Western Union 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

2016 Proxy Statement | 37

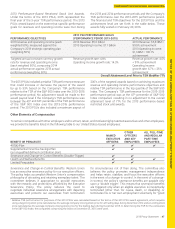

COMPENSATION DISCUSSION AND ANALYSIS

SETTING 2015 COMPENSATION

In late 2014, the Compensation Committee, working with the

Compensation Consultant and the Chief Executive Officer,

engaged in a detailed review of the Company’s executive

compensation programs to evaluate whether the design and

levels of each compensation element were:

• Appropriate to support the Company’s strategic

performance objectives;

• Consistent with the philosophy and objectives described

under “—Our Executive Compensation Philosophy and

Objectives” above; and

• Reasonable when compared to market pay practices

(see “—Market Comparison” below).

For 2015, based on a variety of factors including the “say

on pay” vote results at the Company’s recent Annual

Meetings of Stockholders and positive feedback received

during the Company’s stockholder engagement efforts,

the Compensation Committee determined to continue the

compensation program elements implemented in 2014,

as described above under “—Recent Enhancements to Our

Executive Compensation Program.” Accordingly, for 2015,

the Company’s executive compensation program continued

to be significantly weighted towards performance-based

compensation and continued to include a diversified mix of

long-term incentive awards, weighted 60% Financial PSUs,

20% TSR PSUs and 20% stock options, with Company

performance under the PSUs measured over a three-year

performance period.

In early 2015, Mr. Ersek presented to the Compensation

Committee his evaluation of each of the Executive Vice

Presidents and the level of his or her salary, annual bonus

targets under the Annual Incentive Plan, and long-term

incentive award targets under the Long-Term Incentive

Plan. Mr. Ersek based his assessments on each executive’s

performance and relative contributions to the Company’s

success, the performance of the executive’s respective

business unit or functional area, employee retention

considerations, market data, compensation history and

internal equity. Mr. Ersek also reviewed with the committee

tally sheets that presented comprehensive historical and

current compensation data for each of the Company’s

executive officers. Please see “—Use of Tally Sheets” below

for a description of this tool. The Compensation Consultant

participated in the committee meetings to provide peer

group and market data regarding executive compensation.

Please see “—Market Comparison” for a discussion of the

use of peer group and market data.

In early 2015, Mr. Ersek also submitted a self-evaluation

to the Compensation Committee. The committee shared

Mr. Ersek’s goals for the year and his self-evaluation with the

independent members of the Board of Directors, who then

evaluated Mr. Ersek’s performance in 2014 based on his

actual performance versus such goals. In setting Mr. Ersek’s

compensation, the committee considered this evaluation,

market data regarding chief executive officer compensation

levels provided by the Compensation Consultant, and a tally

sheet of Mr. Ersek’s historical and current compensation data.

No member of management, including Mr. Ersek, made any

recommendations regarding Mr. Ersek’s compensation or

participated in the portions of the Compensation Committee

meeting or in the meeting of the independent directors

of the Board during which Mr. Ersek’s compensation was

determined or ratified.

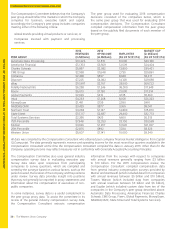

MARKET COMPARISON

For 2015, the Compensation Committee considered market

pay practices when setting executive compensation,

but did not target the specific compensation elements

or total compensation against the market data. Instead,

the committee used market data to assess the overall

competitiveness and reasonableness of the Company’s

executive compensation program. In evaluating 2015 market

data, the committee considered both peer group proxy data

and compensation survey data, but did not assign a specific

weight to either data source. While the Compensation

Committee considers relevant market pay practices when

setting executive compensation, it does not believe it

appropriate to establish compensation levels based only on

market practices. The Compensation Committee believes

that compensation decisions are complex and require

a deliberate review of Company performance and peer

compensation levels. The factors that influence the amount

of compensation awarded include market competition for

a particular position, an individual’s experience and past

performance inside or outside the Company, compensation

history, role and responsibilities within the Company, tenure

with the Company and associated institutional knowledge,

long-term potential with the Company, contributions derived

from creative and innovative thinking and leadership, money

transfer or financial services industry expertise, past and

future performance objectives and the value of the position

within the Company.