Western Union 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

2016 Proxy Statement | 31

COMPENSATION DISCUSSION AND ANALYSIS

RECENT ENHANCEMENTS TO OUR EXECUTIVE COMPENSATION PROGRAM

Over the years, the Compensation Committee has engaged

in an ongoing review and evaluation of our executive

compensation and benefits programs in relation to our

compensation philosophy and objectives, as described in

“—Establishing and Evaluating Executive Compensation—Our

2015 Executive Compensation Philosophy and Objectives”

below, and the interests of our stockholders. As a result of

that review, including our stockholder engagement efforts,

the Compensation Committee has taken the following

actions over the past few years to enhance our executive

compensation program:

• Created Standalone TSR PSUs: In 2014, to enhance focus

on stockholder returns, we replaced the TSR modifier from

our 2013 long-term incentive design with a standalone

TSR PSU. We maintained this compensation element

as part of our 2015 long-term incentive program. Over a

three-year performance period, these TSR PSUs require

the Company to achieve 30th, 60th or 90th percentile relative

TSR performance as compared to the S&P 500 Index

in order to earn threshold, target or maximum payout,

respectively.

• Increased Performance Period for PSUs: In 2014, we

increased the performance period of our PSUs to make

them subject to a three-year total performance period,

rather than the two-year performance period used in prior

years. We maintained the three-year performance period

for our 2015 PSUs.

• Diversified Long-Term Incentive Plan Mix and Increased

Weighting of At-Risk Awards: We increased the

percentage of our annual equity grants that have vesting

provisions that are strictly performance-based and at-

risk. For 2014 and 2015, the annual equity awards under

the Long-Term Incentive Plan consisted of 80% PSUs

(60% Financial PSUs, incorporating both revenue and

operating income growth, and 20% TSR PSUs) and 20%

stock options, as compared to 67% PSUs and 33% stock

options in 2013.

• Reduced Severance Benefits Under Executive Severance

Policy: During 2014, the Compensation Committee

amended the Executive Severance Policy to reduce the

severance multiple for determining severance benefits

prior to a change-in-control from 2 to 1.5 for participants

other than the Company’s Chief Executive Officer.

• Enhanced CEO Stock Ownership Guidelines: In February

2016, the Compensation Committee increased the Chief

Executive Officer’s stock ownership requirement from a

multiple of five times to six times his base salary.

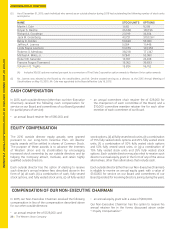

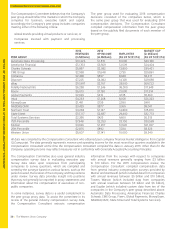

CHIEF EXECUTIVE OFFICER COMPENSATION

Mr. Ersek’s 2015 compensation levels, including his annual

and long-term incentive award targets, remained unchanged

from the levels set in 2012, primarily in light of stock price

performance and challenging market conditions. Further,

Mr. Ersek’s 2015 compensation is below the median

compensation for chief executive officers in the Company’s

peer group used for evaluating 2015 compensation decisions,

based on the most recent publicly available information, as

compiled by the Compensation Committee’s compensation

consultant.

For 2015 performance, Mr. Ersek received a cash payout

under the 2015 Annual Incentive Plan of $1,767,000, reflecting

a blended payout of 118% of target based on the Company’s

achievement of corporate and strategic performance goals

above target levels, as compared to an 88% of target payout

for 2014 performance and an 84% of target payout for

2013 performance. The Compensation Committee based

Mr. Ersek’s award opportunity under the Annual Incentive Plan

on the achievement of corporate and strategic performance

goals and did not include individual performance goals.

The following chart demonstrates that variable, performance-

based pay elements comprised approximately 88% of the

targeted 2015 annual compensation for Mr. Ersek (consisting

of target payout opportunity under the Annual Incentive Plan

and stock option and PSU components under the Long-Term