Western Union 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

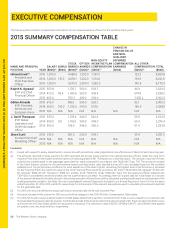

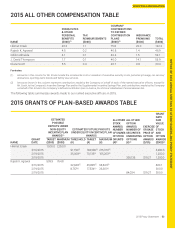

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

2016 Proxy Statement | 49

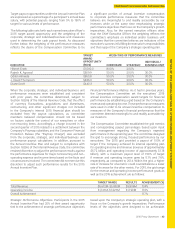

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE GUIDELINE STATUS

Hikmet Ersek 6x salary Meets guideline

Rajesh K. Agrawal 2x salary Meets guideline

Odilon Almeida 2x salary Must hold 50% of

after-tax shares until

guideline is met

J. David Thompson 2x salary Meets guideline

WHAT COUNTS TOWARD

THE GUIDELINE WHAT DOES NOT COUNT

TOWARD THE GUIDELINE

✔ Western Union securities owned personally ✘ Unexercised stock options

✔ Shares held in any Western Union benefit plan ✘ PSUs

✔ After-tax value of time-based restricted stock and restricted

stock units

Prohibition Against Pledging and Hedging of the

Company’s Securities

The Company’s insider trading policy prohibits the

Company’s executive officers and directors from pledging the

Company’s securities or engaging in hedging or short-term

speculative trading of the Company’s securities, including,

without limitation, short sales or put or call options involving

the Company’s securities.

Clawback Policy

The Board of Directors adopted a clawback policy in 2009.

Under the policy, the Company may, in the Board’s discretion

and subject to applicable law, recover incentive compensation

paid to an executive officer of the Company (defined as an

individual subject to Section 16 of the Exchange Act, at the

time the incentive compensation was received by or paid to the

officer) if the compensation resulted from any financial result

or performance metric impacted by the executive officer’s

misconduct or fraud. The Board is monitoring this policy to

ensure that it is consistent with applicable laws, including any

requirements under the Dodd-Frank Wall Street Reform and

Consumer Protection Act (the “Dodd-Frank Act”).

Tax Implications of Executive Compensation Program

Under Section 162(m) of the Internal Revenue Code, named

executive officer (other than the Chief Financial Officer)

compensation over $1 million for any year is generally

not deductible for United States income tax purposes.

Performance-based compensation is exempt from the

deduction limit, however, if certain requirements are met.

The Compensation Committee structures compensation

to take advantage of this exemption under Section 162(m)

to the extent practicable, while satisfying the Company’s

compensation policies and objectives. Because the

Compensation Committee also recognizes the need to

retain flexibility to make compensation decisions that may

not meet the standards of Section 162(m) when necessary

to enable the Company to continue to attract, retain, and

motivate highly-qualified executives, it reserves the authority

to approve potentially non-deductible compensation in

appropriate circumstances.

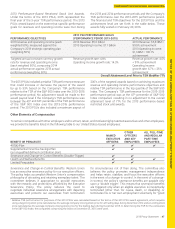

COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Hikmet Ersek

President and Chief Executive Officer

Mr. Ersek’s 2015 compensation was weighted significantly

toward variable and performance-based incentive pay over

fixed pay, and long-term, equity-based pay over annual

cash compensation, because the Compensation Committee

desired to tie a significant level of Mr. Ersek’s compensation

to the performance of the Company. The percentage of

compensation delivered in the form of performance-based

compensation is higher for Mr. Ersek than compared to the

other named executive officers because the Compensation

Committee believes that the Chief Executive Officer’s

leadership is one of the key drivers of the Company’s success,

and that a greater percentage of the Chief Executive Officer’s

total compensation should be variable as a reflection of the

Company’s level of performance. Market data provided by the

Compensation Consultant supported this practice as well.

Accordingly, at target-level performance for 2015, Mr. Ersek’s

annual compensation was weighted 12% base salary, 17%

annual incentive award, and 71% long-term incentive award.

Approximately 88% of Mr. Ersek’s 2015 targeted total annual

compensation varies based on the Company’s performance.