Washington Post 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

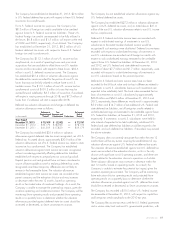

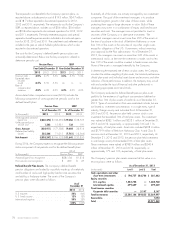

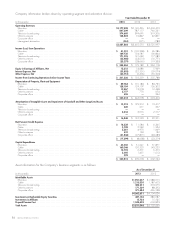

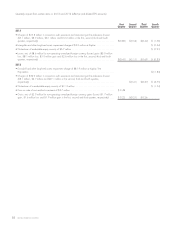

Year Ended December 31, 2012

Before-Tax Income After-Tax

(in thousands) Amount Tax Amount

Foreign currency translation

adjustments

Translation adjustments arising

during the year ........... $ 5,622 $—$ 5,622

Adjustment for sales of businesses

with foreign operations ..... (888) —(888)

4,734 —4,734

Unrealized gains on available-

for-sale securities

Unrealized gains for the year . . . 33,098 (13,239) 19,859

Reclassification adjustment for

write-down on available-for-

sale securities, net of gain,

includedinnetincome ...... 17,226 (6,890) 10,336

50,324 (20,129) 30,195

Pension and other

postretirement plans

Actuarial gain .............. 82,470 (32,987) 49,483

Amortization of net actuarial loss

included in net income ...... 9,368 (3,746) 5,622

Amortization of net prior service

credit included in net

income ................. (1,859) 744 (1,115)

Other adjustments ........... (745) 299 (446)

89,234 (35,690) 53,544

Cash flow hedge

Loss for the year ............ (1,581) 633 (948)

Other Comprehensive

Income ................. $142,711 $(55,186) $87,525

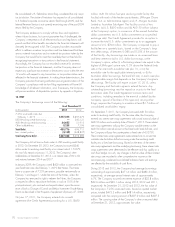

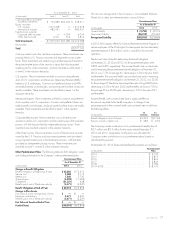

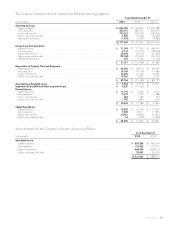

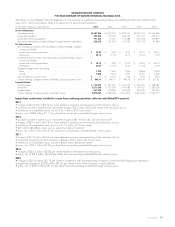

Year Ended December 31, 2011

(in thousands) Before-Tax

Amount Income

Tax After-Tax

Amount

Foreign currency translation

adjustments

Translation adjustments arising

during the year ........... $(21,375) $ 5,107 $(16,268)

Unrealized gains on available-

for-sale securities

Unrealized losses for the year . . (37,708) 15,084 (22,624)

Reclassification adjustment for

write-down on available-for-

sale securities, net of gain,

includedinnetincome...... 53,793 (21,518) 32,275

16,085 (6,434) 9,651

Pension and other

postretirement plans

Actuarial loss .............. (16,048) 6,420 (9,628)

Amortization of net actuarial

gain included in net

income ................. (510) 204 (306)

Amortization of net prior service

credit included in net

income ................. (3,925) 1,570 (2,355)

Foreign affiliate pension

adjustments .............. 2,088 —2,088

(18,395) 8,194 (10,201)

Cash flow hedge

Gain for the year ........... 14 (6) 8

Other Comprehensive Loss .... $(23,671) $ 6,861 $(16,810)

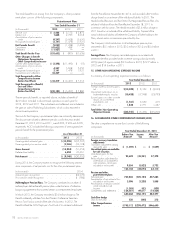

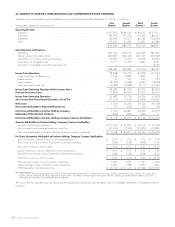

The accumulated balances related to each component of other comprehensive income (loss) are as follows:

(in thousands, net of taxes)

Cumulative

Foreign

Currency

Translation

Adjustment

Unrealized

Gain on

Available-for-

Sale Securities

Unrealized

Gain on

Pensions

and Other

Postretirement

Plans

Cash

Flow

Hedge

Accumulated

Other

Comprehensive

Income

As of December 31, 2011 ........................................... $21,338 $ 80,358 $ 63,625 $ 8 $165,329

Other comprehensive income (loss) before reclassifications .................... 5,622 19,859 49,037 (1,132) 73,386

Net amount reclassified from accumulated other comprehensive income .......... (888) 10,336 4,507 184 14,139

Net other comprehensive income (loss) .................................. 4,734 30,195 53,544 (948) 87,525

As of December 31, 2012 ........................................... 26,072 110,553 117,169 (940) 252,854

Other comprehensive income (loss) before reclassifications .............. (1,059) 57,378 383,249 (178) 439,390

Net amount reclassified from accumulated other comprehensive income .... — 5,732 1,028 490 7,250

Net other comprehensive income (loss) ............................. (1,059) 63,110 384,277 312 446,640

As of December 31, 2013 ....................................... $25,013 $173,663 $501,446 $ (628) $699,494

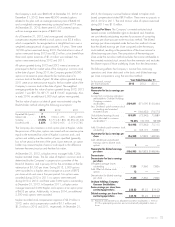

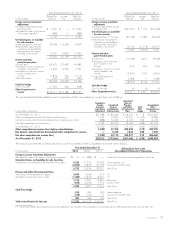

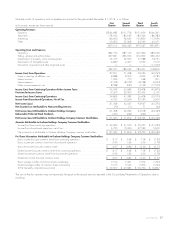

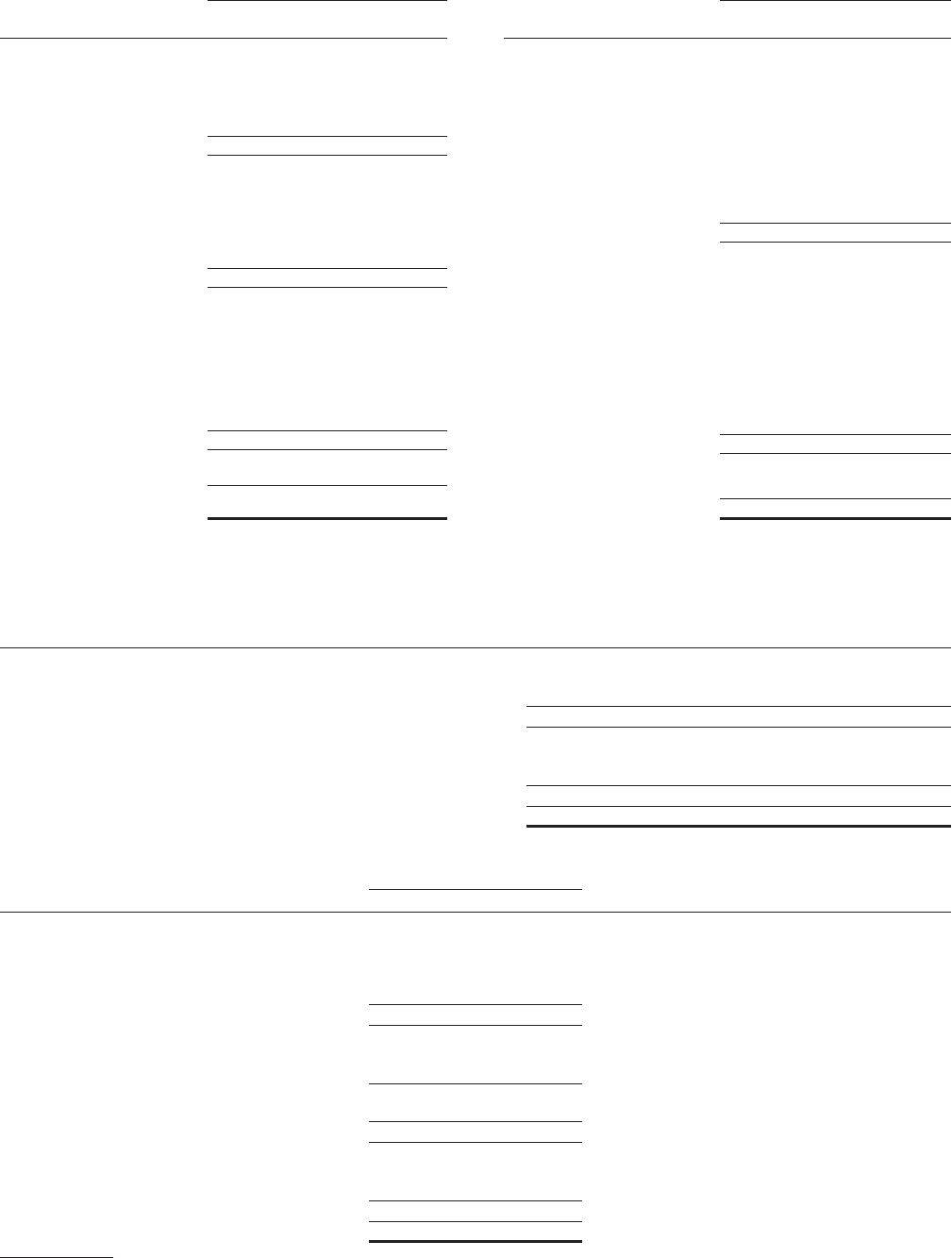

The amounts and line items of reclassifications out of Accumulated Other Comprehensive Income are as follows:

Year Ended December 31 Affected Line Item in the

Consolidated Statement of Operations(in thousands) 2013 2012 2011

Foreign Currency Translation Adjustments

Adjustment for sales of businesses with foreign operations . . . $—$ (888) $—Income (loss) from discontinued operations, net of tax

Unrealized Gains on Available-for-sale Securities

Write-downs on available-for-sale securities, net of gains . . . 9,554 17,226 53,793 Other expense, net

(3,822) (6,890) (21,518) Provision for Income Taxes

5,732 10,336 32,275 Net of Tax

Pension and Other Postretirement Plans

Amortization of net actuarial loss (gain) ................ 3,096 9,368 (510) (1)

Amortization of net prior service credit ................. (1,383) (1,859) (3,925) (1)

1,713 7,509 (4,435) Before tax

(685) (3,002) 1,774 Income Taxes

1,028 4,507 (2,661) Net of Tax

Cash Flow Hedge

816 306 (40) Interest expense

(326) (122) 16 Provision for Income Taxes

490 184 (24) Net of Tax

Total reclassification for the year .................. $ 7,250 $14,139 $ 29,590 Net of Tax

(1) These accumulated other comprehensive income components are included in the computation of net periodic pension and postretirement plan cost (see Note 14).

2013 FORM 10-K 79