Western Union 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

2016 Proxy Statement | 43

COMPENSATION DISCUSSION AND ANALYSIS

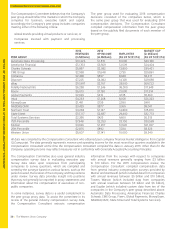

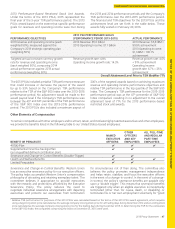

Target payout opportunities under the Annual Incentive Plan

are expressed as a percentage of a participant’s annual base

salary, with potential payouts ranging from 0% to 150% of

target for various levels of performance.

The following table sets forth each named executive officer’s

2015 target award opportunity and the weighting of the

corporate, strategic and individual/business unit measures

used in determining the cash payout levels. As discussed

further below, the weighting of the performance measures

reflects the desire of the Compensation Committee to tie

a significant portion of annual incentive compensation

to corporate performance measures that the committee

believes are meaningful to and readily accessible by our

investors while at the same time emphasizing strategic

performance objectives that focus on the Company’s growth

imperatives. Also, for the named executive officers other

than the Chief Executive Officer, the weighting reflects the

committee’s emphasis on individual and/or business unit

objectives that the committee believes are indicators of the

executive’s success in fulfilling the executive’s responsibilities

and that support the Company’s strategic operating plan.

TARGET

AWARD

OPPORTUNITY

($000)

WEIGHTING OF PERFORMANCE MEASURES

EXECUTIVE CORPORATE STRATEGIC INDIVIDUAL/

BUSINESS UNIT

Hikmet Ersek $1,500.0 80.0% 20.0% —

Rajesh K. Agrawal $509.9 50.0% 20.0% 30.0%

Odilon Almeida $550.8 50.0% 20.0% 30.0%

J. David Thompson $486.0 50.0% 20.0% 30.0%

Diane Scott $440.3 50.0% 20.0% 30.0%

When the corporate, strategic, and individual/business unit

performance measures were established and consistent

with prior years, the committee determined, subject to

Section 162(m) of the Internal Revenue Code, that the effect

of currency fluctuations, acquisitions and divestitures,

restructuring, and other significant charges not included

in the Company’s internal 2015 financial plan should be

excluded from the payout calculations, as committee

members believed compensation should not be based

on factors outside the control of our executives or other

non-recurring items. Accordingly, a charge incurred in the

second quarter of 2015 related to a settlement between the

Company’s Paymap subsidiary and the Consumer Financial

Protection Bureau (the “Paymap Charge”) was excluded

from the corporate, strategic, and individual/business unit

performance payout calculations. In addition, pursuant to

the Annual Incentive Plan and subject to compliance with

Section 162(m) of the Internal Revenue Code, the committee

retained discretion to adjust the performance results against

the performance objectives for major nonrecurring and non-

operating expense and income items based on the facts and

circumstances involved. The committee did not exercise this

discretion to adjust such performance results for the 2015

Annual Incentive Plan.

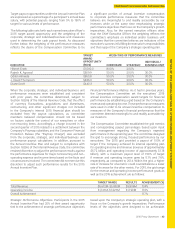

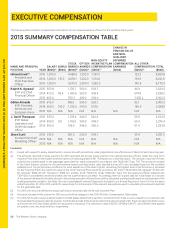

Financial Performance Metrics. As it had in previous years,

the Compensation Committee set the executives’ 2015

annual incentive compensation award targets for financial

performance by establishing a grid based on the Company’s

revenue and operating income. These performance measures

were used in order to tie annual incentive compensation to

measures of the Company’s financial performance that the

committee deemed meaningful to and readily accessible by

our investors.

The Compensation Committee established the grid metrics

and corresponding payout percentages based upon input

from management regarding the Company’s expected

performance in the upcoming year. The committee designed

the grid to encourage strong, focused performance by our

executives. The 2015 grid provided a payout of 100% of

target if the Company achieved its internal operating plan

for operating income and revenue (revenue of approximately

$5.72 billion and operating income of approximately $1.18

billion), with a maximum payout level of 150% of target

if revenue and operating income grew by 5.1% and 7.6%,

respectively, as compared to 2014. Within the grid, a higher

rate of increase for one metric could counterbalance a lower

rate of increase for the other metric. For 2015, the grid range

for the revenue and operating income performance goals as

well as the 2015 achievement are as follows:

TARGET RANGE RESULTS ACHIEVEMENT (%)

Total Revenue $5,612M-$5,892M $5,806M124%

Operating Income $1,147M-$1,227M $1,190M110%

Overall Achievement 117%

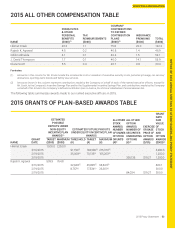

Strategic Performance Objectives. Participants in the 2015

Annual Incentive Plan had 20% of their award opportunity

tied to the achievement of strategic performance objectives

based upon the Company’s strategic operating plan, with a

focus on the Company’s growth imperatives. Performance

levels of the objectives were designed to be achievable,