Western Union 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

2016 Proxy Statement | 45

COMPENSATION DISCUSSION AND ANALYSIS

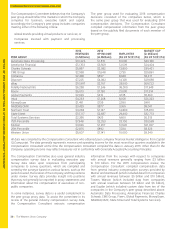

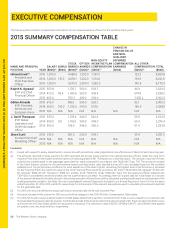

The following table summarizes the annual incentive payouts received by each named executive officer. For additional

discussion, please see “–Compensation of Our Named Executive Officers” below.

EXECUTIVE

TARGET

BONUS

AS A %

OF BASE

SALARY

TARGET

AWARD

OPPORTUNITY

($000)

CORPORATE

OBJECTIVES

PAYOUT

AT 117% OF

TARGET

($000)

STRATEGIC

OBJECTIVES

PAYOUT

AT 121% OF

TARGET

($000)

INDIVIDUAL

OBJECTIVES

ACHIEVEMENT AS A

% OF TARGET AND

CORRESPONDING

PAYOUT AMOUNT

($000)

FINAL

BONUS

($000)

FINAL

BONUS

AS A % OF

TARGET

Hikmet Ersek 150% $1,500.0 $1,404.0 $363.0 N/A $1,767.0 118%

Rajesh K. Agrawal 90% $509.9 $298.3 $123.4 119% achievement =

$182.0 payout

$603.7 118%

Odilon Almeida 90% $550.8 $322.2 $133.3 119% achievement =

$196.6 payout

$652.1 118%

J. David Thompson 90% $486.0 $284.3 $117.6 84% achievement =

$122.5 payout

$524.4 108%

Diane Scott 85% $440.3 $257.6 $106.5 106% achievement =

$140.0 payout

$504.1 115%

Long-Term Incentive Compensation

The Company’s long-term incentive program allows the

Compensation Committee to award various forms of long-

term incentive grants, including stock options, restricted

stock units, performance-based equity and performance-

based cash awards. The Compensation Committee has sole

discretion in selecting participants for long-term incentive

grants and the Compensation Committee approves all

equity grants made to our senior executives, with the equity

grants made to the Chief Executive Officer ratified by the

independent directors of the Board. When making regular

annual equity grants, the Compensation Committee’s

practice is to approve them during the first quarter of each

year as part of the annual compensation review. Among

other factors, the Compensation Committee considers

dilution of the Company’s outstanding shares when making

such grants.

Similar to the Annual Incentive Plan and subject to

Section 162(m) of the Internal Revenue Code, when the

financial performance objectives were established for

the annual long-term incentive awards described below,

the committee determined that the effect of currency

fluctuations, acquisitions and divestitures, restructuring,

and other significant charges not included in the Company’s

internal financial plans should be excluded from the payout

calculations. Accordingly, the Paymap Charge was excluded

from the calculations for the 2014 and 2015 long-term

incentive plan awards.

2015 Annual Long-Term Incentive Awards. The

Compensation Committee’s objectives for the 2015 long-

term incentive awards were to:

• Align the interests of our executives with the interests of

our stockholders by focusing on objectives that result in

stock price appreciation through the use of stock options;

• Increase cross-functional executive focus in the coming

years on key performance metrics through Financial

PSUs;

• Amplify executive focus on stockholder returns through

TSR PSUs; and

• Retain the services of executives through multi-year

vesting provisions.

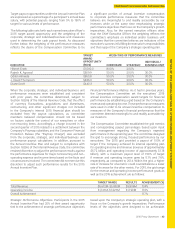

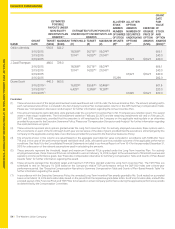

In early 2015, the Compensation Committee granted the

Chief Executive Officer and the Executive Vice Presidents

long-term incentive awards under the Long-Term Incentive

Plan. For 2015, no changes were made to any named

executive officer's long-term incentive award target from the

previous year. The 2015 awards consisted of 80% PSUs (60%

Financial PSUs, incorporating both revenue and operating

income growth, and 20% TSR PSUs) and 20% stock options.

The committee believed that the mix of Financial PSUs, TSR

PSUs and stock options was appropriate because these

forms of awards combined represented a balanced reflection

of stockholder returns and financial performance. The PSUs

are described in greater detail below. The stock options

vest in 25% annual increments over four years and have a

10-year term. In addition, as discussed in “—Compensation

of Our Named Executive Officers” below, Mr. Thompson

received a time-based restricted stock unit grant in 2015 for

retention purposes.

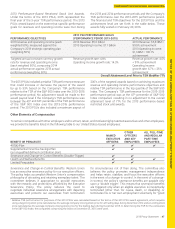

Financial PSUs. The 2015 Financial PSU awards will vest

if and only to the extent that specific performance goals

for revenue and operating income are met during the

performance period. To motivate constant improvement

over prior year results, the performance objectives under the

2015 Financial PSUs design are based on targeted constant

currency compound annual growth rates (“CAGR”) for revenue

and operating income. At the beginning of the performance

period, the committee established revenue and operating

income CAGR goals for each year of the performance period,

with each year weighted equally in the determination of the