Western Union 2015 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

129

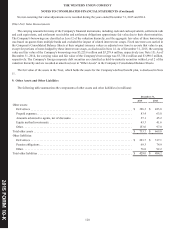

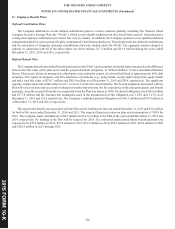

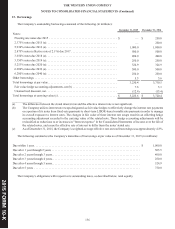

Cash Dividends Paid

Cash dividends paid for the years ended December 31, 2015, 2014 and 2013 were $316.5 million, $265.2 million and $277.2

million, respectively. Dividends per share declared quarterly by the Company's Board of Directors during the years ended 2015,

2014 and 2013 were as follows:

Year Q1 Q2 Q3 Q4

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.155 $ 0.155 $ 0.155 $ 0.155

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.125 $ 0.125 $ 0.125 $ 0.125

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.125 $ 0.125 $ 0.125 $ 0.125

On February 9, 2016, the Company's Board of Directors declared a quarterly cash dividend of $0.16 per common share payable

on March 31, 2016.

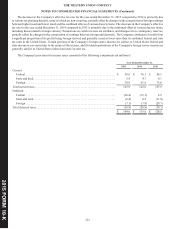

Share Repurchases

During the years ended December 31, 2015, 2014 and 2013, 25.1 million, 29.3 million and 25.7 million shares, respectively,

have been repurchased for $500.0 million, $488.1 million and $393.6 million, respectively, excluding commissions, at an average

cost of $19.96, $16.63 and $15.29 per share, respectively. These amounts represent shares authorized by the Board of Directors

for repurchase under the publicly announced authorizations. As of December 31, 2015, $711.9 million remained available under

the share repurchase authorization approved by the Company's Board of Directors through December 31, 2017. The amounts

included in the "Common stock repurchased" line in the Company's Consolidated Statements of Cash Flows represent both shares

authorized by the Board of Directors for repurchase under the publicly announced authorization, described earlier, as well as shares

withheld from employees to cover tax withholding obligations on restricted stock units that have vested.

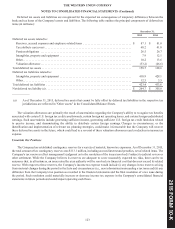

14. Derivatives

The Company is exposed to foreign currency exchange risk resulting from fluctuations in exchange rates, primarily the euro,

and to a lesser degree the British pound, Canadian dollar, Australian dollar, Swiss franc, and other currencies, related to forecasted

money transfer revenues and on money transfer settlement assets and obligations as well as on certain foreign currency denominated

cash and other asset and liability positions. The Company is also exposed to risk from derivative contracts written to its customers

arising from its cross-currency Business Solutions payments operations. Additionally, the Company is exposed to interest rate risk

related to changes in market rates both prior to and subsequent to the issuance of debt. The Company uses derivatives to (a) minimize

its exposures related to changes in foreign currency exchange rates and interest rates and (b) facilitate cross-currency Business

Solutions payments by writing derivatives to customers.

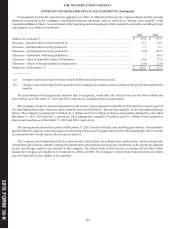

The Company executes derivatives with established financial institutions, with the substantial majority of these financial

institutions having credit ratings of "A-" or better from a major credit rating agency. The Company also writes Business Solutions

derivatives mostly with small and medium size enterprises. The primary credit risk inherent in derivative agreements represents

the possibility that a loss may occur from the nonperformance of a counterparty to the agreements. The Company performs a

review of the credit risk of these counterparties at the inception of the contract and on an ongoing basis. The Company also monitors

the concentration of its contracts with any individual counterparty. The Company anticipates that the counterparties will be able

to fully satisfy their obligations under the agreements, but takes action when doubt arises about the counterparties' ability to perform.

These actions may include requiring Business Solutions customers to post or increase collateral, and for all counterparties, the

possible termination of the related contracts. The Company's hedged foreign currency exposures are in liquid currencies;

consequently, there is minimal risk that appropriate derivatives to maintain the hedging program would not be available in the

future.

201 FORM 10 K

5 -