ComEd 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

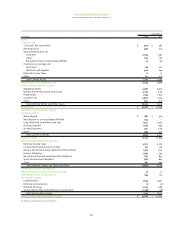

The following table provides a reconciliation of the reserve for

employee severance and other benefits associated with the Merger:

Adjusted employee severance and other benefits reserve $ 179

Payments to employees in 2000 (5)

Payments to employees in 2001 (72)

Payments to employees in 2002 (74)

Employee severance and other benefits reserve

as of December 31, 2002(1) $28

(1) Relates to certain benefits that are being paid after 2002.

The following table provides a reconciliation of the former

Unicom positions that were expected to be eliminated as a

result of the Merger:

Total

Estimate at October 20, 2000 2,275

2001 adjustments(a) 118

Total positions 2,393

Employees terminated in 2000 279

Employees terminated in 2001 607

Employees terminated in 2002 1,053

Normal attrition 298

Business plan changes(b) 156

Total positions 2,393

(a) The increase is a result of the identification of additional positions to be eliminated

in 2001.

(b) The reduction is due to a determination in the third quarter of 2002, that certain

positions would not be eliminated by the end of 2002 as originally planned due to a

change in certain business plans.

note 03 • acquisitions and dispositions

Sithe New England Holdings Asset Acquisition

On November 1, 2002,Generation purchased the assets of Sithe

New England Holdings, LLC (Sithe New England), a subsidiary

of Sithe, and related power marketing operations. Sithe New

England’s primary assets are gas-fired facilities currently under

development. The purchase price for the Sithe New England

assets consisted of a $534 million note to Sithe, $14 million of

direct acquisition costs and an adjustment to Generation’s

investment in Sithe to reflect Sithe’s sale of Sithe New England

to Generation. Additionally, Generation will assume various

Sithe guarantees related to an equity contribution agreement

between Sithe New England and Sithe Boston Generation, LLC

(SBG),a project subsidiary of Sithe New England.The equity con-

tribution agreement requires, among other things, that Sithe

New England,upon the occurrence of certain events,contribute

up to $38 million of equity for the purpose of completing the

construction of two generating facilities. SBG has a $1.25 billion

credit facility (the SBG Facility) to finance the construction of

these two generating facilities. The $1.0 billion outstanding

under the facility at December 31, 2002 is reflected on Exelon’s

Consolidated Balance Sheet. Sithe New England owns 4,066

megawatts (MWs) of generation capacity, consisting of 1,645

MWs in operation and 2,421 MWs under construction. Sithe

New England's generation facilities are located primarily in

Massachusetts.

The allocation of purchase price to the fair value of assets

acquired and liabilities assumed in the acquisition is as follows:

Current Assets (including $12 of cash acquired) $ 82

Property, Plant and Equipment 1,889

Deferred Debits and Other Assets 62

Current Liabilities (159)

Deferred Credits and Other Liabilities (124)

Long-Term Debt (1,036)

Total Purchase Price $ 714

The SBG Facility provides that if these construction projects are

not completed by June 12, 2003, the SBG Facility lenders will

have the right,but will not be required, to, among other things,

declare all amounts then outstanding under the SBG Facility

and the interest rate swap agreements to be due. Generation

believes that the construction projects will be substantially

complete by May 31,2003, but that all of the approvals required

under the SBG Facility may not be issued by that date.

Generation is currently evaluating whether the requirements

of the SBG Facility relating to the construction projects can be

satisfied by June 12, 2003. In the event that the requirements

are not expected to be satisfied by June 12,2003,Generation will

contact the SBG Facility lenders concerning an amendment

or waiver of these provisions of the SBG Facility. Generation

currently expects that arrangements for such an amendment

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

88

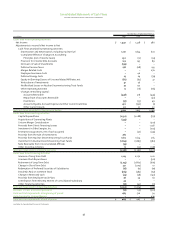

Original Adjustments Adjusted

Estimate 2001 2002 Liabilities

Employee severance payments $ 128 $ 33 $ (10) $ 151 (a)

Other benefits 21 9 (2) 28 (a)

Employee severance payments and other benefits 149 42 (12) 179

Actuarially determined pension and postretirement costs 158 (11) – 147 (b)

Total Unicom employee cost $ 307 $ 31 $ (12) $ 326

(a) The increase is a result of the identification in 2001 of additional positions to be eliminated, partially offset by the 2002 elimination of identified positions through normal attrition and

changes in certain business plans.

(b) The reduction results from lower estimated pension and postretirement welfare benefits reflecting revised actuarial estimates.