ComEd 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

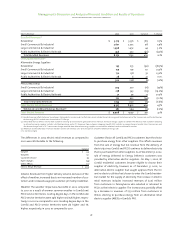

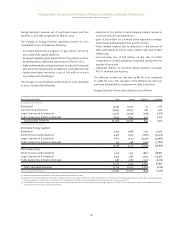

that results from normal operations attributable to changes in

components of the underlying operations of Exelon.The merger

variance represents Unicom results for 2000 prior to the

October 20, 2000 acquisition date, the effect of excluding

Merger-related costs from Exelon’s 2000 operations and an

adjustment to reflect results as if the corporate restructuring

occurred on January 1, 2000.The 2000 pro forma effects of the

Merger and restructuring were developed using estimates of

various items, including allocations of corporate overheads to

business segments and intercompany transactions.

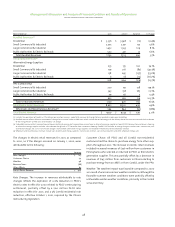

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

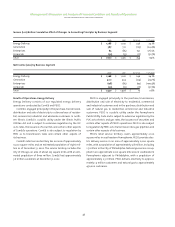

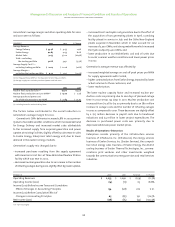

Income (Loss) Before the Cumulative Effect of Changes in Accounting Principles by Business Segment

Components of Variance

Merger Normal

2001 2000 Variance Variance Operations

Energy Delivery $ 1,022 $ 587 $ 435 $ 598 $ (163)

Generation 512 260 252 (1) 253

Enterprises (85) (94) 9 (31) 40

Corporate (33) (191) 158 115 43

Total $ 1,416 $ 562 $ 854 $ 681 $ 173

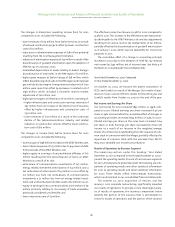

Net Income (Loss) by Business Segment

Components of Variance

Merger Normal

2001 2000 Variance Variance Operations

Energy Delivery $ 1,022 $ 587 $ 435 $ 598 $ (163)

Generation 524 260 264 (1) 265

Enterprises (85) (94) 9 (31) 40

Corporate (33) (167) 134 115 19

Total $ 1,428 $ 586 $ 842 $ 681 $ 161

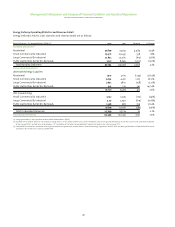

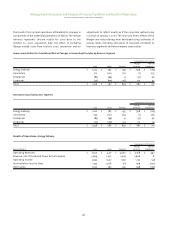

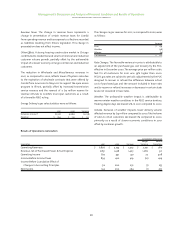

Results of Operations–Energy Delivery

Components of Variance

Merger Normal

Energy Delivery 2001 2000 Variance Variance Operations

Operating Revenues $ 10,171 $ 4,511 $ 5,660 $ 5,168 $ 492

Revenue, net of Purchased Power & Fuel Expense 5,699 2,725 2,974 2,966 8

Operating Income 2,593 1,502 1,091 1,132 (41)

Income Before Income Taxes 1,725 1,008 717 919 (202)

Net Income 1,022 587 435 598 (163)