Western Union 2015 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

132

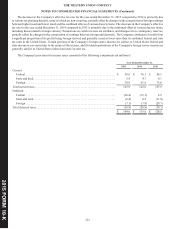

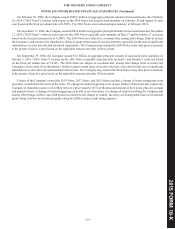

Balance Sheet

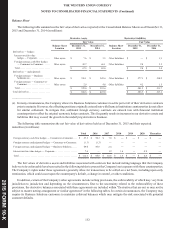

The following table summarizes the fair value of derivatives reported in the Consolidated Balance Sheets as of December 31,

2015 and December 31, 2014 (in millions):

Derivative Assets Derivative Liabilities

Fair Value Fair Value

Balance Sheet

Location

December 31,

2015

December 31,

2014

Balance Sheet

Location

December 31,

2015

December 31,

2014

Derivatives — hedges:

Interest rate fair value

hedges — Corporate . . . . . . . . . . . Other assets $ 7.6 $ 3.5 Other liabilities $ — $ 1.9

Foreign currency cash flow hedges

— Consumer-to-Consumer . . . . . . Other assets 59.7 66.1 Other liabilities 2.4 3.5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 67.3 $ 69.6 $ 2.4 $ 5.4

Derivatives — undesignated:

Foreign currency — Business

Solutions (a) . . . . . . . . . . . . . . . . . Other assets $ 326.1 $ 349.4 Other liabilities $ 277.1 $ 310.2

Foreign currency — Consumer-to-

Consumer. . . . . . . . . . . . . . . . . . . . Other assets 2.9 4.0 Other liabilities 4.2 1.5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 329.0 $ 353.4 $ 281.3 $ 311.7

Total derivatives . . . . . . . . . . . . . . . . . . $ 396.3 $ 423.0 $ 283.7 $ 317.1

____________________

(a) In many circumstances, the Company allows its Business Solutions customers to settle part or all of their derivative contracts

prior to maturity. However, the offsetting positions originally entered into with financial institution counterparties do not allow

for similar settlement. To mitigate this, additional foreign currency contracts are entered into with financial institution

counterparties to offset the original economic hedge contracts. This frequently results in increases in our derivative assets and

liabilities that may exceed the growth in the underlying derivatives business.

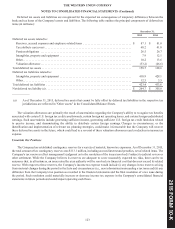

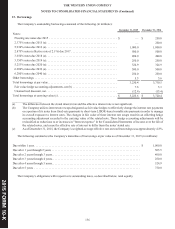

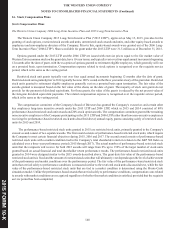

The following table summarizes the net fair value of derivatives held as of December 31, 2015 and their expected

maturities (in millions):

Total 2016 2017 2018 2019 2020 Thereafter

Foreign currency cash flow hedges — Consumer-to-Consumer. . . . $ 57.3 $ 50.3 $ 7.0 $ — $ — $ — $ —

Foreign currency undesignated hedges — Consumer-to-Consumer .(1.3) (1.3) — — — — —

Foreign currency undesignated hedges — Business Solutions . . . . . 49.0 46.6 2.4 — — — —

Interest rate fair value hedges — Corporate . . . . . . . . . . . . . . . . . . . 7.6 — 1.2 1.6 — 4.8 —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 112.6 $ 95.6 $ 10.6 $ 1.6 $ — $ 4.8 $ —

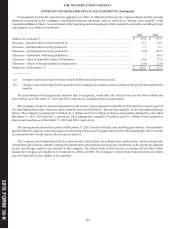

The fair values of derivative assets and liabilities associated with contracts that include netting language that the Company

believes to be enforceable have been netted in the following tables to present the Company's net exposure with these counterparties.

The Company's rights under these agreements generally allow for transactions to be settled on a net basis, including upon early

termination, which could occur upon the counterparty's default, a change in control, or other conditions.

In addition, certain of the Company's other agreements include netting provisions, the enforceability of which may vary from

jurisdiction to jurisdiction and depending on the circumstances. Due to the uncertainty related to the enforceability of these

provisions, the derivative balances associated with these agreements are included within "Derivatives that are not or may not be

subject to master netting arrangement or similar agreement" in the following tables. In certain circumstances, the Company may

require its Business Solutions customers to maintain collateral balances which may mitigate the risk associated with potential

customer defaults.

201 FORM 10-K

5