Western Union 2015 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

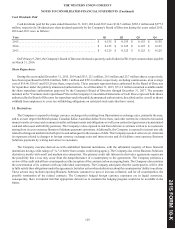

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

126

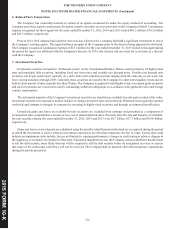

11. Employee Benefit Plans

Defined Contribution Plans

The Company administers several defined contribution plans in various countries globally, including The Western Union

Company Incentive Savings Plan (the "401(k)"), which covers eligible employees on the United States payroll. Such plans have

vesting and employer contribution provisions that vary by country. In addition, the Company sponsors a non-qualified deferred

compensation plan for a select group of highly compensated United States employees. The plan provides tax-deferred contributions

and the restoration of Company matching contributions otherwise limited under the 401(k). The aggregate amount charged to

expense in connection with all of the above plans was $18.0 million, $17.4 million and $16.9 million during the years ended

December 31, 2015, 2014 and 2013, respectively.

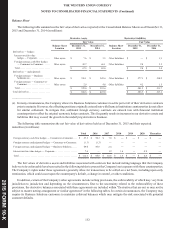

Defined Benefit Plan

The Company has a frozen defined benefit pension plan (the "Plan") and recognizes its funded status, measured as the difference

between the fair value of the plan assets and the projected benefit obligation, in "Other liabilities" in the Consolidated Balance

Sheets. Plan assets, which are managed in a third-party trust, primarily consist of a diversified blend of approximately 60% debt

securities, 20% equity investments, and 20% alternative investments (e.g., hedge funds, royalty rights and private equity funds)

and had a total fair value of $276.7 million and $302.9 million as of December 31, 2015 and 2014, respectively. The significant

majority of plan assets fall within either Level 1 or Level 2 of the fair value hierarchy. The benefit obligation associated with the

Plan will vary over time only as a result of changes in market interest rates, the life expectancy of the plan participants, and benefit

payments, since the accrual of benefits was suspended when the Plan was frozen in 1988. The benefit obligation was $346.0 million

and $377.8 million and the discount rate assumption used in the measurement of this obligation was 3.52% and 3.27% as of

December 31, 2015 and 2014, respectively. The Company’s unfunded pension obligation was $69.3 million and $74.9 million as

of December 31, 2015 and 2014, respectively.

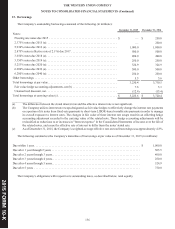

The net periodic benefit cost associated with the Plan was $2.8 million for the year ended December 31, 2015 and $3.8 million

for both of the years ended December 31, 2014 and 2013. The expected long-term return on plan assets assumption is 7.00% for

2016. The Company made contributions of $6.7 million and $13.2 million to the Plan in the years ended December 31, 2015 and

2014, respectively. No funding to the Plan will be required for 2016. The estimated undiscounted future benefit payments are

expected to be $35.0 million in 2016, $33.4 million in 2017, $31.9 million in 2018, $30.4 million in 2019, $28.8 million in 2020

and $120.4 million in 2021 through 2025.

201 FORM 10-K

5