ComEd 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Spent Fuel Storage, additional employee separation costs, the

resolution of certain tax matters and the finalization of other

purchase price allocations.

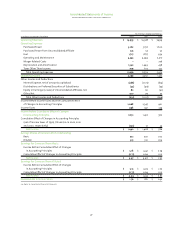

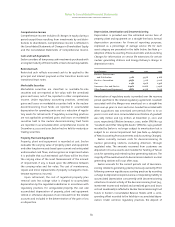

Selected unaudited pro forma combined results of operations

for the year ended December 31, 2000, assuming the Merger

Transaction occurred on January 1,2000 are presented as follows:

(unaudited) 2000

Total revenues $ 13,531

Pro forma net income $ 1,003

Merger-related costs (net of income taxes of $147) 220

Cumulative effect of a change in accounting principle

(net of income taxes of $16) 24

Pro forma net income before Merger-related costs and

the cumulative effect of a change in accounting principle $ 1,247

Pro forma net income before Merger-related costs and

the cumulative effect of a change in accounting

principle per common share (diluted) $ 3.86

Pro forma information assumes the issuance of transition

bonds in 2000 had occurred at the beginning of 2000.The pro

forma financial information is not necessarily indicative of the

operating results that would have occurred had the Merger

been consummated as of the dates indicated, nor are they

necessarily indicative of future operating results.

Merger-Related Costs

In association with the Merger,Exelon recorded certain reserves

for restructuring costs.The reserves associated with PECO were

charged to expense pursuant to FASB Emerging Issues Task

Force (EITF) Issue 94-3, “Liability Recognition for Certain

Employee Termination Benefits and Other Costs to Exit an

Activity (including Certain Costs Incurred in a Restructuring)”;

while the reserves associated with Unicom were recorded as

part of the application of purchase accounting and did not

affect results of operations, consistent with EITF Issue 95-3,

“Recognition of Liabilities in Connection with a Purchase

Business Combination.”

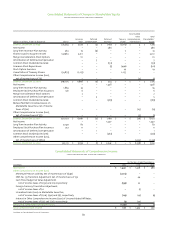

Merger costs charged to expense. PECO’s merger-related costs

charged to expense in 2000 were $248 million, consisting of

$116 million for PECO employee costs and $132 million of direct

incremental costs incurred by PECO in conjunction with the

merger transaction. Direct incremental costs represent

expenses directly associated with completing the Merger,

including professional fees, regulatory approval and settlement

costs, and settlement of compensation arrangements.

Employee costs represent estimated severance costs and pen-

sion and postretirement benefits provided under Exelon’s

merger separation plans for eligible employees who were

expected to be involuntarily terminated before December 2002

due to integration activities of the merged companies.

Additional employee severance costs of $48 million, primarily

related to PECO employees, were charged to operating and

maintenance expense in 2001, and a $10 million reduction in

the estimated liability related to Generation employees was

recorded in operating and maintenance expense in the first

quarter of 2002. Employee costs are being paid from Exelon’s

pension and postretirement benefit plans, except for certain

benefits such as outplacement services, continuation of health

care coverage and educational benefits. As of December 31,

2002, a liability of $4 million is reflected on Exelon’s consoli-

dated balance sheet for payment of these benefits, of which

$1 million is reflected on PECO’s balance sheet and $1 million is

reflected on Generation’s balance sheet.

A total of 960 PECO positions were expected to be elimi-

nated as a result of the Merger, 274 of which related to genera-

tion, 230 of which related to PECO energy delivery and 456 of

which related to enterprises and corporate support areas. As of

December 31, 2002,858 of the positions had been eliminated, of

which 224 related to generation, 195 related to PECO energy

delivery, and 439 to enterprises and corporate support. Of

the remaining 102 positions, 58 were eliminated as a result of

normal attrition and 44 positions will not be eliminated due to

changes in certain business plans.

Additionally,in the third quarter of 2000,approximately $20

million of closing costs and $8 million of stock compensation

costs associated with Unicom were charged to expense.

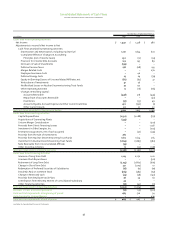

Merger costs included in purchase price allocation.The purchase

price allocation as of December 31, 2000 included a liability of

$307 million for Unicom employee costs and liabilities of

approximately $39 million for estimated costs of exiting various

business activities of former Unicom activities that were not

compatible with the strategic business direction of Exelon.

During 2001, Exelon finalized plans for consolidation of

functions, including negotiation of an agreement with the

International Brotherhood of Electrical Workers Local 15 regard-

ing severance benefits to union employees. In the third quarter

of 2002, Exelon reduced its reserve by $12 million due to the

elimination of identified positions through normal attrition,

which did not require payments under Exelon’s merger separa-

tion plans, and a determination that certain positions would

not be eliminated by the end of 2002, as originally planned,

due to a change in certain business plans. The reduction in

the reserve was recorded as a purchase price adjustment to

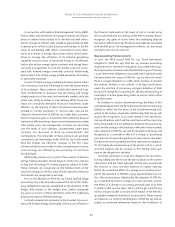

goodwill. In 2001 and 2002, Exelon recorded adjustments to the

purchase price allocation as follows:

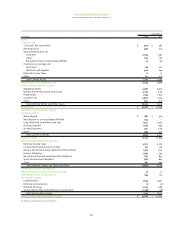

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

87