ComEd 2002 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

basis through November 20,2003.This credit facility includes a

term-out option that allows any outstanding borrowings at the

end of the revolving credit period to be repaid on November 21,

2004.This credit facility is used principally to support the com-

mercial paper programs of Exelon,ComEd,PECO and Generation.

At December 31, 2002, the amount of commercial paper out-

standing was $681 million which does not include $267 million

that has been classified as long-term debt. At December 31,

2001, the amount of commercial paper outstanding was

$360 million. Interest rates on the advances under the credit

facility are based on the London Interbank Offering Rate (LIBOR)

as of the date of the advance.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

99

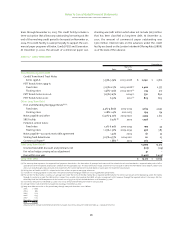

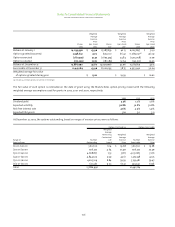

note 13 • long-term debt

December 31,

Maturity

Rates Date 2002 2001

Securitized Long-Term Debt

ComEd Transitional Trust Notes

Series 1998-A: 5.39%-5.74% 2003-2008 $2,040 $ 2,380

PETT Bonds Series 1999-A:

Fixed rates 5.63%-6.13% 2003-2008(a) 2,426 2,577

Floating rates 1.48%-1.55% 2004-2007(a) 274 310

PETT Bonds Series 2000-A: 7.63%-7.65% 2009(a) 750 890

PETT Bonds Series 2001: 6.52% 2010(a) 805 805

Other Long-Term Debt

First and Refunding Mortgage Bonds(b) (c):

Fixed rates 4.4%-9.875% 2003-2023 3,614 3,942

Floating rates 1.08%-1.41% 2012-2013 254 154

Notes payable and other 6.40%-9.20% 2003-2020 2,393 2,651

SBG Facility 6.37%(d) 2007 1,036 –

Pollution control notes:

Fixed rates 5.2%-6.95% 2007-2034 199 44

Floating rates 1.05%-1.50% 2009-2034 456 583

Notes payable—accounts receivable agreement 1.42% 2005 61 55

Sinking fund debentures 3.125%-4.75% 2004-2011 20 23

Commercial Paper(e) 1.88%(f) 2003 267 –

Total Long-Term Debt(g) 14,595 14,414

Unamortized debt discount and premium, net (107) (129)

Fair value hedge carrying value adjustment 41 –

Due within one year (1,402) (1,406)

Long-Term Debt $13,127$ 12,879

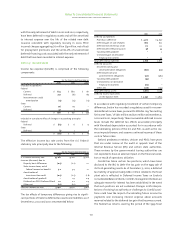

(a) The maturity date represents the expected final payment date which is the date when all principal and interest of the related class of transition bonds is expected to be paid in full in

accordance with the expected amortization schedule for the applicable class.The date when all principal and interest must be paid in full for the PETT Bonds Series 1999-A, 2000-A and

2001-A are 2003 through 2009, 2010 and 2010,respectively.The current portion of transition bonds is based upon the expected maturity date.

(b) Utility plant of ComEd and PECO is subject to the liens of their respective mortgage indentures.

(c) Includes first mortgage bonds issued under the ComEd and PECO mortgage indentures securing pollution control notes.

(d) The rate for the SBG Facility is stated as an average rate. Under the terms of the SBG Facility, SBG is required to effectively fix the interest rate on 50% of the borrowings under the facility

through its maturity in 2007.The SBG Facility is subject to a variable rate based on the LIBOR rate plus a margin of 1.375%, however, through the required interest rate swaps, SBG has

effectively fixed the LIBOR component of the interest rate at 5.73% on 83% of the debt balance as of December 31, 2002.

(e) Classified as long-term at December 31, 2002 since it was refinanced with long-term debt in January 2003.

(f) Average interest rate of commercial paper outstanding at December 31, 2002.

(g) Long-term debt maturities in the period 2003 through 2007 and thereafter are as follows:

2003 $ 1,669

2004 962

2005 1,313

2006 1,273

2007 1,172

Thereafter 8,206

Total $ 14,595

2003 maturities include $267 million of commercial paper classified as long-term debt (see Note 23—Subsequent Events).