Western Union 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

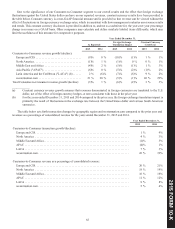

68

Consumer-to-Consumer price reductions totaled approximately 1% of both our Consumer-to-Consumer revenue and

consolidated revenue for the year ended December 31, 2014.

Operating income

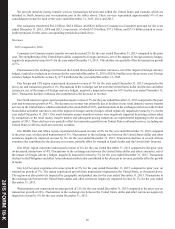

2015 compared to 2014

Consumer-to-Consumer operating income declined 1% during the year ended December 31, 2015 compared to the prior year.

Results for the year ended December 31, 2015 were impacted by increased technology expenses, increased compliance program

costs, and increased incentive compensation expenses, partially offset by benefits from and lower costs related to productivity and

cost-savings initiatives. Results were also impacted by foreign currency translation, as the strengthening of the United States dollar

compared to foreign currencies resulted in lower reported revenues and expenses. Revenue declines are described above. The

change in operating margins in the segment was primarily due to benefits from foreign currency hedges, as well as the other factors

mentioned above.

2014 compared to 2013

Consumer-to-Consumer operating income increased 2% during the year ended December 31, 2014 compared to the prior year

primarily due to the revenue increases described above and benefits from our productivity and cost-savings initiatives. These

increases were partially offset by higher agent commissions, which generally increase as revenue increases, including increases

in agent commission rates in our walk-in services primarily due to the renewal of certain strategic agent agreements, and increased

compliance program costs. The change in operating income margins in the segment was due to the same factors mentioned above.

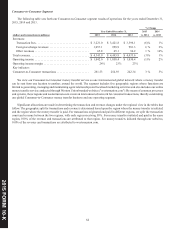

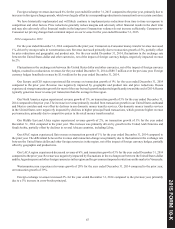

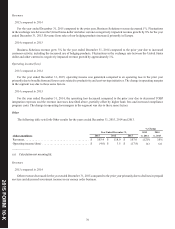

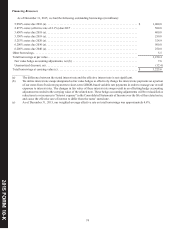

Consumer-to-Business Segment

The table below sets forth our Consumer-to-Business segment results of operations for the years ended December 31, 2015,

2014 and 2013. To assist in evaluating the comparable periods' results, we are including additional line items in the table below

reflecting Consumer-to-Business operating income and operating income margin excluding the effect of the $35.3 million of

expenses related to the Paymap Settlement Agreement, recorded in the second quarter of 2015. Operating income, excluding

Paymap Settlement Agreement, and operating income margin, excluding Paymap Settlement Agreement, are non-GAAP financial

measures and are used by management in evaluating the operating income results and trends of our Consumer-to-Business segment.

This disclosure is provided in addition to, and not as a substitute for, operating income and operating income margin on a GAAP

basis for the year ended December 31, 2015.

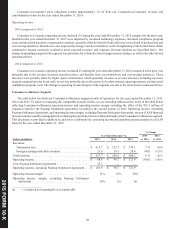

% Change

Year Ended December 31, 2015 2014

(dollars in millions) 2015 2014 2013 vs. 2014 vs. 2013

Revenues:

Transaction fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 612.7 $ 572.7 $ 579.1 7 % (1)%

Foreign exchange and other revenues . . . . . . . . . . . . . . . . . . . 25.0 26.1 29.4 (4)% (11)%

Total revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 637.7 $ 598.8 $ 608.5 6 % (2)%

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 68.6 $ 98.7 $ 121.9 (30)% (19)%

Less: Paymap Settlement Agreement . . . . . . . . . . . . . . . . . . . . . . 35.3 — —

Operating income, excluding Paymap Settlement Agreement . . . $ 103.9 $ 98.7 $ 121.9

Operating income margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11% 16% 20%

Operating income margin, excluding Paymap Settlement

Agreement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16% (a) (a)

____________________

(a) Calculation not meaningful or not applicable

201 FORM 10-K

5