Western Union 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28 | The Western Union Company

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is currently comprised of five

independent directors and operates under a written charter

adopted by the Board. The Audit Committee reviews the

charter at least annually, reviewing it last in December 2015.

The charter is available through the “Investor Relations,

Corporate Governance” portion of the Company’s website,

www.wu.com.

The Board has the ultimate authority for effective corporate

governance, including the role of oversight of the management

of the Company. The Audit Committee’s purpose is to assist

the Board in fulfilling its oversight responsibilities with

respect to the Company’s consolidated financial statements,

independent registered public accounting firm qualifications

and independence, performance of the Company’s internal

audit function and independent registered public accounting

firm, and other matters identified in the Audit Committee

Charter. The Audit Committee relies on the expertise and

knowledge of management, the internal auditors and the

independent registered public accounting firm in carrying

out its responsibilities. Management is responsible for the

preparation, presentation, and integrity of the Company’s

consolidated financial statements, accounting and financial

reporting principles, internal control over financial reporting

and disclosure controls, and procedures designed to ensure

compliance with accounting standards, applicable laws,

and regulations. In addition, management is responsible

for objectively reviewing and evaluating the adequacy,

effectiveness, and quality of the Company’s system of

internal control. The Company’s independent registered

public accounting firm, Ernst & Young LLP, is responsible

for performing an independent audit of the consolidated

financial statements and for expressing an opinion on the

conformity of those financial statements with United States

generally accepted accounting principles. The Company’s

independent registered public accounting firm is also

responsible for expressing an opinion on the effectiveness of

the Company’s internal control over financial reporting.

During fiscal year 2015, the Audit Committee fulfilled its duties

and responsibilities as outlined in its charter. Specifically, the

Audit Committee, among other actions:

• reviewed and discussed with management and the

independent registered public accounting firm the Company’s

quarterly earnings press releases, consolidated financial

statements, and related periodic reports filed with the SEC;

• reviewed with management, the independent registered

public accounting firm and the internal auditor,

management’s assessment of the effectiveness of the

Company’s internal control over financial reporting, and

the effectiveness of the Company’s internal control over

financial reporting;

• reviewed with the independent registered public accounting

firm, management, and the internal auditor, as appropriate,

the audit scope and plans of both the independent registered

public accounting firm and internal auditor;

• met in periodic executive sessions with each of

the independent registered public accounting firm,

management, and the internal auditor;

• received the written disclosures and the annual letter

from Ernst & Young LLP provided to us pursuant to

Public Company Accounting Oversight Board Ethics and

Independence Rule 3526, Communication with Audit

Committees Concerning Independence, concerning their

independence and discussed with Ernst & Young LLP their

independence; and

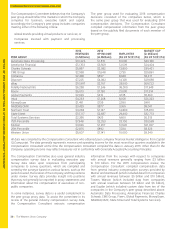

• reviewed and pre-approved all fees paid to Ernst & Young

LLP, as described in Proposal 3, and considered whether

Ernst & Young LLP’s provision of non-audit services to the

Company was compatible with the independence of the

independent registered public accounting firm.

The Audit Committee has reviewed and discussed with

the Company’s management and independent registered

public accounting firm the Company’s audited consolidated

financial statements and related footnotes for the fiscal year

ended December 31, 2015, and the independent registered

public accounting firm’s report on those financial statements.

Management represented to the Audit Committee that the

Company’s financial statements were prepared in accordance

with United States generally accepted accounting principles.

We have discussed with Ernst & Young LLP the matters

required to be discussed with the Audit Committee by Auditing

Standard No. 16, Communications with Audit Committees,

issued by the Public Company Accounting Oversight Board.

The Auditing Standard No. 16 communications include,

among other items, matters relating to the conduct of an audit

of the Company’s consolidated financial statements under

the standards of the Public Company Accounting Oversight

Board. This review included a discussion with management

and the independent registered public accounting firm about

the quality (not merely the acceptability) of the Company’s

accounting principles, the reasonableness of significant

estimates and judgments, and the disclosures in the

Company’s financial statements, including the disclosures

relating to critical accounting policies.

In reliance on the review and discussions described above,

we recommended to the Board of Directors, and the Board

approved, that the audited consolidated financial statements

and management’s assessment of the effectiveness of

internal control over financial reporting be included in the

Company’s Annual Report on Form 10-K for the year ended

December 31, 2015 for filing with the SEC.

Audit Committee

Richard A. Goodman (Chairperson)

Martin I. Cole

Linda Fayne Levinson

Roberto G. Mendoza

Michael A. Miles, Jr.