Western Union 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

60 | The Western Union Company

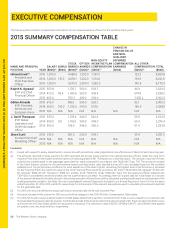

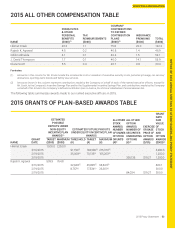

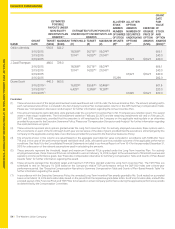

EXECUTIVE COMPENSATION

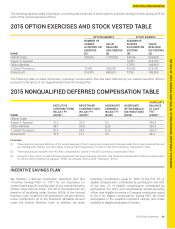

SUPPLEMENTAL INCENTIVE SAVINGS PLAN

We maintain a nonqualified supplemental incentive savings

plan (the “SISP”) for certain of our employees on United States

payroll, including each of our named executive officers other

than Mr. Ersek. Under the SISP, participants may defer up to

80% of their salaries, including commissions and incentive

compensation (other than annual bonuses), and may make a

separate election to defer up to 80% of any annual bonuses

and up to 100% of any performance-based cash awards

they may earn. The SISP also provides participants the

opportunity to receive credits for matching contributions

equal to the difference between the matching contributions

that a participant could receive under the ISP but for the

contribution and compensation limitations imposed by the

Internal Revenue Code, and the matching contributions

allowable to the participant under the ISP. Participants are

generally permitted to choose from among the mutual

funds available for investment under the ISP for purposes

of determining the imputed earnings, gains, and losses

applicable to their SISP accounts. The SISP is unfunded.

Participants may specify the timing of the payment of their

accounts by choosing either a specified payment date or

electing payment upon separation from service (or a date up

to five years following separation from service), and in either

case may elect to receive their accounts in a lump sum or

in annual or quarterly installments over a period of up to ten

years. With respect to each year’s contributions and imputed

earnings, the participant may make a separate distribution

election. Subject to the requirements of Section 409A of the

Internal Revenue Code, applicable Internal Revenue Service

guidance, and the terms of the SISP, participants may receive

an early payment in the event of a severe financial hardship

and may make an election to delay the timing of their

scheduled payment by a minimum of five years.

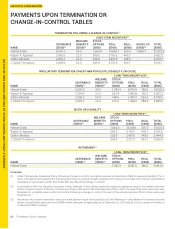

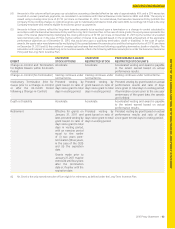

POTENTIAL PAYMENTS UPON TERMINATION

OR CHANGE-IN-CONTROL

EXECUTIVE SEVERANCE POLICY

We maintain an Executive Severance Policy for the payment

of certain benefits to senior executives, including our named

executive officers, upon termination of employment from

Western Union and upon a change-in-control of Western

Union. Under the Executive Severance Policy, an eligible

executive will become eligible for benefits if (i) prior to a

change-in-control, he or she is involuntarily terminated

by the Company other than on account of death, disability

or for cause, or (ii) after a change-in-control, he or she is

involuntarily terminated by the Company other than on

account of death, disability or for cause or terminates his or

her own employment voluntarily for “good reason” (including

a material reduction in title or position, reduction in base

salary or bonus opportunity or an increase in the executive’s

commute to his or her current principal working location

of more than 50 miles without consent) within 24 months

after the date of the change-in-control. Under the Executive

Severance Policy, a change-in-control is generally defined to

include:

• Acquisition by a person or entity of 35% or more of either

the outstanding shares of the Company or the combined

voting power of such shares, with certain exceptions;

• An unapproved change in a majority of the Board

members within a 24-month period; and

• Certain corporate restructurings, including certain

mergers, dissolution and liquidation.

The Executive Severance Policy provided for the

following severance and change-in-control benefits as of

December 31, 2015:

• Effective for senior executives hired before February

24, 2011, a severance payment equal to the senior

executive’s base pay plus target bonus for the year in

which the termination occurs (the “base severance

pay”), multiplied by 1.5 (multiplied by two in the case of

the Chief Executive Officer and in the case of all senior

executives who terminate for an eligible reason within

24 months following a change-in-control). Effective

for senior executives hired on and after February 24,

2011, a senior executive employed by the Company for

12 months or less was entitled to receive a severance

payment equal to the base severance pay and, for every

month employed in excess of 12 months, an additional

severance payment equal to a pro rata portion of the

base severance pay, up to a maximum severance

payment equal to the senior executive’s base severance

pay, multiplied by 1.5 (multiplied by two in the case of all

senior executives who terminate for an eligible reason

within 24 months following a change-in-control).