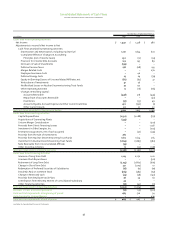

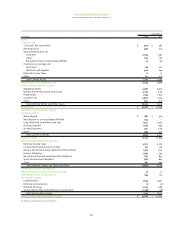

ComEd 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

We use a Value-at-Risk (VaR) model to assess the market risk

associated with financial derivative instruments entered into

for proprietary trading purposes.The measured VaR represents

an estimate of the potential change in value of our proprietary

trading portfolio.

The VaR estimate includes a number of assumptions about

current market prices, estimates of volatility and correlations

between market factors.These estimates,however,are not nec-

essarily indicative of actual results, which may differ because

actual market rate fluctuations may differ from forecasted fluc-

tuations and because the portfolio may change over the hold-

ing period.

We estimate VaR using a model based on the Monte Carlo

simulation of commodity prices that captures the change in

value of forward purchases and sales as well as option values.

Parameters and values are backtested daily against daily

changes in mark-to-market value for proprietary trading activ-

ity. Value-at-Risk assumes that normal market conditions pre-

vail and that there are no changes in positions. We use a 95%

confidence interval,one-day holding period, one-tailed statisti-

cal measure in calculating our VaR. This means that we may

state that there is a one in 20 chance that if prices move against

our portfolio positions, our pre-tax loss in liquidating our port-

folio in a one-day holding period would exceed the calculated

VaR. To account for unusual events and loss of liquidity, we use

stress tests and scenario analysis.

For financial reporting purposes only, we calculate several

other VaR estimates.The higher the confidence interval,the less

likely the chance that the VaR estimate would be exceeded. A

longer holding period considers the effect of liquidity in being

able to actually liquidate the portfolio.A two-tailed test consid-

ers potential upside in the portfolio in addition to the potential

downside in the portfolio considered in the one-tailed test.The

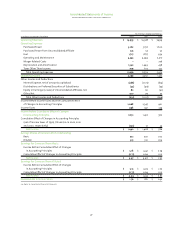

following table provides the VaR for all proprietary trading posi-

tions of Generation as of December 31, 2002.

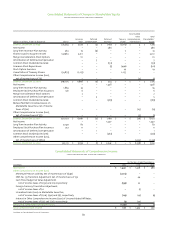

Proprietary

Trading VaR

95% Confidence Level, One-Day Holding Period, One-Tailed

Period End $ 0.2

Average for the Period 1.4

High 5.0

Low 0.2

95% Confidence Level,Ten-Day Holding Period,Two-Tailed

Period End $ 0.3

Average for the Period 1.5

High 5.3

Low 0.1

99% Confidence Level, One-Day Holding Period,Two-Tailed

Period End $ 0.9

Average for the Period 4.6

High 16.7

Low 0.4

Credit Risk

Credit risk for Energy Delivery is managed by each of ComEd’s

and PECO’s credit and collection policies, which are consistent

with state regulatory requirements. ComEd and PECO are each

currently obligated to provide service to all electric customers

within their respective franchised territories.For the year ended

December 31, 2002, ComEd’s ten largest customers represented

approximately 3% of its retail electric revenues and PECO’s ten

largest customers represented approximately 8% of its retail

electric revenues. We record a provision for uncollectible

accounts, based upon historical experience and third-party

studies, to provide for the potential loss from nonpayment by

these customers.

Generation has credit risk associated with counterparty

performance on energy contracts which includes, but is not

limited to, the risk of financial default or slow payment.

Generation manages counterparty credit risk through estab-

lished policies,including counterparty credit limits,and in some

cases, requiring deposits and letters of credit to be posted by

certain counterparties. Generation’s counterparty credit limits

are based on a scoring model that considers a variety of factors,

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies