ComEd 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

States for his signature. The extension would affect facilities

obtaining NRC operating licenses in 2003. Existing facilities are

unaffected by the extension.

Other insurance.In addition to nuclear liability insurance,Exelon

also carries property damage and liability insurance for its

properties and operations. As a result of significant changes in

the insurance marketplace, due in part to the September 11,

2001 terrorist acts,the available coverage and limits may be less

than the amount of insurance obtained in the past, and the

recovery for losses due to terrorists acts may be limited.We are

self-insured for deductibles and to the extent that any losses

may exceed the amount of insurance maintained.

A claim that exceeds the amounts available under our

property damage and liability insurance, together with the

deductible, would negatively affect our results of operations.

Nuclear Electric Insurance Limited (NEIL), a mutual insurance

company to which we belong, provides property and business

interruption insurance for our nuclear operations. In recent

years, NEIL has made distributions to its members. Our distri-

bution for 2002 was $40 million, which was recorded as a

reduction to Operating and Maintenance expense on our

Consolidated Statements of Income. Due in part to the

September 11, 2001 events and the results in the stock market

over the last two years, we cannot predict the level of future

distributions.

The possibility of attack or war may adversely affect our results

of operations, future growth and ability to raise capital.

Any military strikes or sustained military campaign may affect

our operations in unpredictable ways, such as further changes

in insurance markets, increased security measures and disrup-

tions of fuel supplies and markets, particularly oil and LNG.Just

the possibility that infrastructure facilities,such as electric gen-

eration,transmission and distribution facilities,would be direct

targets of, or indirect casualties of, an act of terror or war may

affect our operations. War and the possibility of war may have

an adverse effect on the economy in general. A lower level of

economic activity might result in a decline in energy consump-

tion, which may adversely affect our revenues or restrict our

future growth. Instability in the financial markets as a result of

war may affect our ability to raise capital.

The introduction of new technologies could increase competition

within our markets.

While demand for electricity is generally increasing throughout

the United States, the rate of construction and development of

new, more efficient, electric generation facilities and distribu-

tion methodologies may exceed increases in demand in some

regional electric markets.The introduction of new technologies

could increase competition,which could lower prices and have an

adverse affect on our results of operations or financial condition.

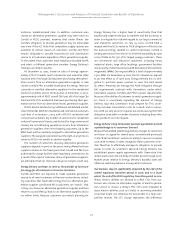

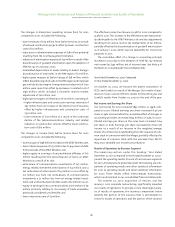

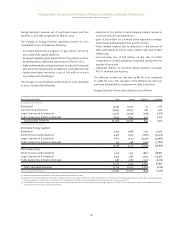

results of operations

Year Ended December 31, 2002 Compared

To Year Ended December 31,2001

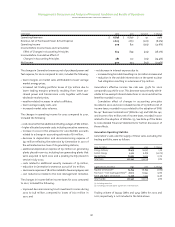

Net Income and Earnings Per Share

Net income for 2002 increased $12 million compared to 2001.

Diluted earnings per common share were $4.44 and $4.43 for

2002 and 2001, respectively.Net income for 2002 reflects a $230

million charge for the cumulative effect of changes in account-

ing principles as a result of the adoption of Financial

Accounting Standards Board (FASB) Statement of Financial

Accounting Standards (SFAS) No. 142, “Goodwill and Other

Intangible Assets” (SFAS No. 142), while net income for 2001

reflects $12 million of income for the cumulative effect of

changes in accounting principles as a result of the adoption of

SFAS No.133,“Accounting for Derivatives and Hedging Activities”

(SFAS No.133). See Note 4 of the Notes to Consolidated Financial

Statements for further information regarding the adoption of

SFAS No. 142 and SFAS No.133.

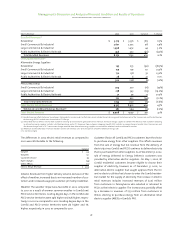

Income Before Cumulative Effect of Changes in Accounting

Principles in 2002 increased $254 million, or 18%, compared to

2001. Diluted earnings per common share on the same basis

increased $0.76 per share, or 17%. The increase reflects

Enterprises’sale of its interest in AT&T Wireless,a 2.6% increase

in retail sales due to a warmer-than-usual summer, an exten-

sion of the estimated service lives of generating stations,the

discontinuation of goodwill amortization as of January 1, 2002

pursuant to SFAS No. 142, lower interest expense, and reduced

depreciation expense resulting from lower depreciation rates

at Energy Delivery.The increase was partially offset by lower

wholesale energy prices, increased nuclear refueling outage

costs, the write-down of certain investments at Enterprises,

employee severance costs, and other factors described below.

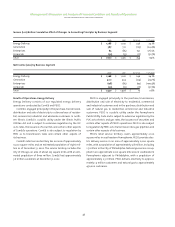

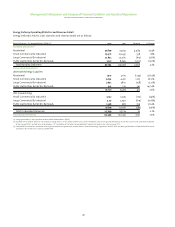

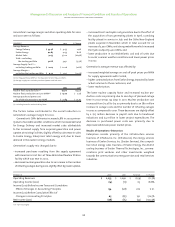

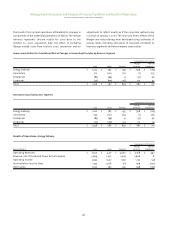

Results of Operations by Business Segment

All comparisons presented under this heading are comparisons

of operating results and other statistical information for 2002 to

operating results and other statistical information for 2001.

These results reflect intercompany transactions, which are

eliminated in our consolidated financial statements.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

exelon corporation and subsidiary companies

37