ComEd 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

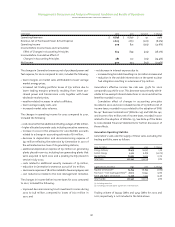

Rate Changes. The decrease in revenues attributable to rate

changes reflects $99 million for the 5% ComEd residential rate

reduction, effective October 1, 2001, required by the Illinois

restructuring legislation and the timing of a $60 million PECO

rate reduction in effect for 2001 and 2002, partially offset

by $50 million related to an increase in PECO’s gross receipts

tax rate effective January 1, 2002 and the expiration of a 6%

reduction in PECO’s rates during the first quarter of 2001.

Other Effects.The primary other item impacting revenues in 2002

was an $11 million settlement of CTCs by a large PECO customer

in the first quarter of 2001.

The reduction in wholesale revenue is primarily attributable to

the expiration of wholesale contracts that ComEd had entered

into to support the open access program in Illinois and the fact

that wholesale revenues for 2001 included a reversal of a $15

million reserve for customer refunds because of a favorable

FERC ruling in 2001.The decrease in wholesale revenue was par-

tially offset by a $12 million reimbursement from Generation

relating to third-party energy reconciliations.

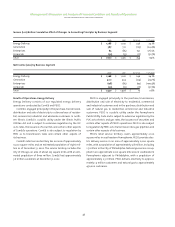

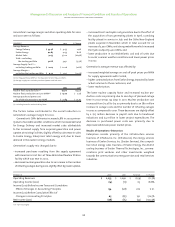

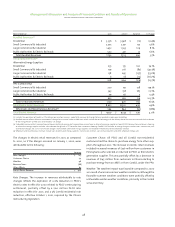

Energy Delivery’s gas sales statistics and revenue detail were

as follows:

2002 2001 Variance

Deliveries in millions

of cubic feet (mmcf) 85,545 81,528 4,017

Revenue $549 $ 654 $ (105)

The changes in gas revenue for 2002 as compared to 2001, were

as follows:

Variance

Rate Changes $ (108)

Weather 2

Volume 1

Gas Revenue $ (105)

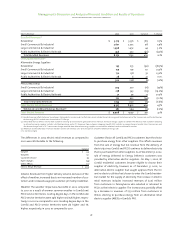

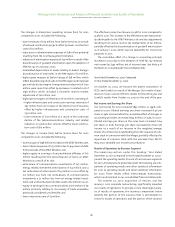

Rate Changes. The unfavorable variance in rates is attributable

to an adjustment of the purchased gas cost recovery by the PUC

in December 2001.The average rate per mmcf in 2002 was 20%

lower than it was in 2001. PECO’s gas rates are subject to peri-

odic adjustments by the PUC and are designed to recover from

or refund to customers the difference between actual cost of

purchased gas and the amount included in base rates and

increases or decreases in certain state taxes not recovered in

base rates. Effective December 1, 2002, the PUC approved a

reduction in the purchased gas adjustment of 4.5%.

Weather.The weather impact was favorable,as a result of colder

weather in 2002, as compared to 2001. Heating degree-days in

PECO’s service territory increased 1% in 2002 compared to 2001.

Volume. Exclusive of weather impacts, higher delivery volume

increased revenue by $1 million in 2002 compared to 2001.Total

deliveries to customers increased 5% in 2002 compared to 2001,

primarily as a result of customer growth and higher trans-

portation volumes.

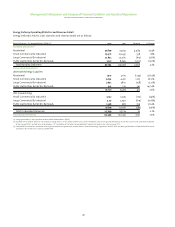

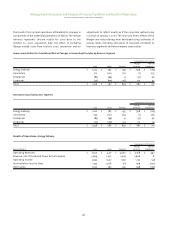

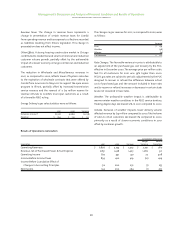

Results of Operations–Generation

Generation is one of the largest competitive electric generation

companies in the United States, as measured by owned and

controlled MWs. Generation combines its large generation fleet

with an experienced wholesale power marketing operation.

During 2002, Generation acquired the generating assets of

Sithe New England as well as two generating stations from TXU

Corp. Including those acquisitions, Generation directly owns

generation assets in the Northeast, Mid-Atlantic, Midwest and

Texas regions with a net capacity of 26,762 MWs including

14,547 MWs of nuclear capacity,and also controls another 13,900

MWs of capacity in the Midwest, Southeast and South Central

regions through long-term contracts.

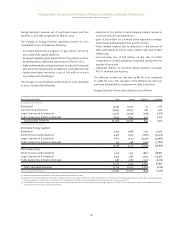

In addition to its owned generation facilities, Generation

owns a 49.9% interest in Sithe with a call option, that first

became available in December 2002,to purchase the remaining

50.1% interest (see further discussion in Liquidity and Capital

Resources). Sithe develops, owns and operates 22 generation

facilities in North America. Currently, Sithe has a total generat-

ing capacity of 1,321 MWs in operation and 230 MWs under con-

struction. Generation also owns a 50% interest in AmerGen, a

joint venture with British Energy plc. AmerGen owns three

nuclear stations with total generation capacity of 2,481 MWs.

Generation’s wholesale marketing unit,Power Team,a major

wholesale marketer of energy, uses Generation’s energy gener-

ation portfolio, transmission rights and expertise to ensure

delivery of energy to Generation’s wholesale customers under

long-term and short-term contracts,including the load require-

ments of ComEd and PECO.Power Team markets any remaining

energy in the wholesale and spot markets.

In the second quarter of 2002, Generation early adopted

Emerging Issues Task Force (EITF) Issue 02-3 “Accounting for

Contracts Involved in Energy Trading and Risk Management

Activities” (EITF 02-3). EITF 02-3 was issued by the FASB EITF in

June 2002 and required revenues and energy costs related to

energy trading contracts to be presented on a net basis in the

income statement. For comparative purposes, energy costs

related to energy trading have been reclassified as revenue for

prior periods to conform to the net basis of presentation

required by EITF 02-3.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies