Western Union 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

2016 Proxy Statement | 63

EXECUTIVE COMPENSATION

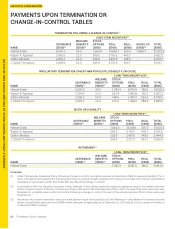

(4) Amounts in this column reflect tax gross-up calculations assuming a blended effective tax rate of approximately 40% and a 20% excise tax

incurred on excess parachute payments, as calculated in accordance with Internal Revenue Code Sections 280G and 4999. The equity is

valued using a closing stock price of $17.91 per share on December 31, 2015. As noted above, the Executive Severance Policy prohibits the

Company from providing change-in-control tax gross-ups to individuals promoted or hired after April 2009. Accordingly, Mr. Ersek is the only

Company employee who remains eligible for excise tax gross-up payments.

(5) Amounts in these columns reflect the long-term incentive awards to be received upon a termination or a change-in-control calculated in

accordance with the Executive Severance Policy and the Long-Term Incentive Plan. In the case of stock grants, the equity value represents the

value of the shares (determined by multiplying the closing stock price of $17.91 per share on December 31, 2015 by the number of unvested

restricted stock units or, in the case of PSUs, by the number of shares to be awarded based on the projected achievement of the applicable

performance objectives as of December 31, 2015, that would vest upon a qualifying termination, death or disability). In the case of option

awards, the equity value was determined by multiplying (i) the spread between the exercise price and the closing stock price of $17.91 per share

on December 31, 2015 and (ii) the number of unvested option shares that would vest following a qualifying termination, death or disability. The

calculation with respect to unvested long-term incentive awards reflects the following additional assumptions under the Executive Severance

Policy and the Long-Term Incentive Plan:

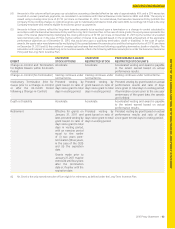

EVENT UNVESTED

STOCK OPTIONS UNVESTED

RESTRICTED STOCK PERFORMANCE-BASED

RESTRICTED STOCK UNITS

Change-in-Control and Termination

for Eligible Reason within 24-month

Period

Accelerate Accelerate Accelerated vesting and award is payable

to the extent earned based on actual

performance results.

Change-in-Control (No Termination) Vesting continues under

normal terms.

Vesting continues under

normal terms.

Vesting continues under normal terms.

Involuntary Termination (Not for

Cause prior to a Change-in-Control

or after the 24-month Period

following a Change-in-Control)

Prorated vesting by

grant based on ratio of

days since grant to total

days in vesting period.

Prorated vesting by

grant based on ratio of

days since grant to total

days in vesting period.

Prorated vesting by grant based on actual

performance results and ratio of days

since grant to total days in vesting period;

if termination occurs prior to the one year

anniversary of the grant date, the awards

are forfeited.

Death or Disability Accelerate Accelerate Accelerated vesting and award is payable

to the extent earned based on actual

performance results.

Retirement Effective for grants on

January 31, 2011 and

later, prorated vesting by

grant based on ratio of

days since grant to total

days in vesting period,

with an exercise period

equal to the earlier

of (i) two years post-

termination (three years,

in the case of the CEO)

and (ii) the expiration

date.

Grants made prior to

January 31, 2011 may be

exercised until four years

after the termination

date or, if earlier until the

expiration date.

Prorated vesting by

grant based on ratio of

days since grant to total

days in vesting period.

Prorated vesting by grant based on actual

performance results and ratio of days

since grant to total days in vesting period.

(6) Mr. Ersek is the only named executive officer eligible for retirement, as defined under the Long-Term Incentive Plan.