ComEd 2002 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

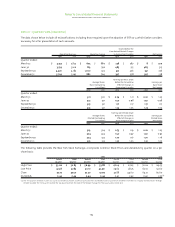

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

116

The United States Environmental Protection Agency (EPA)

has advised Cotter thatit is potentially liable in connection with

radiological contamination at a site known as the West Lake

Landfill in Missouri. Cotter is alleged to have disposed of

approximately 39,000 tons of soils mixed with 8,700 tons of

leached barium sulfate atthe site.Cotter,along with three other

companies identified by the EPA as potentially responsible

parties (PRPs), has submitted a draft feasibility study address-

ing options for remediation of the site. The PRPs are also

engaged in discussions with the State of Missouri and the EPA.

The estimated costs of remediation for the site range from $0

million to $87 million. Once a remedy is selected, it is expected

that the PRPs will agree on an allocation of responsibility for the

costs.Until an agreement is reached,Generation cannot predict

its share of the costs.

Raytheon Arbitration. In March 2001, two subsidiaries of Sithe

New England Holdings (now Exelon New England Holdings)

brought an action in the New York Supreme Court against

Raytheon Corporation (Raytheon) relating to its failure to honor

its guaranty with respect to the performance of the Mystic and

Fore River projects, as a result of the abandonment of the proj-

ects by the turnkey contractor. In a related proceeding, in May

2002,Raytheon submitted claims to the International Chamber

of Commerce Court of Arbitration seeking equitable relief

and damages for alleged owner caused performance delays in

connection with the Fore River Power Plant Engineering,

Procurement & Construction Agreement (EPC Agreement). The

EPC Agreement,executed by a Raytheon subsidiary and guaran-

teed by Raytheon,governs the design,engineering,construction,

start-up, testing and delivery of an 800-MW combined-cycle

power plant in Weymouth, Massachusetts. Raytheon recently

amended its claim and now seeks 141 days of schedule relief

(which would reduce Raytheon’s liquidated damage payment

for late delivery by approximately $25.4 million) and additional

damages of $15.6 million.Raytheon also has asserted a claim for

loss of efficiency and productivity as a result of an alleged con-

structive acceleration,for which a claim has not yet been quan-

tified. Generation believes the Raytheon assertions are without

merit and is vigorously contesting these claims.Hearings by the

International Chamber of Commerce Court of Arbitration with

respect to liability were held in January and February 2003. A

decision on liability is expected to be issued in May 2003 and,if

necessary, additional hearings will be held on damages in May

and June of 2003.

Real Estate Tax Appeals. Generation is involved in tax appeals

regarding a number of its nuclear facilities,Limerick Generating

Station (Montgomery County, PA), Peach Bottom Atomic Power

Station (York County, PA), and Quad Cities Station (Rock Island

County, IL). Generation is also involved in the tax appeal for

Three Mile Island (Dauphin County, PA) through AmerGen.

Generation does not believe the outcome of these matters will

have a material adverse effect on Generation’s results of opera-

tions or financial condition.

General. Exelon is involved in various other litigation matters.

The ultimate outcome of such matters, as well as the matters

discussed above, while uncertain, are not expected to have a

material adverse effect on its respective financial condition or

results of operations.

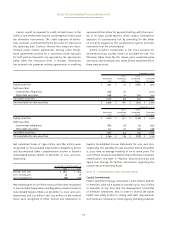

Credit Contingencies

Generation is a counterparty to Dynegy in various energy trans-

actions. In early July 2002, the credit ratings of Dynegy were

downgraded by two credit rating agencies to below investment

grade.As of December 31, 2002,Generation had a net receivable

from Dynegy of approximately $3 million, and consistent with

the terms of the existing credit arrangement, has received col-

lateral in support of this receivable. Generation also has credit

risk associated with Dynegy through Generation’s equity invest-

ment in Sithe.Sithe is a 60% owner of the Independence gener-

ating station,a 1,040-MW gas-fired qualified facility that has an

energy-only long-term tolling agreement with Dynegy, with a

related financial swap arrangement. As of December 31, 2002,

Sithe had recognized an asset on its balance sheet related to the

fair market value of the financial swap agreement with Dynegy

that is marked-to-market under the terms of SFAS No. 133. If

Dynegy is unable to fulfill the terms of this agreement, Sithe

would be required to impair this financial swap asset.We esti-

mate, as a 49.9% owner of Sithe, that the impairment would

result in an after-tax reduction of our equity earnings of

approximately $10 million.

In addition to the impairment of the financial swap asset, if

Dynegy was unable to fulfill its obligations under the financial

swap agreement and the tolling agreement, we would likely

incur a further impairment associated with the Independence

plant. Depending upon the timing of Dynegy’s failure to fulfill

its obligations and the outcome of any restructuring initiatives,

Exelon could realize an after-tax charge of between $0 and

$130 million. In the event of a sale of our investment in Sithe

to a third party, proceeds from the sale could be negatively

impacted by approximately $120 million, which would repre-

sent an after-tax loss of approximately $65 million.

Additionally, the future economic value of AmerGen’s

purchased power arrangement with Illinois Power,a subsidiary

of Dynegy, could be impacted by events related to Dynegy’s

financial condition.