Washington Post 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

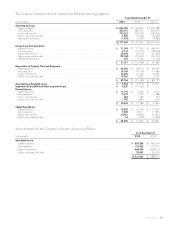

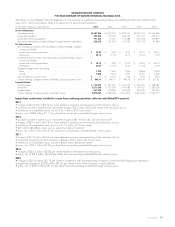

17. LEASES AND OTHER COMMITMENTS

The Company leases real property under operating agreements.

Many of the leases contain renewal options and escalation clauses

that require payments of additional rent to the extent of increases in

the related operating costs.

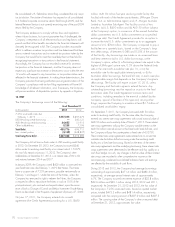

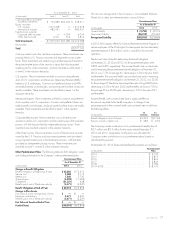

At December 31, 2013, future minimum rental payments under

noncancelable operating leases approximate the following:

(in thousands)

2014 ...................................... $119,129

2015 ...................................... 106,041

2016 ...................................... 99,167

2017 ...................................... 88,119

2018 ...................................... 73,520

Thereafter ................................... 411,466

$897,442

Minimum payments have not been reduced by minimum sublease

rentals of $29.9 million due in the future under noncancelable

subleases.

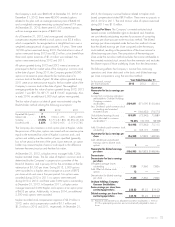

Rent expense under operating leases, including a portion reported

in discontinued operations, was approximately $118.5 million,

$127.2 million and $127.8 million in 2013, 2012 and 2011,

respectively. Sublease income was approximately $5.4 million,

$4.4 million and $2.7 million in 2013, 2012 and 2011,

respectively.

The Company’s broadcast subsidiaries are parties to certain

agreements that commit them to purchase programming to be

produced in future years. At December 31, 2013, such

commitments amounted to approximately $34.5 million. If such

programs are not produced, the Company’s commitment would

expire without obligation.

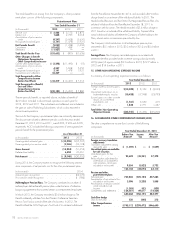

18. CONTINGENCIES

Litigation and Legal Matters. The Company and its subsidiaries are

subject to complaints and administrative proceedings and are

defendants in various civil lawsuits that have arisen in the ordinary

course of their businesses, including contract disputes; actions

alleging negligence, libel, invasion of privacy; trademark, copyright

and patent infringement; U.S. False Claims Act (False Claims Act)

violations; violations of applicable wage and hour laws; and

statutory or common law claims involving current and former

students and employees. Although the outcomes of the legal claims

and proceedings against the Company cannot be predicted with

certainty, based on currently available information, management

believes that there are no existing claims or proceedings that are

likely to have a material effect on the Company’s business, financial

condition, results of operations or cash flows. Also, based on

currently available information, management is of the opinion that

the exposure to future material losses from existing legal

proceedings is not reasonably possible, or that future material losses

in excess of the amounts accrued are not reasonably possible.

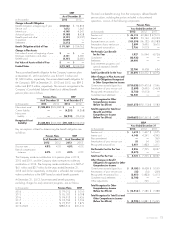

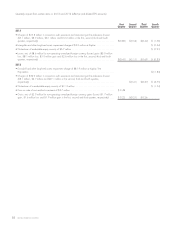

On February 6, 2008, a purported class-action lawsuit was filed in

the U.S. District Court for the Central District of California by

purchasers of BAR/BRI bar review courses, from July 2006 onward,

alleging antitrust claims against Kaplan and West Publishing

Corporation, BAR/BRI’s former owner. On April 10, 2008, the

court granted defendants’ motion to dismiss, a decision that was

reversed by the Ninth Circuit Court of Appeals on November 7,

2011. The Ninth Circuit also referred the matter to a mediator for

the purpose of exploring a settlement. In the fourth quarter of 2012,

the parties reached a comprehensive agreement to settle the matter.

The settlement was approved by the District Court in September

2013, and is expected to be administered in 2014.

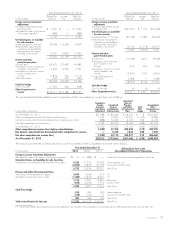

On or about January 17, 2008, an Assistant U.S. Attorney in the

Civil Division of the U.S. Attorney’s Office for the Eastern District of

Pennsylvania contacted KHE’s Broomall campus and made inquiries

about the Surgical Technology program, including the program’s

eligibility for Title IV U.S. Federal financial aid, the program’s

student loan defaults, licensing and accreditation. Kaplan

responded to the information requests and fully cooperated with the

inquiry. The ED also conducted a program review at the Broomall

campus, and Kaplan likewise cooperated with the program review.

On July 22, 2011, the U.S. Attorney’s Office for the Eastern District

of Pennsylvania announced that it had entered into a comprehensive

settlement agreement with Kaplan that resolved the U.S. Attorney’s

inquiry, provided for the conclusion of the ED’s program review and

also settled a previously sealed False Claims Act complaint that had

been filed by a former employee of the CHI-Broomall campus. The

total amount of all required payments by Broomall under the

agreements was $1.6 million. Pursuant to the comprehensive

settlement agreement, the U.S. Attorney inquiry has been closed, the

False Claims Act complaint (United States of America ex rel. David

Goodstein v. Kaplan, Inc. et al.) was dismissed with prejudice and

the ED will issue a final program review determination. At this time,

Kaplan cannot predict the contents of the pending final program

review determination or the ultimate impact the proceedings may

have on the Broomall campus or the KHE business generally.

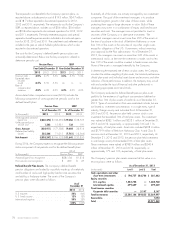

During 2013, certain Kaplan subsidiaries were subject to two other

unsealed cases filed by former employees that include, among other

allegations, claims under the False Claims Act relating to eligibility

for Title IV funding. The U.S. Government declined to intervene in all

cases, and, as previously reported, court decisions either dismissed

the cases in their entirety or narrowed the scope of their allegations.

The two cases are captioned: United States of America ex rel.

Carlos Urquilla-Diaz et al.v. Kaplan University et al. (unsealed

March 25, 2008) and United States of America ex rel. Charles

Jajdelski v. Kaplan Higher Education Corp. et al. (unsealed

January 6, 2009).

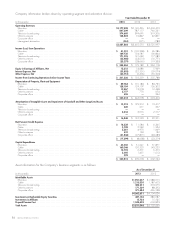

On August 17, 2011, the U.S. District Court for the Southern

District of Florida issued a series of rulings in the Diaz case, which

included three separate complaints: Diaz, Wilcox and Gillespie.

The court dismissed the Wilcox complaint in its entirety; dismissed

all False Claims Act allegations in the Diaz complaint, leaving only

an individual employment claim; and dismissed in part the Gillespie

complaint, thereby limiting the scope and time frame of its False

Claims Act allegations regarding compliance with the U.S. Federal

Rehabilitation Act. On October 31, 2012, the court entered

summary judgment in favor of the Company as to the sole

remaining employment claim in the Diaz complaint. On July 16,

2013, the court likewise entered summary judgment in favor of the

80 GRAHAM HOLDINGS COMPANY