Western Union 2015 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2015 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

116

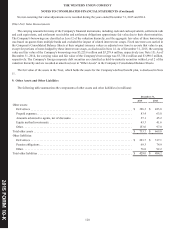

6. Related Party Transactions

The Company has ownership interests in certain of its agents accounted for under the equity method of accounting. The

Company pays these agents commissions for money transfer and other services provided on the Company's behalf. Commission

expense recognized for these agents for the years ended December 31, 2015, 2014 and 2013 totaled $65.5 million, $70.2 million

and $65.5 million, respectively.

Prior to 2014, the Company had a director who was also a director for a company that held a significant investment in one of

the Company's existing agents. This agent had been an agent of the Company prior to the director being appointed to the board.

The Company recognized commission expense of $15.1 million for the year ended December 31, 2013 related to this agent during

the period the agent was affiliated with the Company's director. In 2014, this director did not stand for re-election as a director

with the Company.

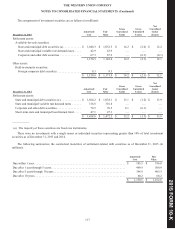

7. Investment Securities

Investment securities included in "Settlement assets" in the Consolidated Balance Sheets consist primarily of highly-rated

state and municipal debt securities, including fixed rate term notes and variable rate demand notes. Variable rate demand note

securities can be put (sold at par) typically on a daily basis with settlement periods ranging from the same day to one week, but

have varying maturities through 2049. Generally, these securities are used by the Company for short-term liquidity needs and are

held for short periods of time, typically less than 30 days. The Company is required to hold highly-rated, investment grade securities

and such investments are restricted to satisfy outstanding settlement obligations in accordance with applicable state and foreign

country requirements.

The substantial majority of the Company's investment securities are classified as available-for-sale and recorded at fair value.

Investment securities are exposed to market risk due to changes in interest rates and credit risk. Western Union regularly monitors

credit risk and attempts to mitigate its exposure by investing in highly-rated securities and through investment diversification.

Unrealized gains and losses on available-for-sale securities are excluded from earnings and presented as a component of

accumulated other comprehensive income or loss, net of related deferred taxes. Proceeds from the sale and maturity of available-

for-sale securities during the years ended December 31, 2015, 2014 and 2013 were $8.7 billion, $17.7 billion and $19.0 billion,

respectively.

Gains and losses on investments are calculated using the specific-identification method and are recognized during the period

in which the investment is sold or when an investment experiences an other-than-temporary decline in value. Factors that could

indicate an impairment exists include, but are not limited to: earnings performance, changes in credit rating or adverse changes in

the regulatory or economic environment of the asset. If potential impairment exists, the Company assesses whether it has the intent

to sell the debt security, more likely than not will be required to sell the debt security before its anticipated recovery or expects

that some of the contractual cash flows will not be received. The Company had no material other-than-temporary impairments

during the periods presented.

201 FORM 10-K

5