ComEd 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assumptions and interpretation at the time of adopting the

standard, including the determination of the credit-adjusted

risk-free rate. Under SFAS No. 143, the fair value of the nuclear

decommissioning obligation will continue to be adjusted on an

ongoing basis as these model input factors change.

The final determination of the 2003 earnings impact and

the cumulative effect of adopting SFAS No. 143, is in part a

function of the credit adjusted risk-free rate at the time of the

adoption of SFAS No. 143. Additionally, although over the life of

the plant the charges to earnings for the depreciation of the

asset and the interest on the liability will be equal to the

amounts that would have been recognized as decommissioning

expense under the current accounting, the timing of those

charges will change and in the near-term period subsequent to

adoption, the depreciation of the asset and the interest on the

liability is expected to result in an increase in expense.

In July 2002, the FASB issued SFAS No. 146, “Accounting for

Costs Associated with Exit or Disposal Activities” (SFAS No. 146).

SFAS No. 146 requires that the liability for costs associated with

exit or disposal activities be recognized when incurred, rather

than at the date of a commitment to an exit or disposal plan.

SFAS No. 146 is to be applied prospectively to exit or disposal

activities initiated after December 31, 2002.

In November 2002,the FASB released FASB Interpretation No.

(FIN) 45,“Guarantor’s Accounting and Disclosure Requirements

for Guarantees, Including Indirect Guarantees of Indebtedness

of Others” (FIN No. 45), providing for expanded disclosures and

recognition of a liability for the fair value of the obligation

undertaken by the guarantor. Under FIN No. 45, guarantors are

required to disclose the nature of the guarantee,the maximum

amount of potential future payments, the carrying amount of

the liability and the nature and amount of recourse provisions

or available collateral that would be recoverable by the guaran-

tor. Exelon has adopted the disclosure requirements under FIN

No. 45, (see Note 19—Commitments and Contingencies) which

were effective for financial statements for periods ended after

December 15, 2002.The recognition and measurement provisions

of FIN No.45 are effective,on a prospective basis,for guarantees

issued or modified after December 31, 2002.

In January 2003, the FASB issued FIN No. 46,“Consolidation

of Variable Interest Entities” (FIN No. 46). FIN No. 46 addresses

consolidating certain variable interest entities and applies

immediately to variable interest entities created after January

31, 2003. The impact, if any, of adopting FIN 46 on our consoli-

dated financial position, results of operations and cash flows,

has not been fully determined.

See Note 4—Adoption of New Accounting Pronouncements

and Accounting Changes for discussion of the impact of new

accounting pronouncements adopted by Exelon.

Reclassifications

Certain prior year amounts have been reclassified for compara-

tive purposes.The reclassifications did not affect net income or

shareholders’equity.

note 02 • merger

On October 20, 2000, Exelon became the parent corporation of

PECO and ComEd as a result of the completion of the transac-

tions contemplated by an Agreement and Plan of Exchange and

Merger,as amended (Merger Agreement),among PECO,Unicom

and Exelon. Pursuant to the Merger Agreement, Unicom

merged with and into Exelon. In the Merger, each share of

the outstanding common stock of Unicom was converted into

0.875 shares of common stock of Exelon plus $3.00 in cash. As

a result of the Share Exchange, Exelon became the owner of all

of the common stock of PECO.As a result of the Merger,Unicom

ceased to exist and its subsidiaries, including ComEd, became

subsidiaries of Exelon.

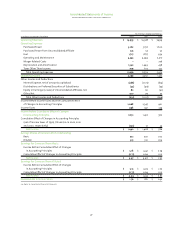

The Merger was accounted for using the purchase method

of accounting. The total purchase price was $6,014 million. In

connection with the Merger,Exelon issued 148 million shares of

common stock in the amount of $5,310 million and paid $507

million in cash to Unicom shareholders pursuant to the terms

of the Merger Agreement. The source of the cash consideration

was borrowings under an Exelon term loan. In addition, the

Merger consideration included $113 million of fair value of stock

options and awards for certain Unicom employees and $84 mil-

lion of direct acquisition costs. The cost in excess of net assets

acquired was $5,150 million as adjusted to reflect final purchase

price allocations. Exelon’s results of operations include Unicom’s

results of operations since October 20, 2000. The fair value of

the assets acquired, including the cost in excess of net assets

acquired, and liabilities assumed in the Merger are as follows:

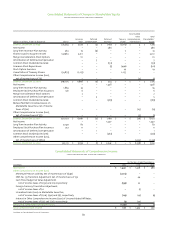

Current Assets (including cash of $974) $ 2,744

Property, Plant and Equipment 7,641

Deferred Debits and Other Assets 5,535

Cost in excess of net assets acquired 5,150

Current Liabilities (2,390)

Long-Term Debt (7,419)

Deferred Credits and Other Liabilities (4,919)

Preferred Securities of Subsidiaries (328)

Total Purchase Price $ 6,014

Goodwill associated with the Merger increased by $14 million

and $262 million in 2002 and 2001,respectively,as a result of the

finalization of the purchase price allocation.The adjustment

resulted primarily from the after-tax effects of the reduction

of the regulatory asset for decommissioning retired nuclear

plants, as discussed in Note 11—Nuclear Decommissioning and

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

86