ComEd 2002 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

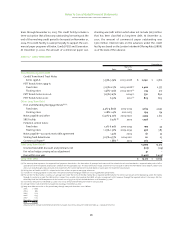

for 2002 increased approximately $48 million ($29 million, net

of income taxes).

Effective April 1, 2001, Generation changed its accounting

estimates related to the depreciation and decommissioning of

certain generating stations. The estimated service lives were

extended by 20 years for three nuclear stations,by periods of up

to 20 years for certain fossil stations and by 50 years for a

pumped storage station. Effective July 1, 2001, the estimated

service lives were extended by 20 years for the remainder of

Exelon’s operating nuclear stations. These changes were based

on engineering and economic feasibility studies performed by

Generation considering,among other things,future capital and

maintenance expenditures at these plants. The service life

extension is subject to Nuclear Regulatory Commission (NRC)

approval of an extension of existing NRC operating licenses,

which are generally 40 years. The estimated annualized reduc-

tion in expense from the change is $132 million ($79 million,net

of income taxes).

In April 2002, ComEd changed its accounting estimate

related to the allowance for uncollectible accounts based on an

independently prepared evaluation of the risk profile of

ComEd’s customer accounts receivable. As a result of the new

evaluation, the allowance for uncollectible accounts reserve

was reduced by $11 million in the second quarter of 2002.

In December 2002, PECO changed its accounting estimate

related to the allowance for uncollectible accounts based on an

independently prepared evaluation of the risk profile of PECO’s

customer accounts receivable.As a result of the new evaluation,

the allowance for uncollectible accounts reserve was reduced by

$17 million in the fourth quarter of 2002.

In 2002,Generation increased its allowance for uncollectible

accounts by $6 million based on an independently prepared

evaluation of the risk profile of Power Team’s counterparties.

Power Team is the unit within Generation that manages the

output of Generation’s assets and energy sales to reduce the

volatility of Generation’s earnings and cash flows.

note 05 • regulatory issues

ComEd

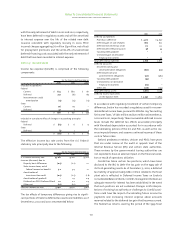

Delivery Service Rates. On June 1, 2001, ComEd filed with the ICC

to establish delivery service charges for residential customers in

preparation for residential customer choice, which began in

May 2002. ComEd is authorized to charge customers who pur-

chase electricity from an alternative supplier for the use of its

distribution system to deliver that electricity. These delivery

service rates are set through proceedings before the ICC based

upon, among other things, the operating costs associated with

ComEd’s distribution system and the capital investment that

ComEd has made in its distribution system.

On April 1, 2002, the ICC issued an interim order in ComEd’s

Delivery Services Rate Case. The interim order is subject to an

audit of test year (2000) expenditures, including capital plant

expenditures, with a final order to be issued in 2003. The order

sets delivery rates for residential customers choosing a new

retail electric supplier. The new rates became effective May 1,

2002 when residential customers became eligible to choose

their supplier of electricity. Traditional bundled rates paid by

customers that retain ComEd as their electricity supplier are

not affected by this order. Bundled rates will remain frozen

through 2006, as a result of the June 6, 2002 amendments to

the Illinois Restructuring Act that extended the freeze on bun-

dled rates for an additional two years. Delivery service rates for

non-residential customers are not affected by the order.

In October 2002, the ICC received the report on the audit of

the test year expenditures by a consulting firm engaged by the

ICC to perform the audit. The consulting firm recommended

certain additional disallowances to test year expenditures and

rate base levels. ComEd does not expect this matter to have a

significant impact on results of operations in 2003, however,

the estimated potential investment write-off, before income

taxes, could be up to approximately $100 million, if the ICC

ultimately determines that all or some portion of ComEd’s dis-

tribution plant is not recoverable through rates.In 2002,ComEd

recorded a charge to earnings, before income taxes, of $12 mil-

lion representing the estimated minimum probable exposure

pursuant to SFAS No. 90, “Regulated Enterprises—Accounting

for Abandonments and Disallowances of Plant Costs an

Amendment of FASB Statement No. 71.” ComEd is in negotia-

tions with several parties to resolve the delivery service case.

Customer Choice. As of December 31,2002,all ComEd’s customers

were eligible to choose an alternative electric supplier and non-

residential customers can also elect the power purchase option

(PPO) that allows the purchase of electric energy from ComEd

at market-based prices. ComEd’s residential customers became

eligible to choose a new electric supplier in May 2002. However,

as of December 31, 2002, no alternative supplier had sought

approval from the ICC and no electric utilities have chosen to

enter the ComEd residential market for the supply of electricity.

As of December 31, 2002, approximately 22,700 non-residential

customers,representing approximately 26% of ComEd’s annual

retail kilowatt-hour sales, had elected to purchase their electric

energy from an alternate electric supplier or had chosen the

power purchase option. Customers who receive energy from an

alternative supplier continue to pay a delivery charge.ComEd is

unable to predict the long-term impact of customer choice on

results of operations.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

92