Western Union 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

48 | The Western Union Company

COMPENSATION DISCUSSION AND ANALYSIS

reason” (including a material reduction in title or position,

reduction in base salary or bonus opportunity or an increase

in the executive’s commute to his or her current principal

working location of more than 50 miles without consent)

within 24 months after the date of a change-in-control.

Severance benefits under the policy are conditioned upon

the executive executing an agreement and release which

includes, among other things, non-competition and non-

solicitation restrictive covenants and a release of claims

against the Company. In addition, the Executive Severance

Policy prohibits excise tax gross-up payments on change-

in-control benefits for those individuals who became

executives of the Company after April 2009. Mr. Ersek is the

only Company employee who remains eligible for excise tax

gross-up payments. In connection with her March 2016

separation from the Company, Ms. Scott became eligible to

receive severance benefits under the terms of the Executive

Severance Policy.

Please see the “Executive Compensation—Potential

Payments Upon Termination or Change-in-Control” section

of this Proxy Statement for further information regarding the

Executive Severance Policy, including the amounts received

by Ms. Scott in connection with her departure, and the

treatment of awards upon qualifying termination events or a

change-in-control.

Retirement Savings Plans. Western Union executives on

United States payroll are eligible for retirement benefits

through a qualified defined contribution 401(k) plan,

the Incentive Savings Plan, and a non-qualified defined

contribution plan, the Supplemental Incentive Savings

Plan (“SISP”). The SISP provides a vehicle for additional

deferred compensation with matching contributions from

the Company. We maintain the Incentive Savings Plan

and the SISP to encourage our employees to save some

percentage of their cash compensation for their eventual

retirement. Mr. Ersek participates in the qualified defined

contribution retirement plan made available to eligible

employees in Austria. The committee believes that these

types of savings plans are consistent with competitive

pay practices, and are an important element in attracting

and retaining talent in a competitive market. Please see

the 2015 Nonqualified Deferred Compensation Table in the

“Executive Compensation” section of this Proxy Statement

for further information regarding Western Union’s retirement

savings plans.

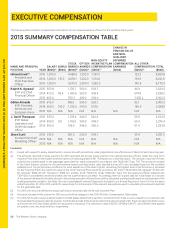

Benefits and Perquisites. The Company’s global benefit

philosophy for employees, including executives, is to provide

a package of benefits consistent with local practices and

competitive within individual markets. Each of our named

executive officers participates in the health and welfare

benefit plans and fringe benefit programs generally available

to all other Western Union employees in the individual

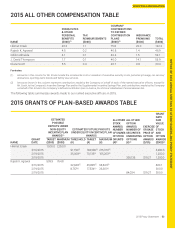

market in which they are located. In addition, in 2015 the

Company provided the benefits and perquisites as described

in the 2015 Summary Compensation Table in the “Executive

Compensation” section of this Proxy Statement.

The Company provided its named executive officers with

competitive perquisites and other personal benefits that are

consistent with the Company’s philosophy of attracting and

retaining exemplary executive talent and, in some cases,

such as the annual physical examination, the Company

provides such personal benefits because the Compensation

Committee believes they are in the interests of the Company

and its stockholders. The committee periodically reviews the

levels of perquisites and other personal benefits provided to

named executive officers.

Employment Agreements. The Company generally executes

an offer of employment before an executive joins the

Company. This offer describes the basic terms of the

executive’s employment, including his or her start date,

starting salary, bonus target and long-term incentive award

target. The terms of the executive’s employment are based

thereafter on sustained good performance rather than

contractual terms, and the Company’s policies, such as the

Executive Severance Policy, will apply as warranted.

Under certain circumstances, the Compensation Committee

recognizes that special arrangements with respect to an

executive’s employment may be necessary or desirable.

For example, Mr. Ersek, the Company, and a subsidiary of

the Company entered into agreements in November 2009

relating to his 2009 promotion to Chief Operating Officer,

which were amended effective September 2010 to reflect

his 2010 promotion to President and Chief Executive Officer.

Employment contracts are a competitive market practice in

Austria where Mr. Ersek resided at the time he assumed his

position as Chief Operating Officer and the Compensation

Committee believes the terms of his agreements are

consistent with those for similarly situated executives in

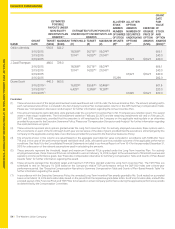

Austria. Please see the “Executive Compensation—Narrative

to Summary Compensation Table and Grants of Plan-Based

Awards Table—Employment Arrangements” section of this

Proxy Statement for a description of the material terms of

Mr. Ersek’s employment agreement.

Stock Ownership Guidelines

To align our executives’ interests with those of our

stockholders and to assure that our executives own

meaningful levels of Western Union stock throughout their

tenures with the Company, the Compensation Committee

established stock ownership guidelines that require each

of the named executive officers to own Company Common

Stock worth a multiple of base salary. Under the stock

ownership guidelines, the executives must retain, until the

required ownership guideline levels have been achieved and

thereafter if required to maintain the required ownership

levels, at least 50% of after-tax shares resulting from the

vesting of restricted stock and restricted stock units and

at least 50% of the shares acquired upon exercise of stock

options after the payment of the exercise price, broker fees,

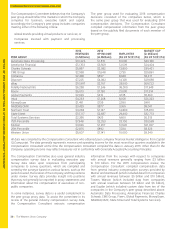

and related tax withholding obligations. The chart below

shows the salary multiple guidelines and the equity holdings

that count towards the requirement as of March 14, 2016. Each

continuing named executive officer has met, or is progressing

towards meeting, his respective ownership guideline.