs of our operations.

We are involved in a number of regulatory proceedings as a part

of the process of establishing the terms and rates for Energy

Delivery’s services.

These regulatory proceedings typically involve multiple parties,

including governmental bodies, consumer advocacy groups

and various consumers of energy, who have differing concerns

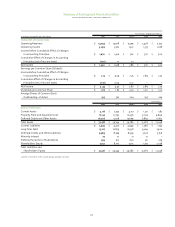

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

25