ComEd 2002 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exelon would be exposed to credit-related losses in the

event of non-performance by the counterparties that issued

the derivative instruments. The credit exposure of deriva-

tives contracts is represented by the fair value of contracts at

the reporting date. Exelon’s interest rate swaps are docu-

mented under master agreements. Among other things,

these agreements provide for a maximum credit exposure

for both parties. Payments are required by the appropriate

party when the maximum limit is reached. Generation

has entered into payment netting agreements or enabling

agreements that allow for payment netting with the major-

ity of its large counterparties, which reduce Generation’s

exposure to counterparty risk by providing for the offset

of amounts payable to the counterparty against amounts

receivable from the counterparty.

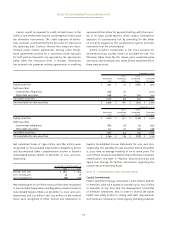

Exelon classifies investments in the trust accounts for

decommissioning nuclear plants as available-for-sale. The

following tables show the fair values, gross unrealized gains

and losses and amortized costs bases for the securities held in

these trust accounts.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

110

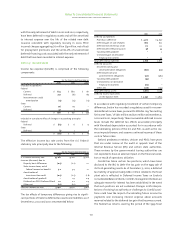

December 31, 2002

Gross Gross

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

Equity securities $ 1,763 $ 72 $ (482) $ 1,353

Debt securities

Government obligations 938 62 – 1,000

Other debt securities 698 32 (30) 700

Total debt securities 1,636 94 (30) 1,700

Total available-for-sale securities $ 3,399 $ 166 $ (512) $ 3,053

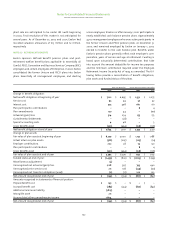

December 31, 2001

Gross Gross

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

Equity securities $ 1,666 $ 130 $ (236) $ 1,560

Debt securities

Government obligations 882 28 (3) 907

Other debt securities 701 16 (19) 698

Total debt securities 1,583 44 (22) 1,605

Total available-for-sale securities $ 3,249 $ 174 $ (258) $ 3,165

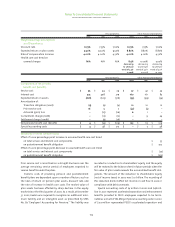

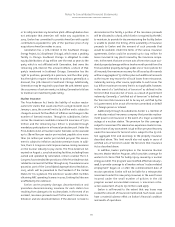

Net unrealized losses of $346 million and $84 million were

recognized in Accumulated Depreciation, Regulatory Assets

and Accumulated Other Comprehensive Income in Exelon’s

Consolidated Balance Sheets at December 31, 2002 and 2001,

respectively.

For the Years Ended December 31

2002 2001

Proceeds from sales $ 1,612 $ 1,624

Gross realized gains 56 76

Gross realized losses (86) (189)

Net realized gains of $2 million and $14 million were recognized

in Accumulated Depreciation and Regulatory Assets in Exelon’s

Consolidated Balance Sheets at December 31, 2002 and 2001,

respectively, and $32 million and $127 million of net realized

losses were recognized in Other Income and Deductions in

Exelon’s Consolidated Income Statements for 2002 and 2001,

respectively. The available-for-sale securities held at December

31, 2002 have an average maturity of six to seven years. The

cost of these securities was determined on the basis of specific

identification. See Note 11—Nuclear Decommissioning and

Spent Fuel Storage for further information regarding the

nuclear decommissioning trusts.

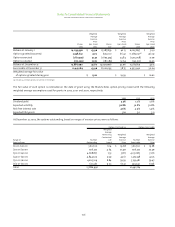

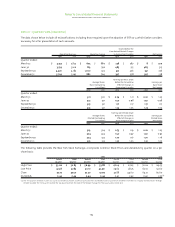

note 19 • commitments and contingencies

Capital Commitments

Exelon and British Energy, Generation’s joint venture partner

in AmerGen, have each agreed to provide up to $100 million

to AmerGen at any time that the Management Committee

of AmerGen determines, that in order to protect the public

health and safety and/or to comply with NRC requirements,

such funds are necessary to meet ongoing operating expenses