ComEd 2002 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

120

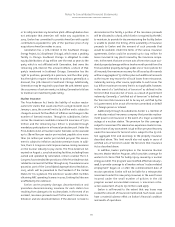

note 23 • subsequent events

On January 22, 2003, ComEd issued $350 million of 3.70% First

Mortgage Bonds, due on February 1, 2008 and $350 million of

5.875% FirstMortgage Bonds,due on February 1,2033.These bond

proceeds were used to refinance long-term debt that had been

retired during the third and fourth quarters of 2002. As part of

these bond issuances, ComEd settled various forward starting

interest rate swaps, for $43 million, which will be recorded as a

regulatory asset and amortized over the life of the debtissuance.

On January 31, 2003, ComEd called $236 million of its First

Mortgage Bonds at a redemption price of 103.86% of the prin-

cipal amount, plus accrued interest to the March 18, 2003

redemption date. The bonds, which carried an interest rate

of 8.375% and had a maturity date of February 15, 2023, are

expected to be refinanced with long-term debt.

On February 14, 2003, ComEd called $200 million of its Trust

Preferred securities at a redemption price of 100% of the prin-

cipal amount,plus accrued interest to the March 20,2003 redemp-

tion date. The preferred securities,which carried an interest rate

of 8.48% and had a maturity date of September 30, 2035, are

expected to be refinanced with trust preferred securities.

On February 20, 2003, ComEd entered into separate agree-

ments with the City of Chicago (City) and with Midwest

Generation (Midwest Agreement). Under the terms of the

agreement with the City, ComEd will pay the City $60 million

over ten years and be relieved of a requirement,originally trans-

ferred to Midwest Generation upon the sale of ComEd’s fossil

stations in 1999, to build a 500-MW generation facility. Under

the terms of the Midwest Agreement, ComEd will receive from

Midwest Generation $36 million over ten years, $22 million of

which was received on February 20, 2003, to relieve Midwest

Generation’s obligation under the fossil sale agreement.

Midwest Generation will also assume from the City a Capacity

Reservation Agreement which the City had entered into with

Calumet Energy Team, LLC (CET), that is effective through June

2012.ComEd will reimburse the City for any nonperformance by

Midwest Generation under the Capacity Reservation Agreement

and will pay approximately $2 million for amounts owed to CET

by the City at the time the agreement is executed.The net effect

of the settlement to ComEd will be amortized over the remaining

life of the franchise agreement with the City.