Washington Post 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

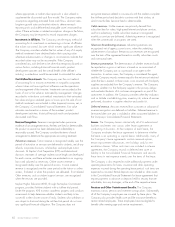

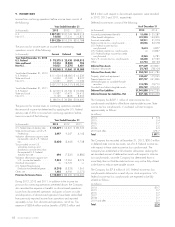

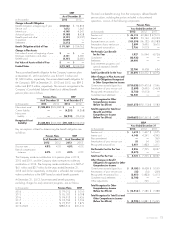

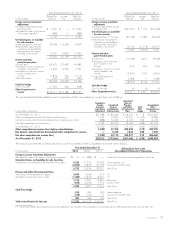

11. FAIR VALUE MEASUREMENTS

The Company’s financial assets and liabilities measured at fair

value on a recurring basis were as follows:

As of December 31, 2013

(in thousands) Level 1 Level 2 Total

Assets

Money market investments(1) ... $ — $431,836 $431,836

Marketable equity

securities(2) ............... 487,156 — 487,156

Other current investments(3) ... 11,826 23,336 35,162

Total Financial Assets ...... $498,982 $455,172 $954,154

Liabilities

Deferred compensation plan

liabilities(4) ............... $ — $ 67,603 $ 67,603

7.25% unsecured notes(5) ..... — 475,224 475,224

AUD revolving credit

borrowing(5) ............. — 44,625 44,625

Interest rate swap(6) ......... — 1,047 1,047

Total Financial Liabilities .... $ — $588,499 $588,499

As of December 31, 2012

(in thousands) Level 1 Level 2 Total

Assets

Money market investments(1) ..... $ —$432,670 $432,670

Marketable equity securities(2) .... 380,087 —380,087

Other current investments(3) ..... 14,134 24,717 38,851

Total Financial Assets ...... $394,221 $457,387 $851,608

Liabilities

Deferred compensation plan

liabilities(4) ............... $ —$62,297 $62,297

7.25% unsecured notes(5) ...... —481,424 481,424

AUD revolving credit

borrowing(5) ............... —51,915 51,915

Interest rate swap(6) ........... —1,567 1,567

Total Financial Liabilities .... $—$597,203 $597,203

(1) The Company’s money market investments are included in cash, cash

equivalents and restricted cash.

(2) The Company’s investments in marketable equity securities are classified as

available-for-sale.

(3) Includes U.S. Government Securities, corporate bonds, mutual funds and time

deposits (with original maturities greater than 90 days, but less than one year).

(4) Includes Graham Holdings Company’s Deferred Compensation Plan and

supplemental savings plan benefits under the Graham Holdings Company’s

Supplemental Executive Retirement Plan, which are included in accrued

compensation and related benefits.

(5) See Note 10 for carrying amount of these notes and borrowing.

(6) Included in Other liabilities. The Company utilized a market approach model

using the notional amount of the interest rate swap multiplied by the

observable inputs of time to maturity and market interest rates.

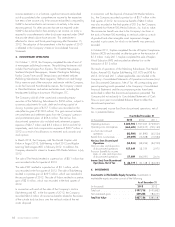

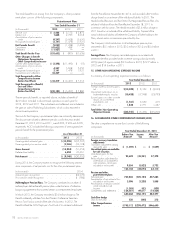

For the year ended December 31, 2013, the Company recorded

an intangible and other long-lived assets impairment charge of $3.3

million. For the year ended December 31, 2012, the Company

recorded a goodwill and other long-lived assets impairment charge

of $111.6 million (see Notes 2 and 8). The remeasurement of the

goodwill and other long-lived assets is classified as a Level 3 fair

valueassessmentduetothesignificanceofunobservableinputs

developed in the determination of the fair value.

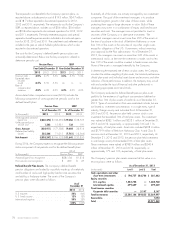

12. REDEEMABLE PREFERRED STOCK

The Series A preferred stock has a par value of $1.00 per share

and a liquidation preference of $1,000 per share; it is redeemable

by the Company at any time on or after October 1, 2015, at a

redemption price of $1,000 per share. In addition, the holders of

such stock have a right to require the Company to purchase their

shares at the redemption price during an annual 60-day election

period. Dividends on the Series A preferred stock are payable four

times a year at the annual rate of $80.00 per share and in

preference to any dividends on the Company’s common stock. The

Series A preferred stock is not convertible into any other security of

the Company, and the holders thereof have no voting rights except

with respect to any proposed changes in the preferences and

special rights of such stock.

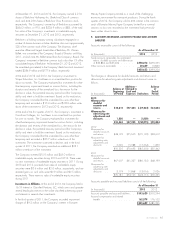

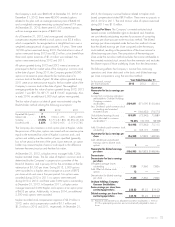

13. CAPITAL STOCK, STOCK AWARDS AND STOCK OPTIONS

Capital Stock. Each share of Class A common stock and Class B

common stock participates equally in dividends. The Class B stock

has limited voting rights and as a class has the right to elect 30% of

the Board of Directors; the Class A stock has unlimited voting rights,

including the right to elect a majority of the Board of Directors. In

2013 and 2012, the Company’s Class A shareholders converted

50,310, or 4%, and 10,000, or 1%, respectively, of the Class A

shares of the Company to an equal number of Class B shares. The

conversions had no impact on the voting rights of the Class A and

Class B common stock.

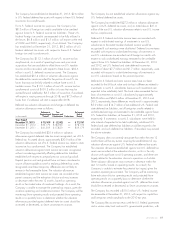

During 2013, 2012 and 2011, the Company purchased a total of

33,024, 301,231 and 644,948 shares, respectively, of its Class B

common stock at a cost of approximately $17.7 million, $103.2

million and $248.1 million, respectively. In September 2011, the

Board of Directors increased the authorization to repurchase a total of

750,000 shares of Class B common stock. The Company did not

announce a ceiling price or a time limit for the purchases. The

authorization included 43,573 shares that remained under the

previous authorization. At December 31, 2013, the Company had

remaining authorization from the Board of Directors to purchase up to

159,219 shares of Class B common stock.

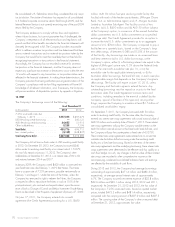

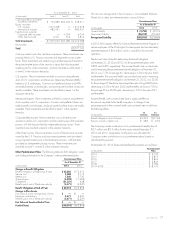

Stock Awards. In 2001, the Company adopted an incentive

compensation plan, which, among other provisions, authorizes

the awarding of Class B common stock to key employees. Stock

awards made under this incentive compensation plan are primarily

subject to the general restriction that stock awarded to a partici-

pant will be forfeited and revert to Company ownership if the

participant’s employment terminates before the end of a specified

period of service to the Company. Some of the awards are also

subject to performance and market conditions and will be forfeited

and revert to Company ownership if the conditions are not met. At

December 31, 2013, there were 43,950 shares reserved for

issuance under this incentive compensation plan, which were all

subject to awards outstanding.

In 2012, the Company adopted a new incentive compensation

plan (the 2012 Plan), which, among other provisions, authorizes the

awarding of Class B common stock to key employees in the form of

stock awards, stock options and other awards involving the actual

transfer of shares. All stock awards, stock options and other awards

involving the actual transfer of shares issued subsequent to the

adoption of this plan are covered under this new incentive

compensation plan. Stock awards made under the 2012 incentive

compensation plan are primarily subject to the general restriction

2013 FORM 10-K 71