ComEd 2002 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

106

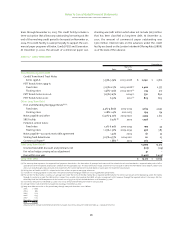

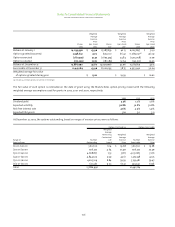

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

Price Price Price

Shares (per share) Shares (per share) Shares (per share)

2002 2002 2001 2001 2000 2000

Balance at January 1 14,039,996 $ 43.96 15,287,859 $ 42.13 6,065,897 $ 31.91

Options granted/assumed 3,938,632 47.12 629,200 66.42 11,089,051(a) 46.09

Options exercised (1,821,339) 33.37 (1,695,474) 34.84 (1,725,058) 31.79

Options canceled (270,299) 53.62 (181,589) 52.64 (142,031) 39.95

Balance at December 31 15,886,990 45.80 14,039,996 43.96 15,287,859 42.13

Exercisable at December 31 10,491,184 43.96 8,006,193 38.75 4,953,942 30.04

Weighted average fair value

of options granted during year $ 13.62 $ 19.59 $ 16.62

(a) Includes 5.3 million options converted in the Merger.

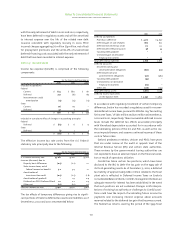

The fair value of each option is estimated on the date of grant using the Black-Scholes option-pricing model with the following

weighted average assumptions used for grants in 2002, 2001 and 2000,respectively:

2002 2001 2000

Dividend yield 3.3% 3.2% 3.6%

Expected volatility 36.8% 36.8% 36.8%

Risk-free interest rate 4.6% 4.9% 5.9%

Expected life (years) 5.0 5.0 5.0

At December 31, 2002, the options outstanding, based on ranges of exercise prices,were as follows:

Options Outstanding Options Exercisable

Weighted

Average

Remaining Weighted Weighted

Contractual Average Average

Range of Number Life Exercise Number Exercise

Exercise Prices Outstanding (years) Price Exercisable Price

$10.01-$20.00 560,700 6.14 $ 19.68 560,700 $ 19.68

$20.01-$30.00 926,332 4.64 25.49 926,332 25.49

$30.01-$40.00 4,668,877 7.53 37.87 4,031,683 37.76

$40.01-$50.00 4,844,505 9.39 45.61 1,419,748 42.25

$50.01-$60.00 4,265,109 8.84 59.39 3,159,481 59.47

$60.01-$70.00 621,467 9.03 67.32 393,240 67.28

Total 15,886,990 10,491,184