ComEd 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

between the competitive price of delivered energy (the sum of

generation service at competitive prices and the regulated price

of energy delivery) and recoveries under historical bundled

rates, reduced by a mitigation factor. The CTC charges are

updated annually. Over time, to facilitate the transition to a

competitive market, the mitigation factor increases, thereby

reducing the CTC charge. Under current law, ComEd will no

longer collect CTCs at the end of 2006.

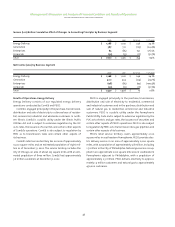

In 2001, ComEd collected $110 million of CTC revenue, while

in 2002, CTC revenue collected increased to $306 million due

to the change in the competitive price of delivered electricity,

primarily due to lower wholesale prices and more customers

choosing alternative energy suppliers or the ComEd PPO. Based

on increasing mitigation factors and our assumptions about

the competitive price of delivered energy and customers’choice

of electric suppliers, we estimate that CTC revenue will be

approximately $250 to $300 million annually by 2006. In addi-

tion, the CTC is dependent on the ICC’s determination of the

market price of electricity. In a proceeding before the ICC, vari-

ous market participants, including alternative providers and

large customers, have proposed modifications to the method

for determining the market price that, if accepted, could have

the effect of reducing the CTC.Under the current restructuring

statute, in 2007 this revenue will likely drop to zero. Through

2006,ComEd will continue to have a bundled service obligation,

particularly to residential and small commercial customers.

ComEd’s current bundled service is generally provided under an

all-inclusive rate that does not separately break out charges for

energy generation service and energy delivery service, but

charges a single set of prices. Much like the CTC collections, this

revenue stream is authorized by the legislature through the

transition period. After the transition ends in 2006, ComEd’s

bundled rates may be reset through a regulatory approval

process, which may include traditional or innovative pricing,

including performance-based incentives to ComEd.

During informal workshops sponsored by a member of the

Illinois General Assembly, various market participants and

interested parties made proposals which,if adopted,could have

the effect of reducing the CTC.

In order to address post-transition uncertainty, we are

constantly working with Illinois state and business community

leadership to facilitate the development of a competitive

electricity market while providing system reliability. This is

particularly important as ComEd’s costs to provide electricity

to bundled residential and small commercial customers are

capped by law at 110% of market. Transparent and liquid mar-

kets will help to minimize litigation over electricity prices and

provide consumers assurance of equitable pricing. At the same

time,we are attempting to establish a regulatory framework for

the post-2006 timeframe.To offset CTC revenue loss after 2006,

we are pursuing measures that would provide greater produc-

tivity,quality and innovation in our work practices across Exelon.

Our ability to make successful acquisition(s) and the recov-

ery of wholesale power prices over the next several years will

affect our ability to successfully manage this situation.

Currently, it is difficult to predict the outcome of a potential

regulatory proceeding to establish rates after 2006. We believe

that no one factor will solve these challenges,but that a combi-

nation of the components currently being worked on, together

with other things that we will do over the next four years, will

address these challenges.

In Pennsylvania,as a mechanism for utilities to recover their

allowed stranded costs, the Pennsylvania Electricity Generation

Customer Choice and Competition Act (Competition Act) pro-

vides for the imposition and collection of non-bypassable CTCs

on customers’ bills. CTCs are assessed to and collected from all

retail customers who have been assigned stranded cost respon-

sibility and access the utilities’ transmission and distribution

systems. As the CTCs are based on access to the utility’s trans-

mission and distribution system, they will be assessed regard-

less of whether such customer purchases electricity from the

utility or an alternative electric generation supplier. The

Competition Act provides,however,that the utility’s right to col-

lect CTCs is contingent on the continued operation, at reason-

able availability levels,of the assets for which the stranded costs

were awarded, except where continued operation is no longer

cost efficient because of the transition to a competitive market.

PECO has been authorized by the PUC to recover stranded

costs of $5.3 billion ($4.6 billion of unamortized costs at

December 31, 2002) over a twelve-year period ending December

31, 2010, with a return on the unamortized balance of 10.75%.

PECO’s recovery of stranded costs is based on the level of transi-

tion charges established in the settlement of PECO’s restructur-

ing case and the projected annual retail sales in PECO’s service

territory. Recovery of transition charges for stranded costs and

PECO’s allowed return on its recovery of stranded costs are

included in revenues. In 2002,revenue attributable to stranded

cost recovery was $850 million and is scheduled to increase to

$932 million by 2010, the final year of stranded cost recovery.

Amortization of PECO’s stranded cost recovery, which is a regu-

latory asset, is included in depreciation and amortization. The

amortization expense for 2002 was $308 million and will

increase to $879 million by 2010. Thus, PECO’s results will be

adversely affected over the remaining period ending December

31, 2010 by the reduction in the unamortized balance of

stranded costs and therefore the return received on that

unamortized balance.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

28