ComEd 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

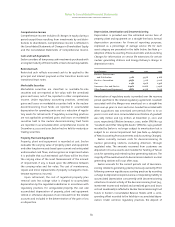

As it relates to nuclear decommissioning, the effect of a

cumulative adjustment will be to decrease the decommission-

ing liability to reflect the fair value of the decommissioning

obligation at the balance sheet date. Additionally, SFAS No. 143

will require the recognition of an asset related to the decom-

missioning obligation, which will be amortized over the

remaining lives of the plants. The net difference, between the

asset recognized and the change in the liability to reflect fair

value recorded upon adoption of SFAS No. 143, will be recorded

in earnings and recognized as a cumulative effect of a change

in accounting principle,net of expected regulatory recovery and

income taxes.The decommissioning liability will then represent

an obligation for the future decommissioning of the plants and,

as a result, accretion expense will be accrued on this liability

until the obligation is satisfied.

Currently, Generation records the obligation for decommis-

sioning ratably over the lives of the plants.Based on the current

information and the credit-adjusted risk-free rate, we estimate

the increase in 2003 non-cash expense to impact earnings

before the cumulative effect of a change in accounting principle

for the adoption of SFAS No. 143 by approximately $24 million,

after income taxes. Additionally, the adoption of SFAS No. 143 is

expected to result in a large, non-cash, one-time cumulative

effect of a change in accounting principle gain of at least $1.5

billion, after income taxes.The $1.5 billion gain and the $24 mil-

lion charge includes our share of the impact of the SFAS No.143

adoption related to AmerGen’s nuclear plants. These impacts

are based on our current interpretation of SFAS No. 143 and are

subject to continued refinement based on the finalization of

assumptions and interpretation at the time of adopting the

standard, including the determination of the credit-adjusted

risk-free rate. Under SFAS No. 143, the fair value of the nuclear

decommissioning obligation will continue to be adjusted on an

ongoing basis as these model input factors change.

The final determination of the 2003 earnings impact and

the cumulative effect of adopting SFAS No. 143 is in part a

function of the credit adjusted risk-free rate at the time of the

adoption of SFAS No. 143. Additionally, although over the life of

the plant the charges to earnings for the depreciation of the

asset and the interest on the liability will be equal to the

amounts that would have been recognized as decommissioning

expense under current accounting, the timing of those charges

will change and in the near-term period subsequent to adop-

tion,the depreciation of the asset and the interest on the liabil-

ity is expected to result in an increase in expense.

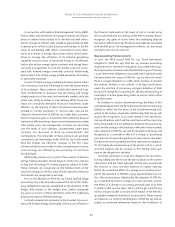

In July 2002, the FASB issued SFAS No. 146, “Accounting for

Costs Associated with Exit or Disposal Activities” (SFAS No. 146).

SFAS No. 146 requires that the liability for costs associated with

exit or disposal activities be recognized when incurred, rather

than at the date of a commitment to an exit or disposal plan.

SFAS No. 146 is to be applied prospectively to exit or disposal

activities initiated after December 31, 2002.

In November 2002,the FASB released FASB Interpretation No.

(FIN) 45,“Guarantor’s Accounting and Disclosure Requirements

for Guarantees, Including Indirect Guarantees of Indebtedness

of Others” (FIN No. 45), providing for expanded disclosures and

recognition of a liability for the fair value of the obligation

undertaken by the guarantor. Under FIN No. 45, guarantors are

required to disclose the nature of the guarantee,the maximum

amount of potential future payments, the carrying amount of

the liability and the nature and amount of recourse provisions

or available collateral that would be recoverable by the guar-

antor. As of December 31, 2002, we have adopted disclosure

requirements under FIN No. 45, which were effective for finan-

cial statements for periods ended after December 15, 2002. The

recognition and measurement provisions of FIN No.45 are effec-

tive, on a prospective basis, for guarantees issued or modified

after December 31, 2002.

In January 2003, the FASB issued FIN No. 46,“Consolidation

of Variable Interest Entities” (FIN No. 46). FIN No. 46 addresses

consolidating certain variable interest entities and applies

immediately to variable interest entities created after January

31, 2003. The impact, if any, of adopting FIN 46 on our consoli-

dated financial position, results of operations and cash flows,

has not been fully determined.

forward-looking statements

Except for the historical information contained in this report,

certain of the matters discussed in this Report are forward-

looking statements that are subject to risks and uncertainties.

The factors that could cause actual results to differ materially

include those we have discussed in this report as well as those

listed in Note 19 of the Notes to Consolidated Financial

Statements and other factors discussed in our filings with the

SEC.Readers should not place undue reliance on these forward-

looking statements, which speak only as of the date of this

Report. We undertake no obligation to publicly release any

revision to these forward-looking statements to reflect events

or circumstances after the date of this Report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

75