Western Union 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

46 | The Western Union Company

COMPENSATION DISCUSSION AND ANALYSIS

award payout. Under the terms of the awards, as much as

150% of the targeted Financial PSUs may be earned based on

the Company’s performance with respect to the revenue and

operating income performance objectives. In order to receive

a threshold payout under the award, the three-year CAGR for

both revenue and operating income must be positive.

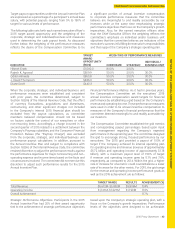

The performance objectives for payment of the 2015

Financial PSU awards and their respective weightings are:

• Targeted CAGR for revenue and operating income (each

weighted 50%), comparing 2015 actual performance

against 2014 actual performance (weighting 33-1/3%);

• Targeted CAGR for revenue and operating income (each

weighted 50%), comparing 2016 actual performance

against 2015 actual performance (weighting 33-1/3%); and

• Targeted CAGR for revenue and operating income (each

weighted 50%), comparing 2017 actual performance

against 2016 actual performance (weighting 33-1/3%).

In order to achieve target performance for the first year of

the three-year performance period, the Company had to

achieve constant currency revenue and operating income

growth of 2.1% and 3.6%, respectively, as compared to

2014 actual performance. Based on 2015 performance,

the Company achieved revenue and operating income of

approximately $5.8 billion and $1.2 billion, respectively,

resulting in blended achievement with respect to the first

year of the three-year performance period of 117% of target.

This portion of the award remains subject to the requirement

for a three-year positive CAGR in both revenue and operating

income, as well as the participant’s continued service

through February 19, 2018.

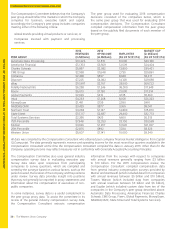

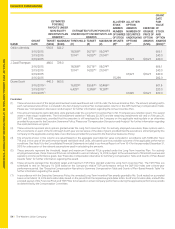

The following table sets forth each named executive officer’s threshold, target and maximum award opportunity with respect

to the 2015 Financial PSUs:

2015 FINANCIAL PSU AWARD OPPORTUNITY

EXECUTIVE THRESHOLD TARGET MAXIMUM

Hikmet Ersek 91,790 183,580 275,370

Rajesh K. Agrawal 22,948 45,895 68,843

Odilon Almeida 18,358 36,716 55,074

J. David Thompson 18,358 36,716 55,074

Diane Scott 16,829 33,657 50,486

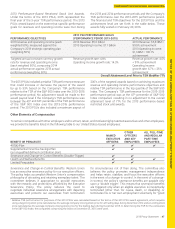

TSR PSUs. In 2015, the Company continued to use a

standalone TSR PSU award in order to enhance focus on

stockholder returns. These TSR PSUs require the Company

to achieve 60th percentile relative TSR performance versus

the S&P 500 Index over a three-year performance period in

order to earn target payout, with 30th percentile relative TSR

performance resulting in threshold payout and 90th percentile

relative TSR resulting in maximum payout. This portion of the

award is also subject to the participant’s continued service

through February 19, 2018.

The following table sets forth each named executive officer’s threshold, target and maximum award opportunities with respect

to the 2015 TSR PSUs:

2015 TSR PSU AWARD OPPORTUNITY

EXECUTIVE THRESHOLD TARGET MAXIMUM

Hikmet Ersek 35,068 70,135 105,203

Rajesh K. Agrawal 8,767 17,534 26,301

Odilon Almeida 7,014 14,027 21,041

J. David Thompson 7,014 14,027 21,041

Diane Scott 6,429 12,858 19,287

2014 Performance-Based Restricted Stock Unit Awards.

During 2015, the 2014 Financial PSU and TSR PSU awards

remained outstanding, each of which has a similar design to

the 2015 Financial PSU and TSR PSU awards. Accordingly,

the 2014 TSR PSU awards will be settled at the end of the

2014-2016 performance period based on the Company’s

TSR performance relative to the S&P 500 Index. For the 2014

Financial PSU awards, in order to achieve target performance

for the second year of the three-year performance period,

the Company had to achieve constant currency revenue and

operating income growth of 4.6% and 5.6%, respectively,

as compared to 2014 actual performance. Based on 2015

performance, the Company achieved revenues and operating

income of approximately $5.8 billion and $1.2 billion,

respectively, resulting in a blended achievement with respect

to the first and second years of the three-year performance

period of 95% of target. This portion of the award remains

subject to the requirement for a three-year positive CAGR in

both revenue and operating income, as well as the

participant’s continued service through February 20, 2017.