ComEd 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

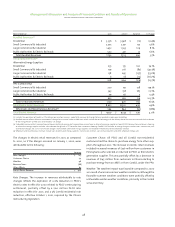

Sithe Boston Generation Project Debt. We participate in a $1.25

billion credit facility, most of which is available to finance the

construction projects of Sithe Boston Generating, LLC (the SBG

Facility).The outstanding balance of this facility at December 31,

2002 was $1.0 billion.The SBG Facility provides that if these con-

struction projects are not completed by June 12, 2003, the SBG

Facility lenders will have the right, but will not be required, to,

among other things, declare all amounts then outstanding

under the SBG Facility and the interest rate swap agreements to

be due. Generation believes that the construction projects will

be substantially complete by May 31, 2003, but that all of the

approvals required under the SBG Facility may not be issued by

that date. Generation is currently evaluating whether the

requirements of the SBG Facility relating to the construction

projects can be satisfied by June 12, 2003. In the event that the

requirements are not expected to be satisfied by June 12, 2003,

Generation will contact the SBG Facility lenders concerning an

amendment or waiver of these provisions of the SBG Facility.

Generation currently expects that arrangements for such an

amendment or waiver, if necessary, can be successfully negoti-

ated with the SBG Facility lenders.

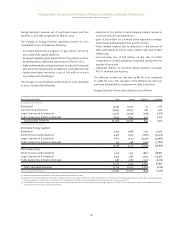

Unconsolidated Equity Investments. Generation is a 49.9%

owner of Sithe and accounts for the investment as an uncon-

solidated equity investment. The Sithe New England purchase

did not affect the accounting for Sithe as an equity investment.

Separate from the Sithe New England transaction, Generation

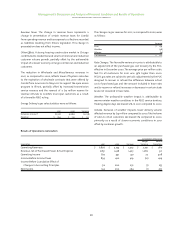

is subject to a Put and Call Agreement (PCA) that gives

Generation the right to purchase (Call) the remaining 50.1% of

Sithe, and gives the other Sithe shareholders the right to sell

(Put) their interest to Generation. If the Put option is exercised,

Generation has the obligation to complete the purchase. At

the end of this exercise period, which is December 2005, if

Generation has notexercised its Call option and the other stock-

holders have not exercised their Put rights,Generation will have

an additional one-time option to purchase shares from the

other stockholders to bring Generation’s ownership in Sithe

from the current 49.9% to 50.1% of Sithe’s total outstanding

common stock.

The PCA originally provided that the Put and Call options

became exercisable as of December 18, 2002 and expired in

December 2005. However, upon Apollo Energy, LLC’s (Apollo)

purchase of Vivendi’s 34.2% ownership and Sithe manage-

ment’s 1% share, Apollo agreed to delay the effective date of its

Put right until June 1, 2003 and, if certain conditions are met,

until September 1,2003.There are also certain events that could

trigger Apollo’s Put right becoming effective prior to June 1,

2003 including Exelon being downgraded below investment

grade by Standard and Poor’s Rating Group or Moody’s Investors

Service, Inc., a stock purchase agreement between Exelon and

Apollo being executed and subsequently terminated, or the

occurrence of any event of default, other than a change of con-

trol, under certain Exelon or Apollo credit agreements.

Depending on the triggering event, the put price of approxi-

mately $460 million,growing at a market rate of interest,needs

to be funded within 18 or 30 days of the Put being exercised.

There have been no changes to the Put and Call terms with

respect to Marubeni’s remaining 14.9% interest.

The delay in the effective date of Apollo’s Put right allows

us to explore a further restructuring of our investment in

Sithe.We are continuing discussions with Apollo and Marubeni

regarding restructuring alternatives that are designed in part

to resolve our ownership limitations of Sithe’s qualifying facili-

ties.We would hope to implement any additional restructuring

of our Sithe investment in 2003.If we are unsuccessful in restruc-

turing the Sithe transaction, we will proceed to implement

measures to address the ownership of the qualified facilities

as well as divest non-strategic assets, for which the financial

outcome is uncertain.

If Generation exercises its option to acquire the remaining

outstanding common stock in Sithe, or if all the other stock-

holders exercise their Put Rights, the purchase price for Apollo’s

35.2% interest will be approximately $460 million, growing at

a market rate of interest. The additional 14.9% interest will be

valued at fair market value subject to a floor of $141 million

and a ceiling of $290 million.

If Generation increases its ownership in Sithe to 50.1% or

more, Sithe may become a consolidated subsidiary and our

financial results may include Sithe’s financial results from the

date of purchase.At December 31,2002,Sithe had total assets of

$2.6 billion and total debt of $1.3 billion.This $1.3 billion includes

$624 million of subsidiary debt incurred primarily to finance

the construction of six new generating facilities, $461 million

of subordinated debt, $103 million of line of credit borrowings,

$43 million of current portion of long-term debt and capital

leases, $30 million of capital leases, and excludes $453 million

of non-recourse project debt associated with Sithe’s equity

investments. For the year ended December 31, 2002, Sithe

had revenues of $1.0 billion.As of December 31,2002,Generation

had a $478 million equity investment in Sithe.

Additionally, the debt on the books of our unconsolidated

equity investments and joint ventures is not reflected on our

Consolidated Balance Sheets. We estimate that this debt,

including the $1.3 billion of Sithe’s debt described in the preced-

ing paragraph, totals approximately $1.3 billion and that our

portion of that amount, based on our ownership interest in the

investments,is approximately $673 million.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies