ComEd 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

market and to implement a financially-based system for deal-

ing with congestion on transmission lines known as “locational

marginal pricing” (LMP). FERC has also issued proposals to

encourage RTO development,independent control of the trans-

mission grid and expansion of the transmission grid by provid-

ing enhanced returns on equity for transmission assets.

PECO is a member of PJM Interconnection, LLC (PJM), an

approved RTO operating in the Mid-Atlantic region. ComEd,

along with other Midwestern utilities,joined PJM in a westward

expansion of PJM. ComEd is expected to turn over control of

its transmission assets to PJM later this year and recover its

current transmission revenues through the PJM open-access

transmission tariff.

FERC Order 2000 has not led to the rapid development of

RTOs and FERC has not yet finalized its SMD proposal, due in

part to substantial opposition by some state regulators and

other governmental officials. We support both of these pro-

posals but cannot predict whether they will be successful,

what impact they may ultimately have on our transmission

rates, revenues and operation of our transmission facilities, or

whether they will ultimately lead to the development of large,

successful regional wholesale markets.To the extent that ComEd

and PECO have POLR obligations, and may at some point no

longer have long-term supply contracts with Generation for their

load, the ability of ComEd and PECO to cost effectively serve

their POLR load obligation will depend on the development of

such markets.

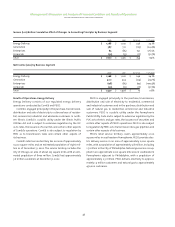

Effective management of capital projects is important to our business.

Energy Delivery’s business is capital intensive and requires sig-

nificant investments in energy transmission and distribution

facilities, and in other internal infrastructure projects.

Energy Delivery continues to make significant capital expen-

ditures to improve the reliability of its transmission and distri-

bution systems in order to provide a high level of service to its

customers.Energy Delivery expects that its capital expenditures

will continue to exceed depreciation on its plant assets. Energy

Delivery’s base rate freeze and caps will generally preclude

incremental rate recovery on any of these incremental invest-

ments prior to January 1, 2007 (see Energy Delivery—Rate and

Equity Return Limitations above).

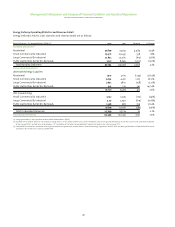

Generation

Our Generation business operates a fleet of generating assets

and markets the output of a portfolio of supply, which includes

100% owned assets, co-owned facilities and purchased power.

As discussed previously, Generation has entered into long-term

power purchase agreements with ComEd and PECO.The major-

ity of Generation’s portfolio is used to provide power under

these agreements. To the extent the portfolio is not needed to

supply power to ComEd or PECO, their output is sold on the

wholesale market. Generation’s ability to grow is dependent

upon its ability to cost-effectively meet ComEd’s and PECO’s

load requirements, to manage its power portfolio and to effec-

tively handle the changes in the wholesale power markets.

Our financial performance may be affected by liabilities arising

from our ownership and operation of nuclear facilities.

The ownership and operation of nuclear facilities involve cer-

tain risks, including: mechanical or structural problems; inade-

quacy or lapses in maintenance protocols; the impairment of

reactor operation and safety systems due to human error; the

costs of storage,handling and disposal of nuclear material;and

uncertainties with respect to the technological and financial

aspects of decommissioning nuclear facilities at the end of

their useful lives.The following are among the more significant

of these risks:

Operational risk. Operations at any nuclear generation plant

could degrade to the point where we would have to shut down

the plant. If this were to happen, the process of identifying and

correcting the causes of the operational downgrade to return

the plant to operation could require significant time and

expense, resulting in both lost revenue and increased fuel and

purchased power expense to meet our supply commitments.

For plants operated by us but not wholly owned by us,we could

incur liabilities to the co-owners. We may choose to close a

plant rather than incur substantial costs to restart the plant.

Nuclear accident risk. Although the safety record of nuclear

reactors has been very good, accidents and other unforeseen

problems have occurred both in the United States and else-

where.The consequences of an accident can be severe and may

include loss of life and property damage. Any resulting liability

from a nuclear accident could exceed our insurance coverages

and significantly affect our results of operations or financial

position. See Note 19 of Notes to the Consolidated Financial

Statements for further discussion of nuclear insurance.

Nuclear regulation. The Nuclear Regulatory Commission (NRC)

may modify, suspend or revoke licenses and impose civil penal-

ties for failure to comply with the Atomic Energy Act, the regu-

lations under it or the terms of the licenses of nuclear facilities.

Changes in regulations by the NRC that require a substantial

increase in capital expenditures or that result in increased

operating or decommissioning costs could adversely affect our

results of operations or financial condition. Events at nuclear

plants owned by others, as well as those owned by us, may

initiate such actions. Additional security requirements could

also be imposed.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

30