ComEd 2002 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with Exelon’s Risk Management Policy (RMP),

Exelon enters into derivatives to manage its exposure to fluctu-

ations in interest rates related to its variable rate debt instru-

ments, changes in interest rates related to planned future debt

issuances prior to their actual issuance and changes in the fair

value of outstanding debt which is planned for early retire-

ment. As it relates to energy transactions, Exelon utilizes deriv-

atives to manage the utilization of its available generating

capability and provisions of wholesale energy to its affiliates.

Exelon also utilizes energy option contracts and energy finan-

cial swap arrangements to limit the market price risk associ-

ated with forward energy commodity contracts. Additionally,

Exelon enters into certain energy related derivatives for trading

or speculative purposes.

As part of Exelon’s energy marketing business,Exelon enters

into contracts to buy and sell energy to meet the requirements

of its customers. These contracts include short-term and long-

term commitments to purchase and sell energy and energy

related products in the retail and wholesale markets with the

intent and ability to deliver or take delivery. While these con-

tracts are considered derivative financial instruments under

SFAS No. 133, the majority of these transactions have been des-

ignated as “normal purchases” or “normal sales” and are not

subject to the provisions of SFAS No. 133. Under these contracts,

Exelon recognizes gains or losses when the underlying physical

transaction affects earnings.Revenues and expenses associated

with market price risk management contracts are amortized

over the terms of such contracts. Commitments under these

contracts are discussed in Note 19—Commitments and

Contingencies. The remainder of these contracts are generally

considered cash flow hedges under SFAS No. 133. To the extent

that the hedges are effective, changes in the fair value

of these contracts are recorded in other comprehensive income,

until earnings are affected by the variability of cash flows

being hedged.

Additionally, during 2001, as part of the creation of Exelon’s

energy trading operation, Exelon began to enter into contracts

to buy and sell energy for trading purposes subject to limits.

These contracts are recognized on the balance sheet at fair

value and changes in the fair value of these derivative financial

instruments are recognized in earnings.

Prior to the adoption of SFAS No. 133, Exelon applied hedge

accounting only if the derivative reduced the risk of the under-

lying hedged item and was designated at the inception of the

hedge, with respect to the hedged item. Exelon recognized

any gains or losses on these derivatives when the underlying

physical transaction affected earnings.

Contracts entered into by Exelon to limit market risk associ-

ated with forward energy commodity contracts are reflected in

the financial statements at the lower of cost or market using

the accrual method of accounting.Under these contracts, Exelon

recognizes any gains or losses when the underlying physical

transaction affects earnings.Revenues and expenses associated

with market price risk management contracts are amortized

over the terms of such contracts.

New Accounting Pronouncements

In 2001, the FASB issued SFAS No. 143, “Asset Retirement

Obligations” (SFAS No. 143). SFAS No. 143 provides accounting

requirements for retirement obligations associated with tangi-

ble long-lived assets.Exelon will adopt SFAS No.143 as of January

1, 2003.Retirement obligations associated with long-lived assets

included within the scope of SFAS No. 143 are those for which

there is a legal obligation to settle under existing or enacted

law, statute, written or oral contract or by legal construction

under the doctrine of promissory estoppel. Adoption of SFAS

No. 143 will change the accounting for the decommissioning of

Generation’s nuclear generating plants as well as certain other

long-lived assets.

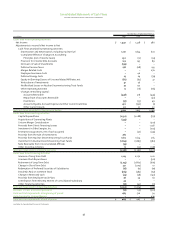

As it relates to nuclear decommissioning, the effect of this

cumulative adjustment will be to decrease the decommissioning

liability to reflect the fair value of the decommissioning obli-

gation at the balance sheet date. Additionally, SFAS No. 143 will

require the recognition of an asset related to the decommis-

sioning obligation, which will be amortized over the remaining

lives of the plants. The net difference, between the asset recog-

nized and the change in the liability to reflect fair value recorded

upon adoption of SFAS No.143, will be recorded in earnings and

recognized as a cumulative effect of a change in accounting

principle,net of expected regulatory recovery and income taxes.

The decommissioning liability will then represent an obligation

for the future decommissioning of the plants and, as a result,

accretion expense will be accrued on this liability until such

time as the obligation is satisfied.

Currently, Generation records the obligation for decommis-

sioning ratably over the lives of the plants.Based on the current

information and the credit-adjusted risk-free rate, we estimate

the increase in 2003 non-cash expense to impact earnings

before the cumulative effect of a change in accounting princi-

ple for the adoption of SFAS No. 143 by approximately $24 mil-

lion, after income taxes. Additionally, the adoption of SFAS No.

143 is expected to result in a large, non-cash,one-time cumula-

tive effect of a change in accounting principle gain of at least

$1.5 billion, after income taxes.The $1.5 billion gain and the $24

million charge includes our share of the impact of the SFAS No.

143 adoption related to AmerGen’s nuclear plants.These impacts

are based on our current interpretation of SFAS No. 143 and are

subject to continued refinement based on the finalization of

Notes To Consolidated Financial Statements

exelon corporation and subsidiary companies

85