ComEd 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

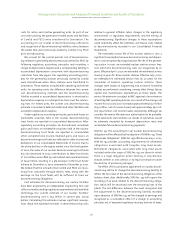

authority. Our request that the short-term debt sub-limit

restriction be eliminated is pending with the SEC.The SEC order

also authorized us to issue guarantees of up to $4.5 billion out-

standing at any one time.At December 31,2002,Exelon had pro-

vided $1.5 billion of guarantees. See Contractual Obligations,

Commercial Commitments and Off Balance Sheet Obligations

in this section for further discussion of guarantees. The SEC

order requires us to maintain a ratio of common equity to total

capitalization (including securitization debt) on and after June

30, 2002 of not less than 30%. Exelon expects that it will main-

tain a common equity ratio of at least 30%.

Under PUHCA,Exelon,ComEd,PECO and Generation can pay

dividends only from retained, undistributed or current earn-

ings.However, the SEC order granted permission to ComEd,and

to us,to the extent we receive dividends from ComEd paid from

ComEd additional paid-in-capital, to pay up to $500 million in

dividends out of additional paid-in capital, although Exelon

may not pay dividends out of paid-in capital after December 31,

2002 if its common equity is less than 30% of its total capital-

ization. At December 31, 2002, Exelon had retained earnings of

$2.0 billion, including ComEd’s retained earnings of $577 mil-

lion, PECO’s retained earnings of $401 million and Generation’s

undistributed earnings of $924 million. We are also limited

by order of the SEC under PUHCA to an aggregate investment of

$4 billion in exempt wholesale generators (EWGs) and foreign

utility companies (FUCOs). At December 31, 2002, we had

invested $2.1 billion in EWGs, leaving $1.9 billion of investment

authority under the order.Our request for an additional $1.5 bil-

lion in EWG investment authorization is pending with the SEC.

During 2001, we loaned $150 million to Sithe. Sithe paid

$2 million in interest on this loan and fully repaid the principal

balance in December of 2001 from the proceeds of a bank

borrowing. In connection with a bank borrowing by Sithe, we

provided the lenders with a support letter confirming our

investment in Sithe and agreeing to maintain a positive net

worth in Sithe. We expect that Sithe’s net worth will remain

positive for the foreseeable future and, accordingly, this agree-

ment is not reflected in the following Contractual Obligations,

Commercial Commitments and Off Balance Sheet Obligations

discussion. This agreement does not guarantee any debt or

obligation of Sithe.

Contractual Obligations, Commercial Commitments

and Off Balance Sheet Obligations

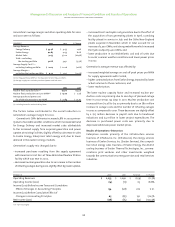

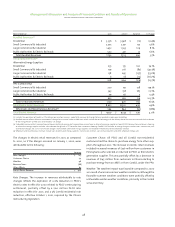

Our contractual obligations as of December 31,2002 representing

cash obligations that we consider to be firm commitments are

as follows:

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

Payment due within

Due 2008

Total 2003 2004–2005 2006–2007 and beyond

Long-Term Debt $ 14,595 $ 1,669 $ 2,275 $ 2,445 $ 8,206

Notes Payable 681 681 – – –

Short-Term Note to Sithe 534 534 – – –

Operating Leases 895 77 117 103 598

Purchase Obligations 14,729 2,677 2,987 1,856 7,209

Spent Nuclear Fuel Obligation 858 – – – 858

Obligation to Minority Shareholders 54 3 6 6 39

Total Contractual Obligations $ 32,346 $ 5,641 $ 5,385 $ 4,410 $ 16,910

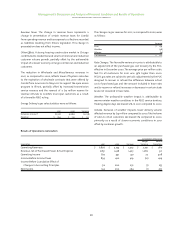

For additional information about:

– long-term debt see Note 13 of the Notes to Consolidated

Financial Statements

– notes payable see Note 12 of the Notes to Consolidated

Financial Statements

– short-term note to Sithe see Note 3 of the Notes to Consolidated

Financial Statements

– operating leases see Note 19 of the Notes to Consolidated

Financial Statements

– purchase obligations see Note 19 of the Notes to Consolidated

Financial Statements

– the spent nuclear fuel obligation see Note 11 of the Notes to

Consolidated Financial Statements

– the obligation to minority shareholders see Note 19 of the

Notes to Consolidated Financial Statements