Western Union 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

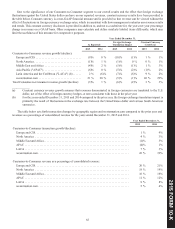

57

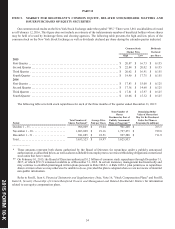

(a) Revenue for the years ended December 31, 2012 and 2011 included $238.5 million and $35.2 million, respectively, of

revenue related to Travelex Global Business Payments ("TGBP"), which was acquired in November 2011 and is included

in our Business Solutions segment.

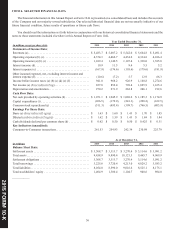

(b) Operating expenses for the year ended December 31, 2011 included $46.8 million of restructuring and related expenses,

respectively, associated with a restructuring plan designed to reduce overall headcount and migrate positions from various

facilities, primarily within the United States and Europe, to regional operating centers.

(c) During the year ended December 31, 2015, operating expenses included $35.3 million of expenses as a result of a settlement

agreement between the Consumer Financial Protection Bureau and one of our subsidiaries, Paymap, Inc., which operates

solely in the United States. For further discussion of this matter, see Part II, Item 8, Financial Statements and Supplementary

Data, Note 5, "Commitments and Contingencies."

(d) Interest income consists of interest earned on cash balances not required to satisfy settlement obligations.

(e) Interest expense primarily relates to our outstanding borrowings.

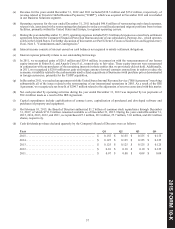

(f) In 2011, we recognized gains of $20.5 million and $29.4 million, in connection with the remeasurement of our former

equity interests in Finint S.r.l. and Angelo Costa S.r.l., respectively, to fair value. These equity interests were remeasured

in conjunction with our purchases of the remaining interests in these entities that we previously did not hold. Additionally,

in 2011, we recognized a $20.8 million net gain on foreign currency forward contracts entered into in order to reduce the

economic variability related to the cash amounts used to fund acquisitions of businesses with purchase prices denominated

in foreign currencies, primarily for the TGBP acquisition.

(g) In December 2011, we reached an agreement with the United States Internal Revenue Service ("IRS Agreement") resolving

substantially all of the issues related to the restructuring of our international operations in 2003. As a result of the IRS

Agreement, we recognized a tax benefit of $204.7 million related to the adjustment of reserves associated with this matter.

(h) Net cash provided by operating activities during the year ended December 31, 2012 was impacted by tax payments of

$92.4 million made as a result of the IRS Agreement.

(i) Capital expenditures include capitalization of contract costs, capitalization of purchased and developed software and

purchases of property and equipment.

(j) On February 10, 2015, the Board of Directors authorized $1.2 billion of common stock repurchases through December

31, 2017, of which $711.9 million remained available as of December 31, 2015. During the years ended December 31,

2015, 2014, 2013, 2012, and 2011, we repurchased 25.1 million, 29.3 million, 25.7 million, 51.0 million, and 40.3 million

shares, respectively.

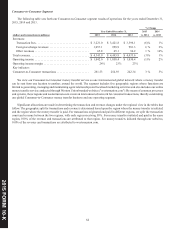

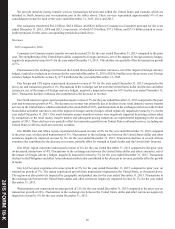

(k) Cash dividends per share declared quarterly by the Company's Board of Directors were as follows:

Year Q1 Q2 Q3 Q4

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.155 $ 0.155 $ 0.155 $ 0.155

2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.125 $ 0.125 $ 0.125 $ 0.125

2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.125 $ 0.125 $ 0.125 $ 0.125

2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.10 $ 0.10 $ 0.10 $ 0.125

2011. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.07 $ 0.08 $ 0.08 $ 0.08

201 FORM 10 K

5 -