ComEd 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

impairment loss is reported as a reduction to goodwill and a

charge to operating expense, except at the transition date,

when the loss is reflected as a cumulative effect of a change in

accounting principle.

As of December 31, 2001, Exelon’s Consolidated Balance

Sheets reflected approximately $5.3 billion in goodwill net of

accumulated amortization, including $4.9 billion of net good-

will related to the Merger recorded on ComEd’s Consolidated

Balance Sheets, with the remainder related to Enterprises. The

first step of the transitional impairment analysis indicated that

ComEd’s goodwill was not impaired but that an impairment did

exist with respect to goodwill recorded in Enterprises’reporting

units.InfraSource,the energy services business (Exelon Services)

and the competitive retail energy sales business (Exelon Energy)

were determined to be those reporting units of Enterprises that

had goodwill allocated to them.The second step of the analysis,

which compared the fair value of each of Enterprises’reporting

units’goodwill to the carrying value at December 31, 2001, indi-

cated a total goodwill impairment of $357 million ($243 million,

net of income taxes and minority interest).The fair value of the

Enterprises’ reporting units was determined using discounted

cash flow models reflecting the expected range of future cash

flow outcomes related to each of the Enterprises reporting

units over the life of the investment. These cash flows were

discounted to 2002 using a risk-adjusted discount rate. The

impairment was recorded as a cumulative effect of a change in

accounting principle in the first quarter of 2002.

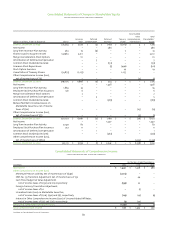

The changes in the carrying amount of goodwill by

reportable segment (see Note 20—Segment Information) for

the year ended December 31, 2002 are as follows:

Energy Delivery Enterprises Total

Balance as of January 1, 2002 $ 4,902 $ 433 $ 5,335

Impairment losses – (357) (357)

Resolution of certain tax matters 21 – 21

Merger severance adjustment (7) – (7)

Balance as of December 31, 2002 $ 4,916 $ 76 $ 4,992

The December 31, 2002, Energy Delivery goodwill relates to

ComEd and the remaining Enterprises goodwill relates to the

InfraSource and Exelon Services reporting units. Consistent

with SFAS No. 142, the remaining goodwill will be reviewed for

impairment on an annual basis, or more frequently if signifi-

cant events occur that could indicate an impairment exists.

ComEd and Enterprises performed an impairment review in the

fourth quarter of 2002. Such review was consistent with the

review conducted related to the implementation of SFAS No.

142, which required estimates of numerous items with varying

degrees of uncertainty, such as discount rates, terminal value

earnings multiples,future revenue levels and estimated future

expenditure levels for ComEd and Enterprises; load growth and

the resolution of future rate proceedings for ComEd; and cus-

tomer base and construction back logs for Enterprises. These

valuations determined the Step I calculated fair value of both

ComEd and the Enterprises’units to be in excess of their respec-

tive book values at November 1, 2002. Significant changes from

the assumptions used in the impairment review could possibly

result in a future impairment loss. Illinois legislation provides

that reductions to ComEd’s common equity resulting from

goodwill impairments will not impact ComEd’s earnings

through 2006 under the earnings provisions of the legislation.

See Note 5—Regulatory Issues for further discussion of ComEd’s

earnings provisions.

The components of the net transitional impairment loss

recognized in the first quarter of 2002 as a cumulative effect of

a change in accounting principle are as follows:

Enterprises goodwill impairment

(net of income taxes of $103) $ (254)

Minority interest (net of income taxes of $4) 11

Elimination of AmerGen negative goodwill (net of

income taxes of $9) 13

Total cumulative effect of a change in accounting principle $ (230)

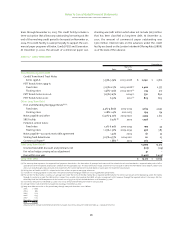

The following tables set forth Exelon’s net income and earnings

per common share for 2002,2001,and 2000 adjusted to exclude

2001 and 2000 amortization expense related to goodwill that is

no longer being amortized.

2002 2001 2000

Reported income before

cumulative effect of changes

in accounting principles $ 1,670 $ 1,416 $ 562

Cumulative effect of changes

in accounting principles (230) 12 24

Reported net income 1,440 1,428 586

Goodwill amortization –155 34

Adjusted net income $ 1,440 $ 1,583 $ 620

Basic earnings per common share:

Reported income before

cumulative effect of changes

in accounting principles $ 5.18 $ 4.42 $ 2.79

Cumulative effect of changes

in accounting principles (0.71) 0.04 0.12

Reported net income 4.47 4.46 2.91

Goodwill amortization –0.48 0.17

Adjusted net income $4.47 $ 4.94 $ 3.08

Diluted earnings per common share:

Reported income before

cumulative effect of changes

in accounting principles $ 5.15 $ 4.39 $ 2.75

Cumulative effect of changes

in accounting principles (0.71) 0.04 0.12

Reported net income 4.44 4.43 2.87

Goodwill amortization –0.48 0.17

Adjusted net income $4.44 $ 4.91 $ 3.04

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

90