Western Union 2015 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

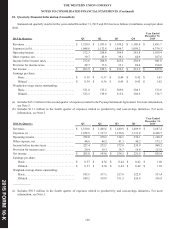

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

138

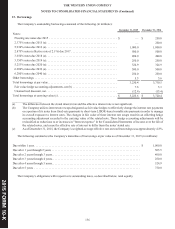

On December 10, 2012, the Company issued $250.0 million and $500.0 million of aggregate principal amounts of unsecured

notes due December 10, 2015 ("2015 Fixed Rate Notes") and December 10, 2017 ("2017 Notes"), respectively. The 2015 Fixed

Rate Notes matured and were repaid from the Company's cash balances in December 2015. Interest with respect to the 2017 Notes

is payable semi-annually in arrears on June 10 and December 10 of each year, currently based on the per annum rate of 2.875%.

The interest rate payable on the 2017 Notes will be increased if the debt rating assigned to such notes is downgraded by an applicable

credit rating agency, beginning at a downgrade below investment grade. However, in no event will the interest rate on the 2017

Notes be increased by more than 2.00% above 2.875% per annum. The interest rate on the 2017 Notes may also be adjusted

downward for debt rating upgrades subsequent to any debt rating downgrades but may not be adjusted below 2.875% per annum.

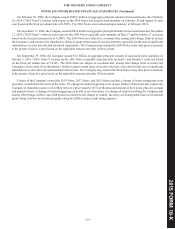

The 2017 Notes are subject to covenants that, among other things, limit or restrict the ability of the Company to sell or transfer

assets or merge or consolidate with another company, and limit or restrict the Company’s and certain of its subsidiaries’ ability to

incur certain types of security interests, or enter into sale and leaseback transactions. The Company may redeem the 2017 Notes

at any time prior to maturity at the greater of par or a price based on the applicable treasury rate plus 40 basis points.

On August 22, 2011, the Company issued $400.0 million of aggregate principal amount of unsecured notes due August 22,

2018 ("2018 Notes"). Interest with respect to the 2018 Notes is payable semi-annually in arrears on February 22 and August 22

of each year, based on the fixed per annum rate of 3.650%. The 2018 Notes are subject to covenants that, among other things, limit

or restrict the ability of the Company to sell or transfer assets or merge or consolidate with another company, and limit or restrict

the Company’s and certain of its subsidiaries’ ability to incur certain types of security interests, or enter into certain sale and

leaseback transactions. The Company may redeem the 2018 Notes at any time prior to maturity at the greater of par or a price

based on the applicable treasury rate plus 35 basis points.

On June 21, 2010, the Company issued $250.0 million of aggregate principal amount of unsecured notes due June 21, 2040

("2040 Notes"). Interest with respect to the 2040 Notes is payable semi-annually on June 21 and December 21 each year based on

the fixed per annum rate of 6.200%. The 2040 Notes are subject to covenants that, among other things, limit or restrict the Company’s

and certain of its subsidiaries’ ability to grant certain types of security interests or enter into sale and leaseback transactions. The

Company may redeem the 2040 Notes at any time prior to maturity at the greater of par or a price based on the applicable treasury

rate plus 30 basis points.

On March 30, 2010, the Company exchanged $303.7 million of aggregate principal amount of unsecured notes due November

17, 2011 for unsecured notes due April 1, 2020 ("2020 Notes"). Interest with respect to the 2020 Notes is payable semi-annually

on April 1 and October 1 each year based on the fixed per annum rate of 5.253%. In connection with the exchange, note holders

were given a 7% premium ($21.2 million), which approximated market value at the exchange date, as additional principal. As this

transaction was accounted for as a debt modification, this premium was not charged to expense. Rather, the premium, along with

the offsetting hedge accounting adjustments, will be accreted into "Interest expense" over the life of the notes. The 2020 Notes

are subject to covenants that, among other things, limit or restrict the Company’s and certain of its subsidiaries’ ability to grant

certain types of security interests, incur debt (in the case of significant subsidiaries), or enter into sale and leaseback transactions.

The Company may redeem the 2020 Notes at any time prior to maturity at the greater of par or a price based on the applicable

treasury rate plus 15 basis points.

The 2020 Notes were originally issued in reliance on exemptions from the registration requirements of the Securities Act of

1933, as amended (the "Securities Act"). On October 8, 2010, the Company exchanged the 2020 Notes for notes registered under

the Securities Act, pursuant to the terms of a Registration Rights Agreement.

201 FORM 10-K

5