ComEd 2002 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

holds the leasehold interests in the generating stations in several

separate bankruptcy remote, special purpose companies it

directly or indirectly wholly owns. Under the terms of the lease

agreements, Exelon received a prepayment of $1.2 billion in the

fourth quarter of 2000, which reduced the investment in the

lease. The remaining payments are payable at the end of the

thirty year lease and there are no minimum scheduled lease

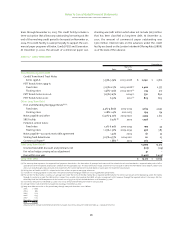

payments to be received over the next five years.The components

of the netinvestment in the direct financing leases are as follows:

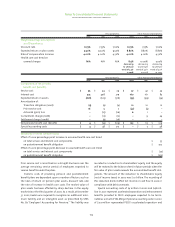

December 31,

2002 2001

Total minimum lease payments $ 1,492 $ 1,492

Less:Unearned income 1,047 1,065

Net investment in direct financing leases $ 445 $427

December 31,

2002 2001

Regulatory Assets

Competitive transition charge $ 4,639 $ 4,947

Recoverable deferred income taxes (see Note 14) 661 701

Nuclear decommissioning costs for retired plants 248 310

Recoverable transition costs 175 277

Reacquired debt costs and interest rate

swap settlements 137 112

Non-pension postretirement benefits 65 71

Compensated absences 65

Other 7–

Long-Term Regulatory Assets 5,938 6,423

Deferred energy costs (current asset) 31 56

Total $ 5,969 $6,479

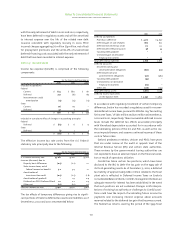

– Competitive Transition Charges (CTC) represent PECO’s stranded

costs that the PUC determined would be allowed to be recover-

able through regulated rates. These costs are related to the

deregulation of the generation portion of the electric utility

business in Pennsylvania.The unamortized balance of the CTC

of $4.6 billion and $4.9 billion as of December 31, 2002 and

2001, respectively, was recorded on our Consolidated Balance

Sheets.The CTC includes Intangible Transition Property sold to

PECO Energy Transition Trust, a wholly owned subsidiary of

PECO,in connection with the securitization of PECO’s stranded

cost recovery. These charges are being amortized through

December 31, 2010 with a return on the unamortized balance

of 10.75%.

– Nuclear decommissioning costs for retired plants—recovery is

provided through ComEd’s current regulated rates and is

expected to be fully recovered by the end of 2006.

– Recoverable transition costs—recovery is provided for in

regulated rates pursuant to the Illinois Restructuring Act and

is expected to be recovered by the end of 2006.

– Reacquired debt costs and interest rate swap settlements—

recoverable gains and losses on reacquired debt are deferred

and amortized over the rate-regulatory period,which is over the

life of the new debt issued to finance the debt redemption.

Interest rate swap settlements are deferred and amortized

over the period that the related debt is outstanding.

The regulatory assets related to the nuclear decommissioning

costs and deferred income taxes did not require a cash outlay

of investor supplied funds; consequently, these costs are not

earning a rate of return. Recovery of the regulatory assets for

loss on reacquired debt and recoverable transition costs is pro-

vided for through regulated revenue sources that are based on

the pre-open access cost of service.Therefore,they are earning a

rate of return.

December 31,

2002 2001

Accrued Expenses

Taxes Accrued $ 420 $91

Interest Accrued 307 299

Other Accrued Expenses 584 745

Total $ 1,311 $1,135

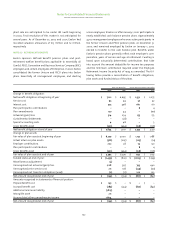

note 07 • earnings per share

Diluted earnings per share are calculated by dividing net

income by the weighted average shares of common stock out-

standing including shares issuable upon exercise of stock

options outstanding under Exelon’s stock option plans consid-

ered to be common stock equivalents. The following table

shows the effect of these stock options on the weighted average

number of shares outstanding used in calculating diluted

earnings per share (in millions):

2002 2001 2000

Average Common Shares Outstanding 322 320 202

Assumed Exercise of Stock Options 322

Average Dilutive Common Shares

Outstanding 325 322 204

Stock options not included in average common shares used in

calculating diluted earnings per share due to their antidilutive

effect were approximately five million, five million and 30,000

for 2002, 2001 and 2000,respectively.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

95